Dollar Drops Amid Trade War Concerns and Fed Speculation

The dollar index (DXY00) experienced a decline of -0.40% on Tuesday. This downturn stemmed from worries that a global trade war could hinder economic growth and prompt the Federal Reserve to reduce interest rates. President Trump announced he would increase tariffs on China by 50% if China does not eliminate its 34% tariff on U.S. goods by Wednesday. In response, China stated it is prepared to “fight to the end.” Additionally, the dollar is grappling with a crisis of confidence as the U.S. renegotiates trade relationships, which threatens the dollar’s status as the world’s reserve currency and has led some foreign investors to sell off their dollar holdings. Elevated T-note yields and hawkish remarks from San Francisco Fed President Daly helped mitigate further losses in the dollar.

Concerns over tariffs have sparked anxiety among business leaders, according to Chicago Fed President Goolsbee, who highlighted fears that these measures could revert the economy to the inflationary conditions seen in 2021 and 2022.

In a measured approach, San Francisco Fed President Daly suggested that the Fed could afford to delay any adjustments to interest rates while it assesses the impact of evolving trade policies. Currently, markets are pricing in a 52% probability of a -25 basis point rate cut following the FOMC meeting scheduled for May 6-7.

Euro and Yen React to Dollar Weakness

EUR/USD (^EURUSD) saw an increase of +0.57% on Tuesday, buoyed by the dollar’s struggles. However, the euro’s gains were somewhat constrained by dovish comments from European Central Bank (ECB) officials. ECB Governing Council member Simkus expressed that he believes the ECB should cut interest rates in their upcoming meeting, while Bundesbank President Nagel reassured that the ECB is “well on track” to meet its inflation goals this year.

Market swaps indicate an 89% likelihood of a -25 basis point rate cut from the ECB during its policy meeting on April 17.

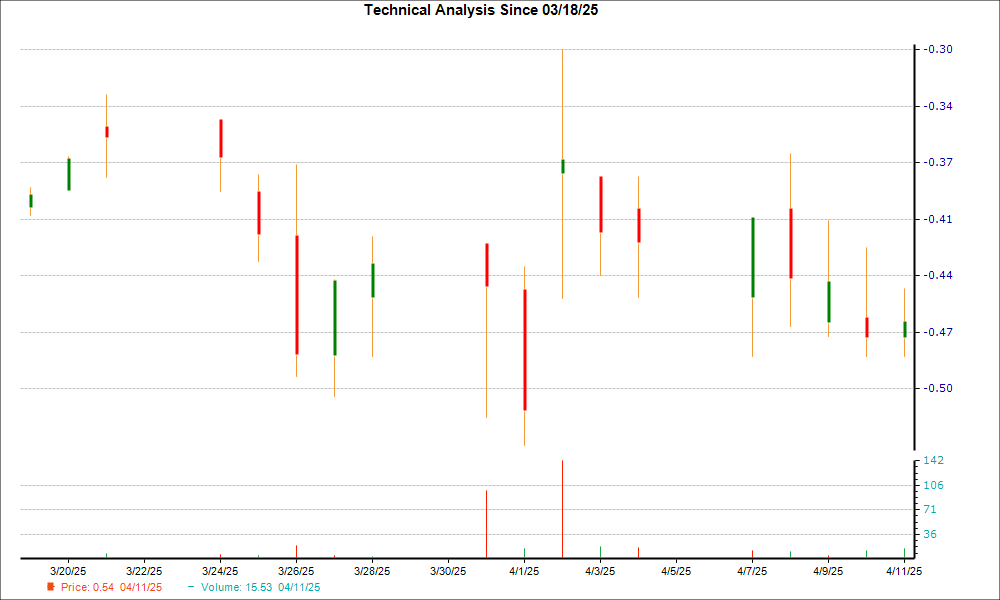

Similarly, USD/JPY (^USDJPY) decreased by -1.15% on Tuesday. The yen strengthened against the dollar, in part due to comments from U.S. Treasury Secretary Bessent on Monday, which emphasized Japan’s priority status in discussions about reducing U.S. tariffs. Furthermore, the escalation of the trade conflict has increased the yen’s appeal as a safe-haven asset following President Trump’s tariff threats against China.

Nevertheless, negative economic data from Japan weighed on the yen, as the March economic watchers outlook survey dropped -1.4 points to a 2.5-year low of 45.2, falling short of expectations of 46.1.

Precious Metals Gain Amid Market Volatility

On Tuesday, June gold (GCM25) closed up +16.60 (+0.56%), and May silver (SIK25) rose by +0.082 (+0.28%). The weaker dollar facilitated moderate gains in precious metals, while the trade war’s escalation fueled demand for safe-haven assets. Dovish comments from ECB’s Simkus also supported precious metals, reinforcing expectations for an interest rate cut. Additionally, geopolitical tensions in the Middle East, including ongoing airstrikes in Gaza and U.S. actions in Yemen, have increased demand for these commodities as safe havens.

However, higher global bond yields on Tuesday posed a negative influence on precious metals. Hawkish statements from San Francisco Fed President Daly further pressured metals prices as she indicated that the Fed might take its time with interest rate changes. Silver’s price gains were stymied by concerns that heightened trade tensions could derail economic growth and reduce demand for industrial metals.

On the date of publication,

Rich Asplund did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data are for informational purposes only. Please view the Barchart Disclosure Policy here.

The views and opinions expressed herein represent those of the author and do not necessarily reflect those of Nasdaq, Inc.