Valaris Limited Falls Short on Earnings Despite Revenue Growth

Quarterly Earnings Analysis

Valaris Limited (VAL) reported earnings of $0.88 per share for the recent quarter, which is below the Zacks Consensus Estimate of $1.36 per share. This is a significant increase compared to earnings of $0.17 per share from the same quarter last year. All figures are adjusted for non-recurring items.

This earning result reflects a surprise of -35.29%. In the previous quarter, Valaris had an impressive earnings of $2.03 per share against an expected $0.96, resulting in a surprise of 111.46%.

Revenue Performance

In the third quarter of 2024, Valaris generated revenues of $643.1 million, surpassing the Zacks Consensus Estimate by 9.37%. This represents a substantial increase from $455.1 million in revenues during the same quarter last year. Over the last four quarters, the company has exceeded consensus revenue estimates three times.

The stock’s price movement will largely depend on the insights provided by management during the upcoming earnings call, particularly regarding future earnings expectations.

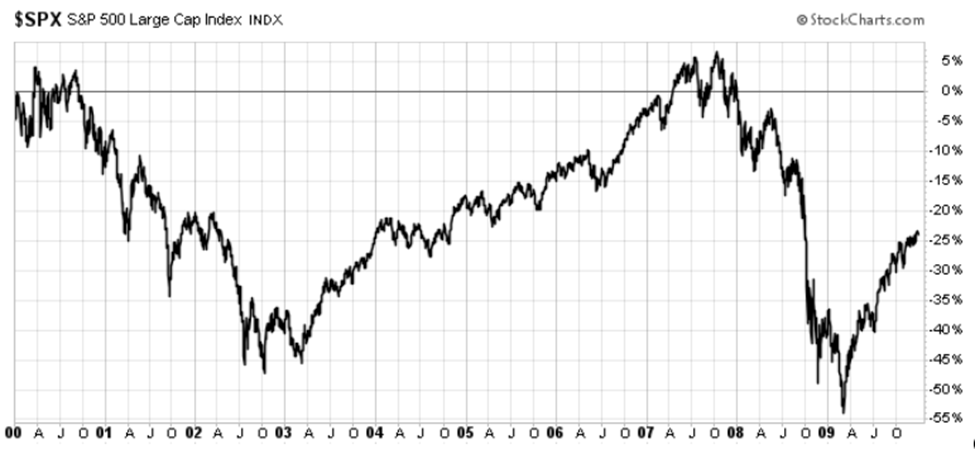

Since the start of 2024, Valaris shares have dropped approximately 29.3%, contrasting sharply with the S&P 500’s 22.3% increase.

Future Outlook for Valaris

Despite its recent underperformance, investors are left wondering about the future trajectory of Valaris stock. A key factor to consider is the company’s earnings forecast, which reflects current consensus expectations for upcoming quarters.

Studies have shown a strong link between stock movements and earnings estimate revisions. Investors can monitor these revisions or use tools like the Zacks Rank, noted for effectively predicting stock performance.

Leading up to this earnings report, the trend for estimate revisions at Valaris has been positive. Although the figures may adjust following the latest earnings announcement, the current Zacks Rank stands at #2 (Buy), indicating anticipated outperformance in the near term. A complete list of today’s Zacks #1 Rank (Strong Buy) stocks is available for interested investors.

The consensus EPS estimate for the upcoming quarter is $1.71, with projected revenues of $625 million. For the current fiscal year, estimates stand at $4.37 in EPS on revenues of $2.3 billion.

Additionally, it’s important to consider industry trends, as they can significantly impact stock performance. The Oil and Gas – Drilling sector is currently positioned in the lowest 18% of over 250 Zacks industries, suggesting challenges ahead. Historical data indicates that stocks within the top 50% of these rankings tend to outperform those in the bottom half by a factor of more than two to one.

Industry Comparison: Helmerich & Payne

In the same industry, Helmerich & Payne (HP) has not yet reported its earnings for the quarter ending September 2024, with results expected on November 13. Analysts anticipate quarterly earnings of $0.79 per share, marking a year-over-year increase of 14.5%. The EPS estimate for this quarter has seen a recent increase of 2.6% over the last month.

Helmerich & Payne’s expected revenues for this quarter are $687.23 million, reflecting a growth of 4.2% compared to the previous year.

Investment Considerations

Before making an investment in Valaris Limited (VAL), investors may want to explore recommended stocks for the next month. Zacks Investment Research offers insights on top choices.

Since 1978, Zacks Investment Research has provided tools and independent research to investors. Their stock-rating system, the Zacks Rank, has consistently outperformed the S&P 500, demonstrating an average gain of +24.08% per year from January 1, 1988, to May 6, 2024.

For additional recommendations from Zacks Investment Research, access their free report on 5 Stocks Set to Double.

Valaris Limited (VAL): Free Stock Analysis Report

Helmerich & Payne, Inc. (HP): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.