The Departure of CFO Brent Bowman

Veeva Systems’ VEEV shares faced a 6.1% decline on April 2 after the announcement of CFO Brent Bowman’s departure. However, this change is more like a shifting wind than a thunderstorm. Bowman leaves on good terms, with his departure unrelated to financial strife or impropriety. He will support VEEV for three months in a consultancy role, ensuring a smooth handover. As Bowman sails off into the sunset, Tim Cabral, a former Veeva Systems CFO, will take the helm as interim CFO until a permanent successor is found. Not stopping at Bowman, VEEV has appointed fresh blood in the form of a new president, chief of staff, and chief marketing officer, signaling a new chapter for the company’s leadership saga.

Redrawing the Corporate Canvas

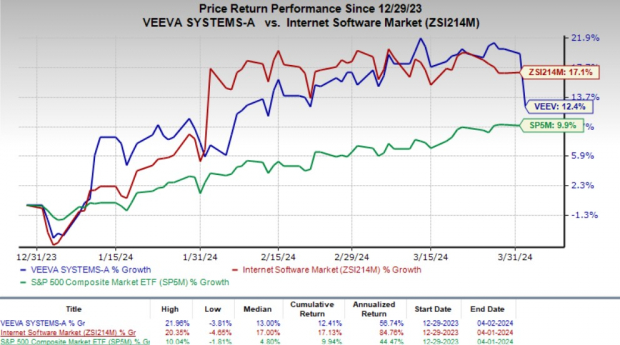

Despite the shake-up, Veeva Systems’ stock is still riding high with a 12.4% year-to-date surge, showcasing investors’ unwavering faith in the company’s future vision. In a sector that has swelled by 17.1% during the same period, VEEV stands out. The S&P 500 Index, by comparison, has seen a 9.9% rise year to date, making VEEV’s upward trajectory even more impressive. Changes at the top might be akin to pruning a flourishing tree — necessary for future growth.

Unveiling Future Scenarios

Reactions in the market to Bowman’s departure have shone a light on the vital role of steady financial stewardship in keeping investors on an even keel. Stifel analysts believe that structural, not strategic shifts likely spurred Bowman’s exit. While VEEV’s shares dipped momentarily, the pontoon’s stability depends on how deftly the company navigates the waters ahead. The focus now turns to VEEV’s fiscal performance and the quest for a new CFO — a pivotal decision for setting sail into uncharted waters.

Charting the Revolving Door of Leadership

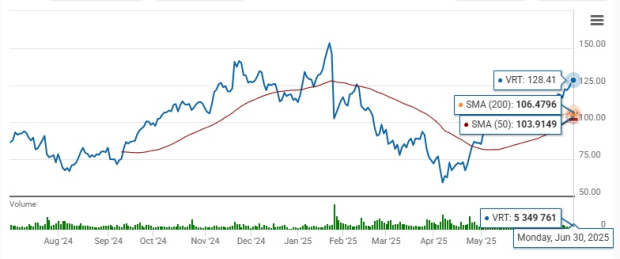

Veeva Systems Inc. price | Veeva Systems Inc. Quote

Glimpse at the Bigger Picture

Embracing uncertainty, Veeva Systems holds a Zacks Rank #3 (Hold). To contrast, DaVita Inc., Cardinal Health, Inc., and Cencora, Inc. stand out as top contenders in the medical realm. DaVita, boasting a Zacks Rank #1 (Strong Buy), has seen chart-topping growth rates and earnings, while Cardinal Health and Cencora hold their ground with impressive figures in their respective fields.

(DISCLAIMER: The original version of this article, posted on April 3, 2024, stands amended for clarity regarding Brent Bowman’s stepping down.)

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028. See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.