On the ever-fluctuating landscape of the stock market, Vaxart (NasdaqCM:VXRT) has emerged like a phoenix, with its average one-year price target ascending to a commendable 5.10 per share. This upward revision of 5.26% marks a substantial improvement from the earlier estimate of 4.84, as of the fateful date, January 16, 2024.

Peering into the crystal ball of analyst predictions, the latest target range spans from a modest 2.02 to a staggering 8.40 per share. This average price target heralds a meteoric rise of 301.57% from the most recent reported closing price of 1.27 per share.

The Fundamentals

What is the Fund Sentiment revolving around Vaxart? A tale of 112 funds or institutions reporting their positions in this stock unfolds before us. This reveals a chorus of 19 owners bidding adieu, marking a descent of 14.50% over the last quarter. The average portfolio weight embraced by all funds dedicated to VXRT stands at 0.01%, an impressive growth of 39.84%. Institutions have seen a dwindling percentage of total shares owned, down by 14.15% in the past three months to settle at 16,013K shares.

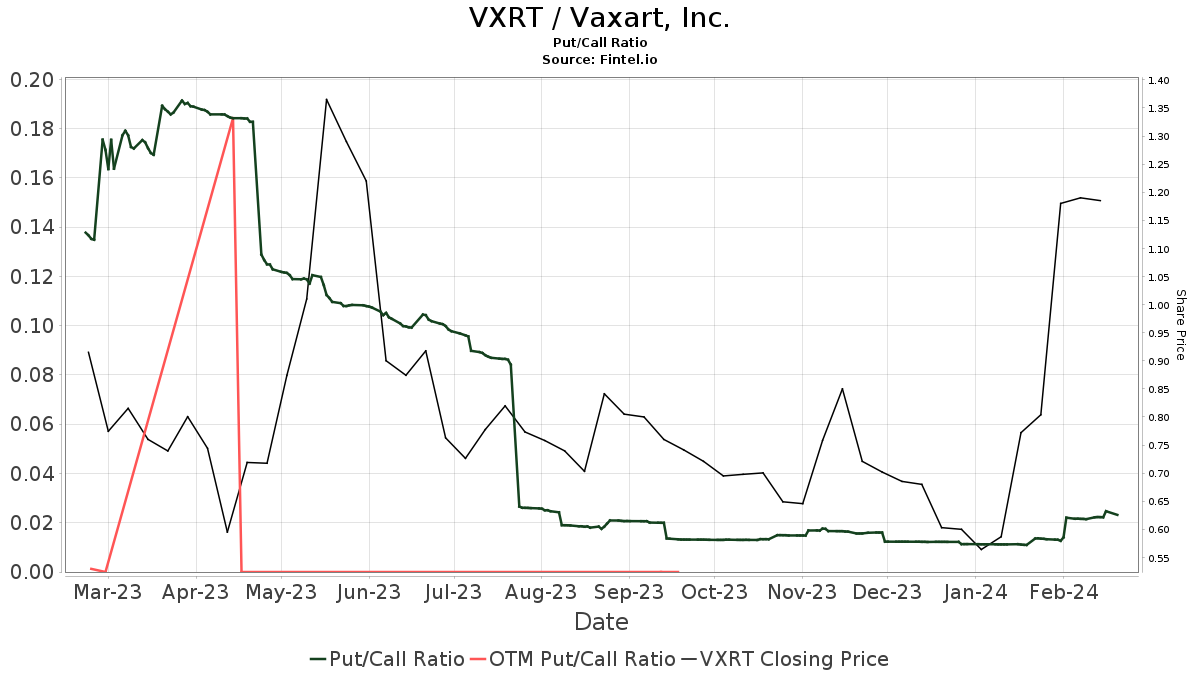

The put/call ratio of VXRT, a mere 0.04, paints a picture of optimism and a bullish outlook that echoes through the roaring halls of Wall Street.

Insight into Shareholders

Engaging in a game of ownership stakes, Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) shines bright holding 4,069K shares, representing a significant 2.41% stake in the company. With no change in the last quarter, stability reigns supreme.

Meanwhile, Geode Capital Management enters the fray with 1,962K shares, commanding a 1.16% ownership slice. Their prior filing showcased ownership of 1,787K shares, showcasing an enticing 8.94% increase. However, the firm exhibited a tactical retreat, decreasing its portfolio allocation in VXRT by 26.72% over the last quarter.

Further in the spotlight, Vanguard Extended Market Index Fund Investor Shares (VEXMX) hoists its flag with 1,769K shares, clutching onto a 1.05% ownership piece. Standing firm without alterations in the last quarter, VEXMX projects an image of unwavering faith in the Vaxart saga.

Breathing Life into Numbers

As the narrative unfolds, Fidelity Extended Market Index Fund (FSMAX) steps onto the stage with 756K shares, a respectable 0.45% ownership slice. Their prior filing revealed ownership of 706K shares, showcasing a delightful 6.68% increase. Yet, with strategic finesse, the firm staged a 6.49% decrease in its portfolio allocation in VXRT over the last quarter.

Adding to the storyline, Vanguard Health Care Index Fund Admiral Shares (VHCIX) brandishes its banner with 529K shares, claiming a 0.31% share of the pie. Their previous filing disclosed ownership of 482K shares, indicating a tantalizing rise of 8.95%. The firm amplified its portfolio allocation in VXRT by a modest 1.25% over the last quarter.

Vaxart Unwrapped

Diving into the essence of Vaxart, we encounter a clinical-stage biotechnology company navigating the intricate waters of developing oral recombinant vaccines. The crux of their innovation lies in a proprietary delivery platform that breathes life into their vision. These oral vaccines, akin to hidden treasures locked in tablets, promise a storied fate devoid of refrigeration woes or the looming specter of needle-stick injuries.

Embossed in this grand tapestry of innovation are aspirations to design recombinant vaccines for fresh frontiers while crafting oral renditions of existing vaccines. Vaxart’s ambitious portfolio includes tablet vaccines tailored to combat coronavirus, Norovirus, seasonal influenza, respiratory syncytial virus (RSV), and even a therapeutic vaccine for human papillomavirus (HPV) – their foray into the realm of immuno-oncology.

Their arsenal asserts a stronghold through broad domestic and international patents, safeguarding their turf. These patents, bedecked with oral vaccination using adenovirus and TLR3 agonists, serve as sentinels heralding the dawn of a new era.

Fintel stands as a bastion, a lighthouse guiding individual investors, traders, financial advisors, and small hedge funds through the tempestuous seas of investing research. Powered by a backbone of data that spans the globe, Fintel’s offerings delve into the nuances of fundamentals, analyst reports, ownership data, and a confluence of sentiments and trading activities, all encapsulated with the aim of ushering in profitable endeavors.

As the clock ticks and the market whirls, Vaxart treads a path lined with newfound heights and unforeseen challenges, sculpting a narrative that intertwines innovation with investor appetite.

Click to Learn More about this titillating saga that continues to captivate the minds of those immersed in the realm of stocks and shares.

The views and opinions sculpted within this piece are a vibrant tapestry spun by the author, offering a singular perspective that dances on the precipice of the financial world, a reflection that may or may not harmonize with Nasdaq, Inc.