Dollar Index Hits 3-Month Low Amid Economic Concerns

The dollar index (DXY00) fell by -1.38% on Wednesday, reaching a low not seen in 3-3/4 months. This decline was mainly driven by concerns regarding the adverse effects of U.S. tariffs on the economy. Strength in the euro also contributed to the dollar’s woes, as the EUR/USD pair surged to a 3-3/4 month high that same day. The dollar’s losses deepened after the U.S. February ADP employment change reported a modest increase of only +77,000 jobs, the smallest uptick in seven months, indicating potential dovish implications for Federal Reserve policy.

Despite the downward pressure, the dollar found some underlying support when the U.S. February ISM services index showed unexpected expansion, surpassing expectations. The Fed’s Beige Book reported that U.S. economic activity had “slightly” risen since mid-January.

The Barchart Brief: Your FREE insider update on the biggest news stories and investing trends, delivered midday.

Specifically, U.S. February ADP employment rose by only +77,000, well below the anticipated +140,000, marking the smallest gain in seven months. Conversely, U.S. January factory orders increased by +1.7% month-over-month, aligning with expectations and representing the largest increase in six months. The February ISM services index unexpectedly climbed by +0.7 to 53.5, beating the expectation of a decline to 52.5. Additionally, the ISM services prices paid sub-index rose by +2.2 to 62.6, contrary to expectations of no change at 60.4.

The Fed’s Beige Book noted that U.S. economic activity had risen “slightly,” and that prices increased “moderately” in most regions. Many firms expressed concerns about impending tariffs on inputs that could lead to price increases.

Looking ahead, market participants are set to focus on the February nonfarm payroll report due on Friday, which is expected to show an increase of +160,000 jobs, with the unemployment rate anticipated to remain steady at 4.0%. Additionally, average hourly earnings are predicted to remain unchanged from January at +4.1% year-over-year. Furthermore, Federal Reserve Chair Jerome Powell will deliver the keynote speech on the economic outlook at the Chicago Booth’s 2025 U.S. Monetary Policy Forum on Friday.

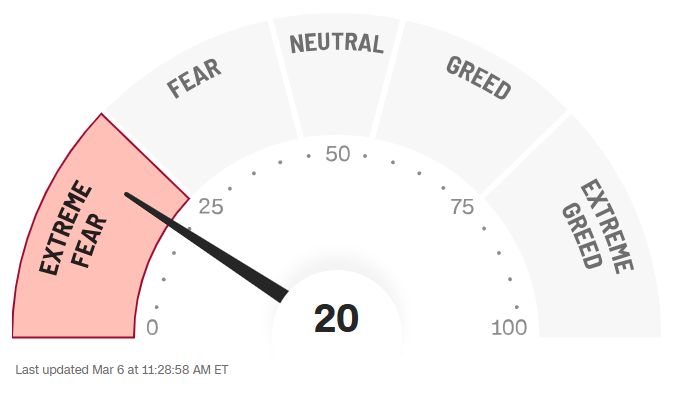

The markets are currently assessing chances for a -25 basis point rate cut at the next FOMC meeting on March 18-19 at just 9%.

In currency markets, EUR/USD (^EURUSD) gained +1.53% on Wednesday, reaching a 3-3/4 month high. The euro strengthened after the yield on the 10-year German bund surged to a 15-month high. German Chancellor-in-waiting Merz announced that Germany would amend its constitution to exempt defense and security outlays from fiscal spending limits. The euro also received a boost from a higher-than-expected Eurozone January PPI, which rose by +0.8% month-over-month and +1.8% year-over-year, exceeding expectations of +0.3% month-over-month and +1.3% year-over-year, indicating hawkish implications for the ECB’s policy direction.

Market expectations for a -25 basis point rate cut by the ECB are currently estimated at 99% ahead of the March 6 policy meeting.

Meanwhile, USD/JPY (^USDJPY) saw a decline of -0.61% on Wednesday. The yen appreciated against the dollar after Japan’s Jibun Bank services PMI was revised upwards to a six-month high. Additionally, comments from BOJ Deputy Governor Uchida, stating that Japan’s benchmark interest rate would continue on a gradual upward path, further supported the yen. The rise in Japanese government bond yields, with the 10-year JGB bond yield reaching a 1-1/2 week high of 1.452%, also contributed to the yen’s strength. However, the yen’s position weakened later in the day due to increasing T-note yields.

Jibun Bank’s services PMI was adjusted upwards by +0.6 to reach 53.7, marking the strongest pace of expansion in six months. BOJ Deputy Governor Uchida remarked that “the BOJ will accordingly continue to raise the policy interest rate and adjust the degree of monetary accommodation” as long as the economic outlook holds.

In commodities, April gold (GCJ25) settled up +5.40 (+0.18%) on Wednesday, while May silver (SIK25) rose by +0.753 (+2.33%). Prices for precious metals increased as the dollar index dipped to a 3-3/4 month low, signaling bullish sentiment. Precious metals maintain strong safe-haven demand as U.S. tariffs against Canada, China, and Mexico have taken effect, with retaliatory tariffs also being enacted. Additionally, gold benefits as a store of value as Germany’s Chancellor-in-waiting Merz declared plans to amend constitutional limits on fiscal spending for defense and security. Silver prices surged due to a rally in copper, which reached a 2-1/2 week high following President Trump’s suggestion that copper imports could face a 25% tariff.

However, the precious metals market experienced pressure from reduced safe-haven demand as equities rebounded after Monday-Tuesday’s selloff. Statements from U.S. Commerce Secretary Lutnick, suggesting the possibility of a compromise on U.S. tariffs with Canada and Mexico, also weighed on precious metals demand.

On the date of publication, Rich Asplund did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.