Analyst Targets Suggest Positive Outlook for Vanguard Small-Cap ETF

In a detailed analysis of Exchange-Traded Funds (ETFs), ETF Channel examined individual stocks within the Vanguard Small-Cap ETF (Symbol: VB). This analysis compared each stock’s trading price to analysts’ average 12-month target prices to derive a weighted average for the ETF. The results point to an implied target price of $264.29 per share for VB.

Current Trading and Analyst Projection

Currently, VB trades at approximately $238.97 per share, suggesting a promising upside of 10.59% based on analysts’ targets for the ETF’s holdings. Notably, among VB’s investments, three stocks exhibit significant potential for growth: Janus International Group Inc (Symbol: JBI), Recursion Pharmaceuticals Inc (Symbol: RXRX), and Dine Brands Global Inc (Symbol: DIN). For instance, JBI’s recent share price is $7.24, with analysts expecting it to rise by 76.10% to $12.75 per share. Likewise, RXRX is expected to increase to $10.14 from a current price of $6.74, signaling a potential upside of 50.47%. Lastly, DIN is projected to grow by 47.06%, moving from $30.77 to a target of $45.25.

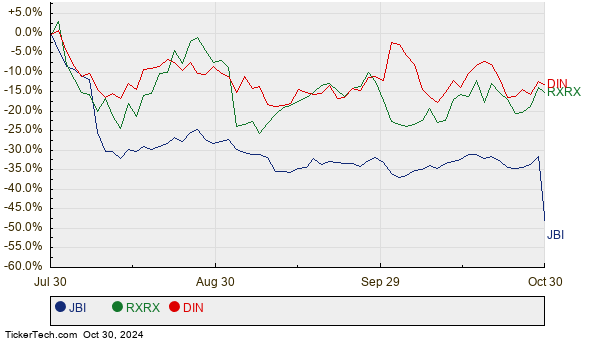

Performance Comparison Chart

Below is a twelve-month price history chart that illustrates the performance of JBI, RXRX, and DIN:

Summary of Analyst Target Prices

The following table summarizes the recent prices and the expected upside for each stock:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Small-Cap ETF | VB | $238.97 | $264.29 | 10.59% |

| Janus International Group Inc | JBI | $7.24 | $12.75 | 76.10% |

| Recursion Pharmaceuticals Inc | RXRX | $6.74 | $10.14 | 50.47% |

| Dine Brands Global Inc | DIN | $30.77 | $45.25 | 47.06% |

Evaluating Analyst Projections

As these targets suggest significant growth, one might wonder whether analysts are being realistic or overly optimistic. Are the expectations in line with recent developments in the companies and their respective industries? While a high target relative to a stock’s current price often indicates optimism about future performance, it may also prompt revisiting those targets if they do not align with current market conditions. Investors should conduct their own research to assess these opinions thoroughly.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• CNTX shares outstanding history

• ADRU Split History

• Top Ten Hedge Funds Holding ACTU

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.