On Sunday, the U.S. military conducted a surprise operation in Venezuela, resulting in the capture of President Nicolás Maduro and his wife, Cilia Flores. Both are now in U.S. custody facing charges related to narco-terrorism. In the wake of Maduro’s arrest, Delcy Rodríguez has assumed the role of acting president, with a focus on restoring diplomatic relations with the U.S.

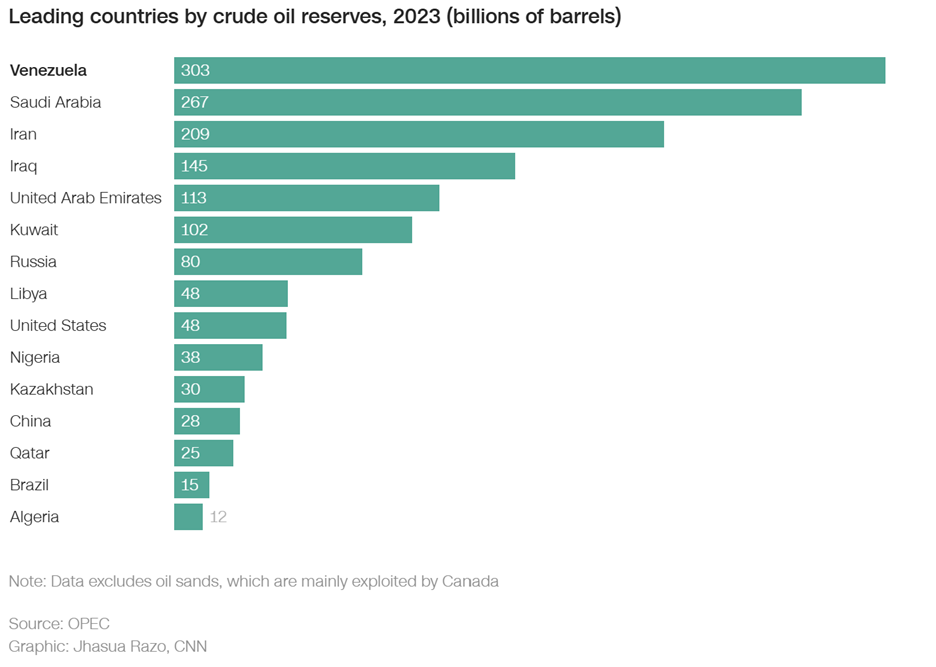

This significant geopolitical shift may have profound implications for global energy markets, as Venezuela possesses the world’s largest proven oil reserves. U.S. companies, particularly Chevron, which has retained operations in Venezuela, stand to benefit. Chevron’s stock rose approximately 4% following the news, while Valero increased by over 12% and Phillips 66 by 9%. The restructuring of Venezuela’s energy sector may lead to an influx of oil supply, potentially lowering global prices and contributing to economic growth.

As capital markets react to this new landscape, the emphasis will shift toward restoring Venezuela’s oil production and infrastructure. The U.S. government aims to facilitate this rebuilding effort, which could redefine Venezuela’s role in global energy and other critical sectors.