Wall Street saw slight gains at midday, with investors anticipating critical earnings reports, the Federal Reserve’s meeting, and the upcoming job market report.

Tech giants like Microsoft Corp., Alphabet Inc., and Advanced Micro Devices Inc. are scheduled to release earnings reports this week. Tesla Inc. rebounded 2.4% after a 12% decline last week.

The S&P 500 and Nasdaq 100 rose by 0.1% and 0.3% respectively, while the Dow Jones Industrial Average remained mostly unchanged. Small-cap stocks outperformed large-caps, with the Russell 2000 Index climbing 0.5%.

In the bond market, Treasury yields slightly decreased, leading to gains in fixed-income securities. The iShares 20+ Year Treasury Bond ETF experienced a 0.8% increase.

Gold prices, as tracked by the SPDR Gold Trust, rose by 0.5%, while crude oil prices fell by 1.6% despite escalating tensions in the Middle East.

Bitcoin surged 2.3% to reach $43,000.

Performance of Major Indices and ETFs

| Major Indices | Price | Change (%) |

|---|---|---|

| Russell 2000 | 196.84 | 0.4% |

| Nasdaq 100 | 17,480.46 | 0.3% |

| S&P 500 | 4,896.79 | 0.1% |

| Dow Jones | 38,072.47 | -0.1% |

The SPDR S&P 500 ETF Trust was 0.1% higher to $487.95, the SPDR Dow Jones Industrial Average edged 0.1% lower to $380.73, and the tech-heavy Invesco QQQ Trust rose 0.3% to $424.06, according to Benzinga Pro data.

Consumer Discretionary Select Sector Fund outperformed, up 0.7%, aided by Tesla. The Energy Select Sector Fund underperformed, down 1.1%.

Highlights of Stock Movements

- Tesla rose 2.4% after announcing capital expenditures to exceed $10 billion in 2024, aimed at next-generation vehicles and AI products.

- Lucid Group Inc. experienced a 20% surge following rumors suggesting the company’s luxury electric vehicle might be selected for the next James Bond film.

- SoFi Technologies Inc. saw its stock climb more than 17% after reporting better-than-expected revenue and profits in the fourth quarter.

- Bloom Energy Corp. fell over 8% after Bank of America downgraded the company from Neutral to Underperform, lowering the price target.

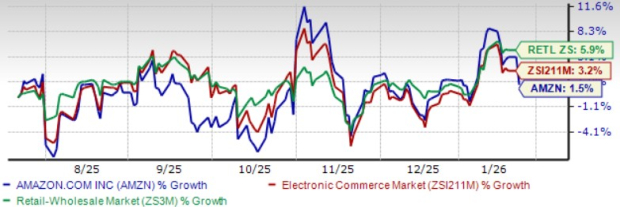

- Amazon.com Inc. and iRobot Corp. announced a deal termination. Shares of the retail giant increased by 1%, whereas iRobot experienced a decline of over 7%.

Read now: iRobot Hit By Regulatory Hangover: Amazon Merger Collapse Triggers Stock Plunge, Restructuring Efforts

Photo via Shutterstock.