Understanding the Impact of Current US Tariffs: A Month into President Trump’s Second Term

New Tariff Developments: A Focus on China

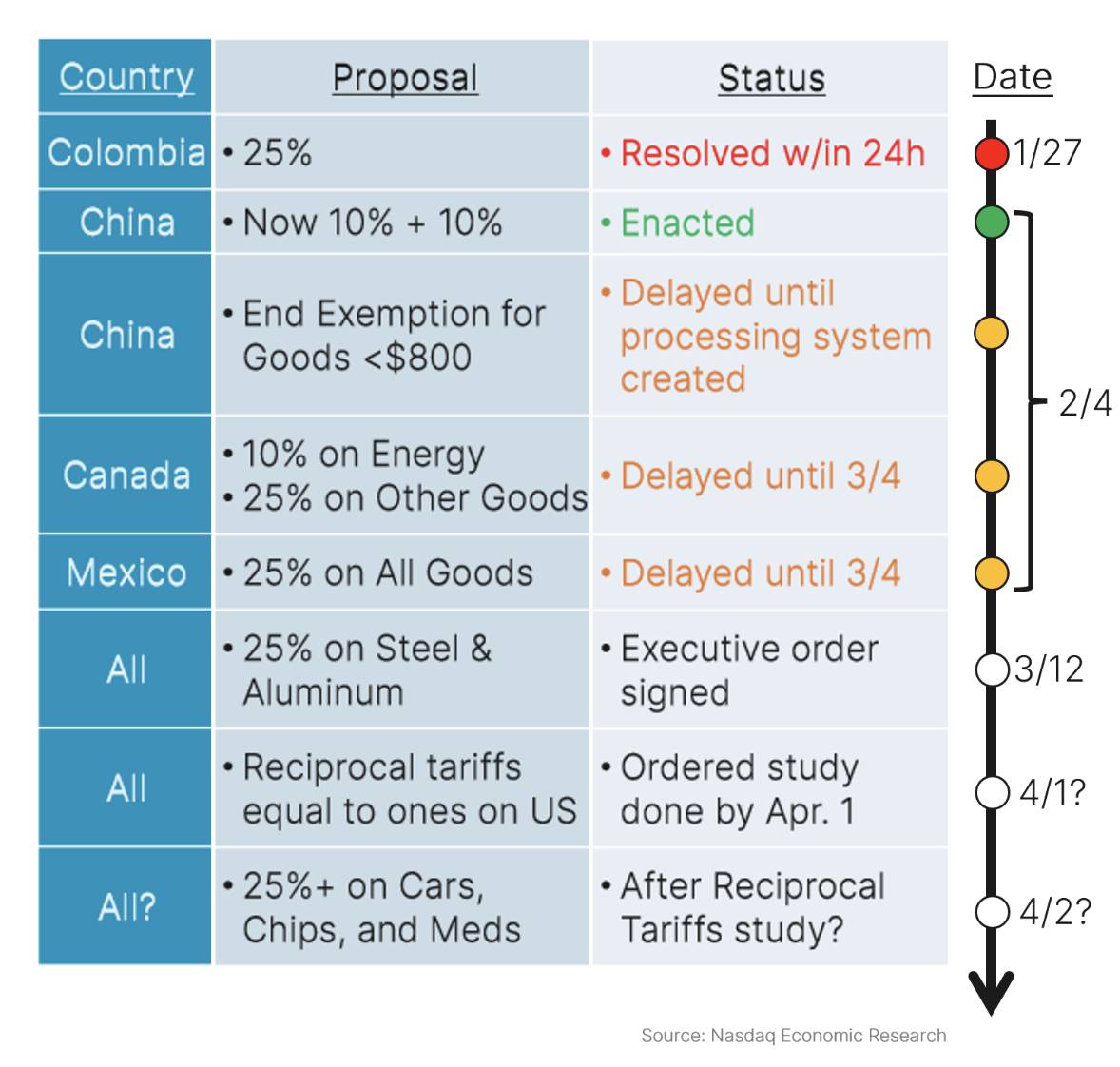

As we enter President Trump’s second term, tariffs have taken the spotlight. Currently, only the new 10% tariff on China is in effect. The rest of the proposed changes remain uncertain, especially concerning potential tariffs affecting Canada and Mexico.

While President Trump recently suggested a trade deal with China “is possible,” many tariffs are still in limbo. This raises questions about future implementations and whether delays on tariffs for specific countries might lessen their initial impact.

1. Exports: A Bidirectional Perspective

Trade comprises only a small portion of the US economy. Currently, total exports contribute less than 11% to the US GDP, with goods exports under 7%. This dynamic contrasts sharply with other major economies.

For instance, exports to the US account for over 25% of Mexico’s GDP. In comparison, Mexican imports from the US make up only 1% of the US GDP. Canada shows a similar pattern, with 20% of their GDP reliant on US exports.

Because US exports represent such a minor fraction of the national economy, tariffs may lead to only slight price increases and demand drops domestically. However, they could significantly affect countries that rely heavily on their exports to the US.

2. Tariffs Influence Trade Dynamics

Despite their limited impact on the US economy, tariffs play an essential role in shaping trade patterns. During President Trump’s first term in 2018, tariffs were primarily directed at China.

This focus resulted in China’s share of US goods imports shrinking nearly in half, as shown in recent data. Companies adapted by diversifying their suppliers and adjusting supply chains to avoid higher costs from importing Chinese goods. Consequently, neighboring countries like Taiwan, Korea, and Vietnam, as well as Mexico, have seen an increase in trade.

The current difference between the first and second term is the broader scope of proposed tariffs. Should these differing rates for various countries be implemented—like 25% on Canada versus 10% on Europe—it’s likely that US import preferences will shift toward countries with lower tariffs.

Uncertainty Surrounds Future Impacts of Tariffs

Many economists speculate that President Trump may leverage these tariffs as negotiation tools for future agreements. Consequently, the already minor repercussions might diminish even further. Currently, the ambiguity regarding how tariffs will be finalized makes it challenging to assess their exact implications.

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved.