VanEck’s Head of ETF Product, Ed Lopez, recently shared insights at the Exchange conference about the changing landscape in ETFs. Amidst the evolving environment, VanEck stands out with strategies focusing on crucial themes like semiconductors. However, the overarching theme this year from the issuer is crystal clear.

“Bonds are making a comeback,” Lopez declared. “With the economy and markets expected to be relatively stagnant this year, and uncertainties around the Fed’s decisions looming large, there is a unique opening for investors to enter the bond market, benefitting from the carry it provides as a cushion against potential volatility.”

The VanEck ETF Lineup

VanEck’s ETF suite comprises five bond ETFs, each boasting an AUM of over $1 billion. Leading the pack is the VanEck Fallen Angel High Yield Bond ETF (ANGL) with a hefty $3 billion in assets. Tracking the ICE BofA U.S. Fallen Angel High Yield 10% Constrained index, the fund charges a 35 bps fee.

ANGL sets itself apart in the high yield bond ETF arena with its unique strategy of targeting bonds that were initially investment grade before being downgraded. This approach has paid off with ANGL delivering a solid 10.3% return over the past year.

Lopez expressed his enthusiasm for ANGL, terming it as an all-weather bond strategy that can thrive in various market conditions, including scenarios where companies see rating upgrades, pushing them back into the investment-grade territory.

He further highlighted that regardless of whether the economy maintains its strength or the Fed intervenes with rate adjustments, ANGL’s appeal remains intact for portfolio diversification.

Equity ETFs: Looking Beyond Traditional Beta

While fixed income options are attractive, Lopez also shed light on two alternative ETFs worth consideration. One notable addition is the VanEck Bitcoin Trust (HODL), which enters the realm of spot bitcoin ETFs. This offering tracks the CME CF Benchmarks Bitcoin Reference Rate-New York Variant, charging a modest 25 bps fee.

“We’ve advised advisors that allocating about 1% of their portfolio to bitcoin can potentially yield significant returns given the historical performance of this asset,” Lopez explained. This move can provide investors with exposure to the cryptocurrency boom without significant risk.

VanEck’s Embrace of the MOAT

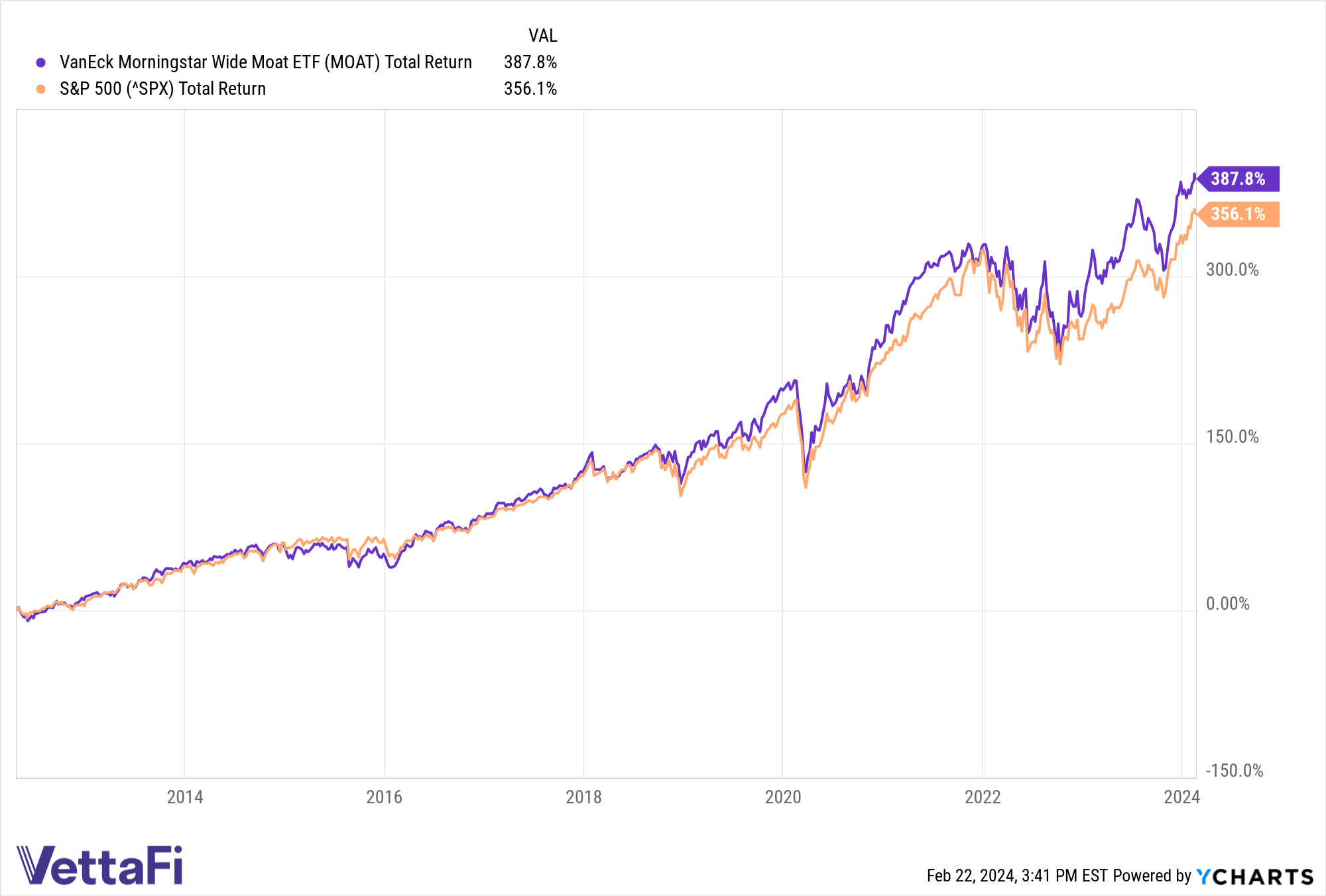

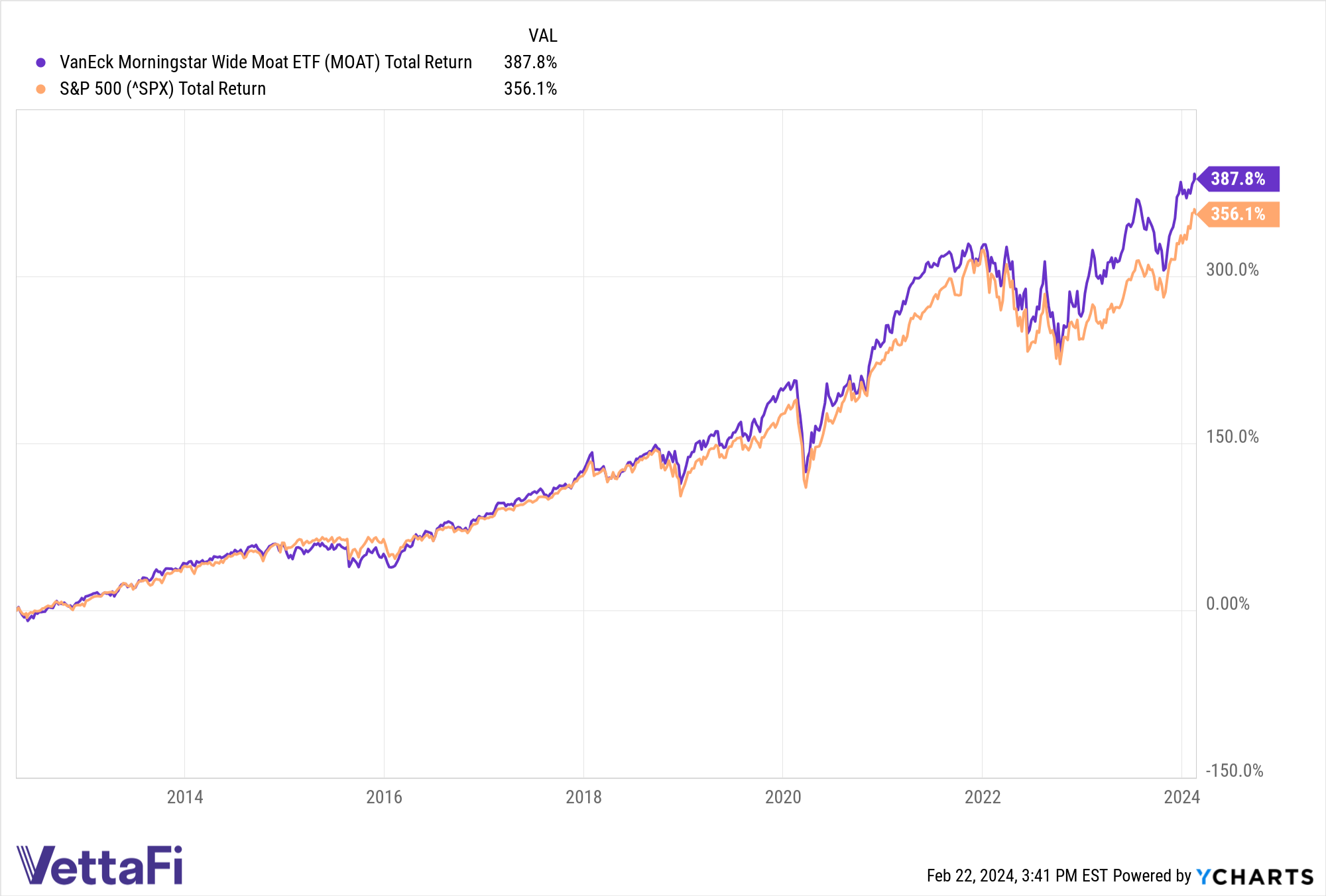

Lastly, VanEck continues to champion the MOAT ETF, tracking the Morningstar Wide Moat Focus Index. With a 46 bps fee, this strategy hunts for companies with substantial competitive advantages, leading to an impressive 14.2% return over the past five years, surpassing both its ETF Database Category and FactSet Segment averages.

Reflecting on MOAT’s performance against the S&P 500, Lopez commended its success in delivering superior returns, underpinned by a methodology centered on acquiring high-quality assets at attractive valuations. Even during periods when growth and tech stocks dominated the market, MOAT managed to outshine the S&P 500, showcasing its resilience.

MOAT has outperformed the S&P 500 since inception.

MOAT has outperformed the S&P 500 since inception.

Heading into the future, VanEck’s eclectic range of ETF offerings beckons to investors seeking diverse and robust strategies, from ANGL’s bond-centric approach to innovative ventures like the spot bitcoin ETF. These distinctive options signal VanEck’s commitment to catering to an array of investor preferences.

For additional news, insights, and analysis, explore the Beyond Basic Beta Channel.

Discover more on ETFTrends.com.