Analysts Predict Upside for Fidelity MSCI Industrials ETF Holdings

At ETF Channel, we analyzed the underlying holdings of various ETFs in our coverage universe. We compared the trading prices of these holdings against the average 12-month forward target prices set by analysts. Specifically for the Fidelity MSCI Industrials Index ETF (Symbol: FIDU), our findings indicate that the implied analyst target price for the ETF, based on its holdings, is $81.17 per unit.

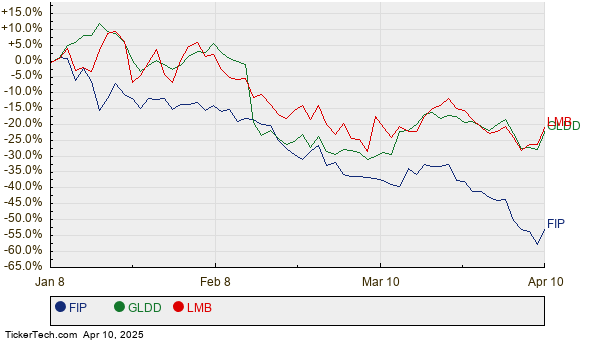

Currently, FIDU trades at approximately $66.64 per unit. This suggests analysts foresee a 21.80% potential upside for this ETF based on the average expected targets of its underlying holdings. Notably, three of these holdings show significant upside potential relative to their analyst target prices: FTAI Infrastructure Inc (Symbol: FIP), Great Lakes Dredge & Dock Corp (Symbol: GLDD), and Limbach Holdings Inc (Symbol: LMB). FIP, trading at $3.84 per share, has an average analyst target of $12.00, representing a 212.50% upside. Additionally, GLDD, priced at $8.81, has a target of $14.00, which implies a 58.91% increase should it be achieved. Lastly, LMB shows an expected target of $109.33, which is 40.91% above its current share price of $77.59. Below is a twelve-month price history chart that illustrates the performance of FIP, GLDD, and LMB:

The following table summarizes the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity MSCI Industrials Index ETF | FIDU | $66.64 | $81.17 | 21.80% |

| FTAI Infrastructure Inc | FIP | $3.84 | $12.00 | 212.50% |

| Great Lakes Dredge & Dock Corp | GLDD | $8.81 | $14.00 | 58.91% |

| Limbach Holdings Inc | LMB | $77.59 | $109.33 | 40.91% |

This raises important questions: Are analysts justified in these targets, or are they overly optimistic about future trading prices? Do they have valid reasons to support their projections, or might they be misjudging recent developments in these companies and their industries? A high price target compared to a stock’s trading price can signal optimism about the future; however, it also risks being revised downward if those targets become outdated. These considerations warrant further investigation by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• EVCM Stock Predictions

• OIA Videos

• BMCH Stock Predictions

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.