Valmont Industries Posts Third-Quarter Profit, Outperforming Estimates

Valmont Industries, Inc. (VMI) reported a profit of $83 million or $4.11 per share for the third quarter of 2024. This marks a significant improvement from a loss of $49 million or $2.34 per share during the same period last year. Adjusted earnings remain at $4.11, slightly down from $4.12 a year prior. The results exceeded the Zacks Consensus Estimate of $3.96.

For the latest EPS estimates and surprises, visit Zacks Earnings Calendar.

Revenues reached $1,020.2 million this quarter, reflecting a 2.9% decrease year over year. However, this figure surpassed the Zacks Consensus Estimate of $1,019.1 million.

Overview of Valmont’s Performance

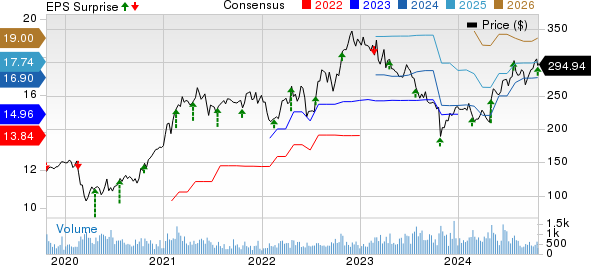

Insights on Valmont Industries’ Price and Consensus

Valmont Industries, Inc. price-consensus-eps-surprise-chart | Valmont Industries, Inc. Quote

Review of Business Segments

In the infrastructure segment, revenues climbed 0.4% year over year, amounting to $756.4 million. This figure fell short of our estimate of $759.3 million. Sales growth in utility and telecommunications offset declines in Lighting, Transportation, and solar sales. Utility sales surged approximately 15%, aided by a favorable mix of projects and higher volumes of distribution and substation products. Telecommunications experienced increased volumes in response to growing carrier expenses in a stable North American environment.

The agriculture segment generated $263.8 million, an 11.1% decline from the previous year, yet this still exceeded our estimate of $261.8 million. International sales faced challenges, particularly in Brazil, where lower grain prices affected growers’ purchasing decisions. However, there was some revenue growth in the Europe, Middle East, and Africa (EMEA) region, along with contributions from the HR Products acquisition. In North America, volumes for irrigation equipment slightly decreased, though a rise in replacement sales due to severe weather earlier in the year mitigated this decline.

Valmont’s Financial Status

Operating cash flows were reported at $225.1 million. By the end of the third quarter, the company had $200.5 million in cash and cash equivalents. Valmont paid dividends totaling $12.1 million and repurchased $40.1 million of its shares, leaving $81 million available for future buybacks. Additionally, the firm reduced its borrowings on a revolving credit facility by approximately $120 million this quarter, which brings the total reduction year-to-date to about $210 million.

2024 Projections for Valmont

For 2024, Valmont forecasts a decline in net sales ranging from 1.5% to 3.5%. Earnings per share are anticipated to be between $16.50 and $17.30, while capital expenditures are expected to fall between $85 million and $95 million to support growth initiatives.

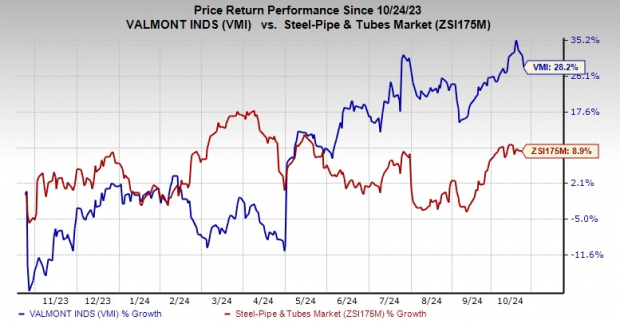

Stock Price Performance

Over the past year, VMI shares have risen by 28.2%, significantly outperforming the industry’s increase of 8.9% during the same timeframe.

Image Source: Zacks Investment Research

Valmont’s Zacks Rank and Noteworthy Picks

Currently, VMI holds a Zacks Rank of #2 (Buy).

In the basic materials sector, other notable stocks include IAMGOLD Corporation (IAG), Agnico Eagle Mines Limited (AEM), and Barrick Gold Corporation (GOLD).

IAMGOLD is scheduled to report its third-quarter results on Nov. 7, with a consensus estimate of 11 cents for earnings. IAG has outperformed the Zacks Consensus Estimate in three out of the last four quarters, reflecting an impressive average earnings surprise of 200%. It also carries a Zacks Rank #2.

Agnico Eagle is set to release its third-quarter results on Oct. 30. The current consensus estimate for AEM’s earnings stands at 96 cents, with the company having beaten expectations in all four previous quarters, producing an average earnings surprise of 15.7%. AEM holds a Zacks Rank #1.

Barrick Gold will report its results on Nov. 7, and its earnings consensus is projected at 35 cents. GOLD, which also carries a Zacks Rank #2, has consistently exceeded consensus estimates in its last four quarters, achieving an average earnings surprise of 21.1%.

Zacks’ Research Chief Identifies a Promising Stock

Our expert team has unveiled five stocks likely to gain over 100% in the coming months. Among these, Director of Research Sheraz Mian highlights one in particular that stands out. This top candidate is one of the most innovative financial firms, boasting over 50 million customers and a variety of cutting-edge solutions, positioning it for significant growth.

Although not every pick will yield positive returns, this one may outperform previous Zacks’ Stocks Set to Double, such as Nano-X Imaging, which saw a 129.6% rise in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Valmont Industries, Inc. (VMI): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

IAMGOLD Corporation (IAG): Free Stock Analysis Report

Barrick Gold Corporation (GOLD): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.