US-China Trade Developments Boost Stocks and Investor Confidence

On Monday, markets rallied as reports emerged that the ongoing trade tensions between the US and China had eased. Both parties announced that significant progress had been made in negotiations.

Simultaneously, the two largest economies in the world issued a rare joint statement. Stocks such as Tesla (TSLA), Alibaba (BABA), and Amazon (AMZN) responded positively, climbing at the start of the trading week. Below are four reasons illustrating this shift in market sentiment toward a bullish outlook:

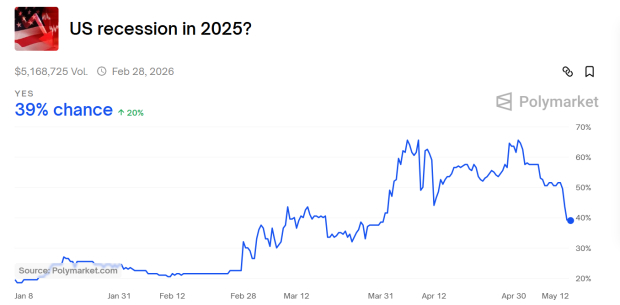

Recession Odds for 2025 Decrease Significantly

Betting markets, such as Polymarket, gained traction during the 2024 presidential election, with various predictions made about politics and markets. While traditional polls often missed the mark, platforms like Polymarket accurately forecasted that Donald Trump would secure a second term.

One intriguing market on Polymarket offers insights into the likelihood of a US recession occurring in 2025. Earlier this month, odds placed the chance of a recession at 66%. In a rapid turn, those odds dropped to 39% within two weeks.

Image Source: PolyMarket

S&P 500 and Nasdaq Cross 200-Day Moving Average

Monday’s trading activity was notable. It marked the first occasion since November 9th, 2020, where the S&P 500 Index ETF (SPY) opened 3% higher on a Monday. At that time, the announcement of Pfizer’s (PFE) COVID vaccine eased pandemic-related market fears. This time, improved US-China relations are the catalyst. Furthermore, SPY has crossed back above its 200-day moving average, a strong indicator of long-term market trends.

Image Source: TradingView

Interpreting the VIX’s Reversion to the Mean

The Cboe Volatility Index, known as the VIX, gauges market volatility expectations in the S&P 500 over the next month. Historically, VIX levels above $45 align with moments of market fear and capitulation. Instances include post-2008 financial crisis spikes and spikes during the peak of the COVID-19 pandemic. Since 1988, the VIX has dipped below $20 after rising above $45 on six occasions, with the S&P 500 making gains nine months to one year later.

Image Source: @subutrade

Given the recent volatility triggered by tariff disputes, the VIX has entered this significant cycle again. Will the patterns repeat in 2025?

Anticipating a Trade-Deal Domino Effect

With a preliminary trade agreement between the US, UK, and China, a domino effect is expected in future trade dealings. Each completed deal can bolster President Trump’s negotiating position, facilitating more frequent agreements. Additionally, Fed Chair Jerome Powell may gain more clarity on inflation trends, increasing the likelihood of interest rate cuts that could support equity markets.

Conclusion

A notable thaw in US-China trade relations has driven increased optimism on Wall Street. This development, combined with reduced recession odds, fosters a bullish outlook for investors.