Energy Fuels Partners to Enhance U.S. Rare Earth Supply Chains

Energy Fuels (UUUU) increased by 3% over the last two trading days, driven by two significant partnership announcements with POSCO Holdings Inc. (PKX) and Chemours (CC). The alliance with South Korea’s POSCO aims to create a supply chain for rare earth magnets crucial for electric vehicles (EVs) and other technologies. Alongside, the collaboration with Chemours focuses on boosting domestic production of rare earth elements (REE), titanium, and zirconium.

Partnership with POSCO to Develop Independent REE Supply

Energy Fuels and POSCO unveiled their partnership on March 17. Their goal is to develop a competitively priced REE supply chain that operates independently of China. POSCO is renowned for producing traction motor cores, vital components in the drivetrains of electric and hybrid vehicles. By combining this capability with Energy Fuels’ production of rare earth oxides, the partnership could significantly boost REE materials available to automakers in the U.S., Europe, Japan, and South Korea.

Initial samples of Energy Fuels’ neodymium-praseodymium (NdPr) oxide, produced at its White Mesa Mill in Utah, have met POSCO’s specifications. The next step involves Energy Fuels supplying larger samples for conversion into NdPr metal, alloy, and high-performance permanent REE magnets. After successful validation, the companies will discuss delivering larger volumes that could potentially power over 30,000 EVs within the year.

Expansion with Chemours to Strengthen U.S. Supply Chains

On March 18, Energy Fuels announced an expansion of its four-year partnership with Chemours. This collaboration aims to bolster U.S. domestic supply chains for rare earth and critical minerals, reducing reliance on Chinese sources. Both companies stand to benefit from the rising demand for materials essential to sectors like energy, defense, and advanced manufacturing.

As a prominent U.S. producer of REE, Energy Fuels is also advancing heavy mineral sand projects in Madagascar, Brazil, and Australia, with expectations of large-scale production of rare earth, titanium ilmenite, and zircon minerals in coming years. In parallel, Chemours operates mines in Florida and Georgia, where it extracts and separates heavy mineral sands.

UUUU Stock Performance Against Industry Standards

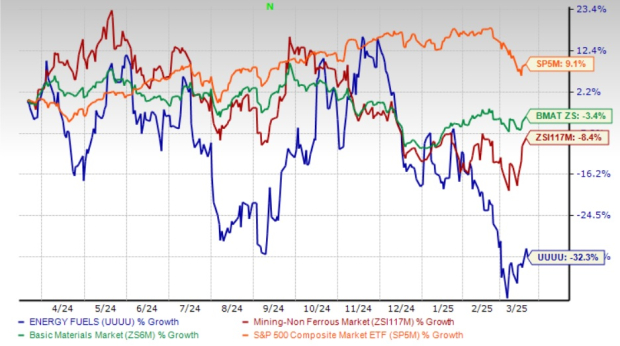

Despite the recent uptick, UUUU stock has declined by 32.3% over the past year, significantly underperforming the industry’s decline of only 8.4%. The stock has also trailed the Zacks Basic Materials sector’s decrease of 3.4% and the S&P 500’s rise of 9.1%.

1-Year Performance of Energy Fuels Stock

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

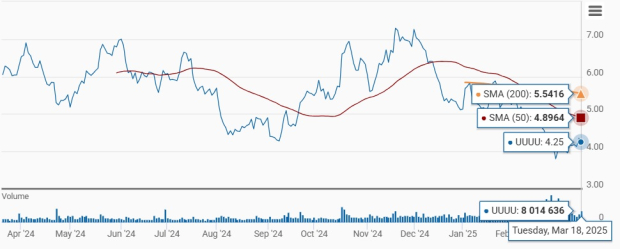

Technical indicators reveal that Energy Fuels’ stock is currently trading below its 50-day and 200-day simple moving averages (SMAs).

UUUU Trading Below Key Moving Averages

Image Source: Zacks Investment Research

Is this decline in UUUU stock a potential buying opportunity? Let’s explore this question further.

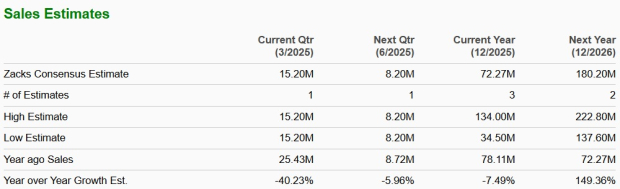

Negative Revisions Impacting Energy Fuels’ Estimates

Estimates for Energy Fuels have been revised downward, as illustrated in the chart below.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Expectations indicate that UUUU will report a loss of 14 cents per share in 2025, contrasting with an earlier projection of earnings at 7 cents. Revenue estimates for that year stand at $72.27 million, reflecting a year-over-year decline of 7.5%.

Image Source: Zacks Investment Research

For 2026, revenue estimates are projected at $180.2 million, suggesting a substantial year-over-year growth of 149%. Additionally, the consensus for earnings indicates 6 cents per share, marking a possible first profitable year for the company since it commenced trading on the NYSE in December 2013.

Image Source: Zacks Investment Research

Valuation of Energy Fuels Appears Elevated

Currently, Energy Fuels is trading at a forward price-to-sales ratio of 9.37, which is significantly higher than the industry average of 2.89. Its Value Score of F indicates that the stock is not particularly cheap at this time, suggesting an inflated valuation.

Image Source: Zacks Investment Research

Uranium Price Decline May Influence UUUU

Uranium prices currently stand at $64.3 per pound, marking an 18-month low and a 27% decrease for the year. This decline is attributed to adequate supply levels amidst uncertain demand.

Microsoft (MSFT) recently canceled multiple data center leases, challenging the common belief that technology giants are actively expanding their power capacity. This development raises concerns about future uranium demand.

Long-Term Outlook for Energy Fuels Remains Positive

UUUU Sees Growth Amid Rising Demand for Uranium and REEs

The growing need for uranium and rare earth elements (REEs) in clean energy technologies presents a significant opportunity for Energy Fuels Inc. (UUUU). The White Mesa Mill in Utah stands as the only facility in the U.S. capable of processing monazite and producing separated REE materials, giving Energy Fuels a competitive advantage in this sector.

With a debt-free balance sheet, UUUU is increasing uranium production while simultaneously developing substantial REE capabilities. In line with this strategy, the company acquired Base Resources Limited in October 2024, allowing it to tap into the promising Toliara Mineral Sand Project. This acquisition not only enhances UUUU’s potential to produce REE metals but also positions the company as a potential major producer of titanium and zirconium minerals.

Considering Energy Fuels’ current production levels and its development pipeline, the company could potentially produce up to 6 million pounds of uranium annually.

Our Assessment of UUUU

Given the premium valuation, recent declines in uranium prices, adjusted earnings forecasts, and an anticipated loss for the current year, it may be wise to sell UUUU stock at this time. Currently, Energy Fuels holds a Zacks Rank #4 (Sell), reflecting caution in the current market environment.

You can view the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Top Stocks for the Coming Month

Recently released, experts have identified 7 elite stocks from a list of 220 ranked as Zacks Rank #1 Strong Buys. These stocks are considered “Most Likely for Early Price Pops.”

Since 1988, the complete list has outperformed the market by more than two times, achieving an average gain of +24.3% annually. Investors should take notice of these carefully selected stocks.

See them now >>

Interested in the latest stock recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days today. Click to gain access to this free report.

POSCO (PKX): Free Stock Analysis report

Microsoft Corporation (MSFT): Free Stock Analysis report

Energy Fuels Inc (UUUU): Free Stock Analysis report

The Chemours Company (CC): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.