Written by Sam Kovacs

The Dogs of the Dow

I’ve always harbored a skepticism towards the “Dogs of the Dow” investment strategy. Sure, it sounds enticing to cherry-pick the 10 stocks from the Dow with the highest dividend yield each year — but isn’t that a bit like trying to pick a champion pig at the state fair? The reality is far more complex than a surface-level yield comparison from the Dow.

Value investing and the value factor both aim to capitalize on undervalued stocks, but they approach this goal differently. The concept of the Dogs of the Dow strategy is particularly interesting considering the statistically-proven tendency for companies with high dividend yields to show potential for outperforming others over time.

The Current “Dogs of the Dow”

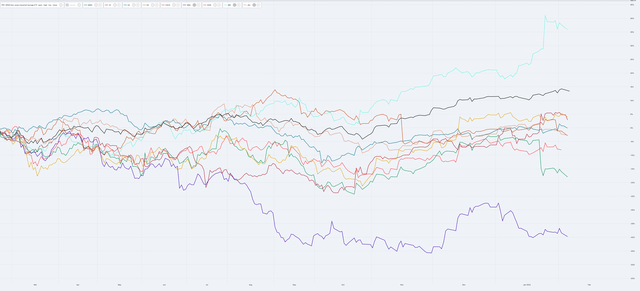

The current list includes 3M, Dow, Walgreens, Chevron, IBM, Cisco, Coca-Cola, Johnson & Johnson, Goldman Sachs, and Verizon. It’s worth noting that just because a stock is among the highest yielding, it doesn’t necessarily correlate to top performance as shown below.

The list includes stocks like IBM, which has outperformed the Dow Jones (DIA) in the past 12 months. This demonstrates that the Dogs of the Dow strategy might be an oversimplified attempt at a value factor, disregarding aspects such as the momentum factor.

Verizon: A Dive Into the Numbers

Verizon, one of the highest yielding stocks in the list, was already on the radar as one of the top stocks for 2024. Despite its modest 5% increase since the beginning of the year, our position hasn’t been all smooth sailing.

Our decision to buy Verizon at $50 in April 2022 wasn’t without its uncertainties. However, we managed to average down our cost to $41 by accumulating shares at various price points, ultimately bringing it to a favorable $41.5. With a current yield of 6.4%, the stock’s financials aren’t to be sniffed at.

Investing on the way down can certainly be a rollercoaster of emotions. Conviction and fortitude are key in these scenarios. On the flip side, one might opt to wait for a stock to hit rock bottom before pouncing on its recovery – effectively riding the momentum.

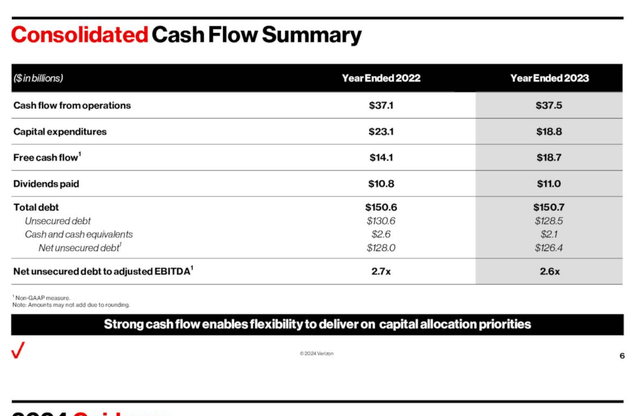

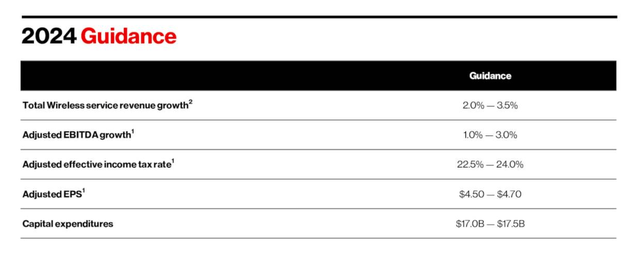

After some painstaking times, I’m convinced that VZ has turned a corner with its revenue up 3% in 2023 and generating $18.7 billion in free cash flow. With the dividend representing only 59% of FCF, the cash position looks robust – a good sign for potential investors.

Looking forward to 2024, the outlook is more promising, with the possibility of further declining payout ratio in the cards, which is encouraging news for shareholders.

What seemed like an anomaly in VZ’s price decline is now becoming its defining feature – making it a potential standout among the rest of the Dow. With positive financial indicators and a turnaround in sight, Verizon’s position seems stronger than ever.

Investors Beware: 3M’s Troubling Outlook

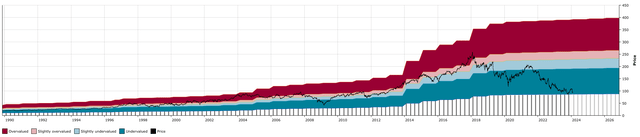

When it comes to 3M, the track record appears to have been quite a rollercoaster, to say the least. The company experienced overvaluation, followed by expectations of decline, only to be bought and then sold. The chart of 3M’s journey seems to resemble an erratic heartbeat – a symbol of uncertainty.

Recent Earnings and Market Reaction

3M recently reported earnings that failed to impress the market, leading to a significant drop in the stock price, which now hovers at $92, providing a yield of 6.3%. This has caught the attention of yield-hungry investors, prompting them to contemplate whether this might be an opportune moment to buy into the stock, akin to scavenging for scraps in a battlefield.

The earnings call yielded a treasure trove of information, including the revelation of a 2024 earnings guidance of $9.55 at the midpoint.

Lawsuits Loom Large

However, amidst the financial figures and projections lie two ominous lawsuits casting a dark shadow over 3M. One pertains to Combat Arms Earplugs, a case in which 3M agreed to a $6 billion settlement to redress the hearing loss suffered by service members. The second lawsuit involves PFAS water contamination, with a commitment of up to $10.3 billion stretched over 13 years. This financial burden is equivalent to a long-term debt that 3M must dutifully honor.

Estimating the Financial Impact

With these settlements looming on the horizon, the ramifications for 3M’s financial health are looming large. The settlements threaten to consume around a quarter of 3M’s free cash flow for the next few years. Although management has sought to reassure investors by hinting at the use of proceeds from a healthcare spinoff to fund these payments, the financial aftershocks are sure to be felt.

Implications for Dividend and Payout Ratio

Amidst these legal woes, questions arise about the sustainability of 3M’s dividend. The projected earnings and the anticipated spinoff of the healthcare unit paint a worrisome picture, with an estimated 85% payout ratio. This figure represents a trend of deteriorating payout ratios for 3M, with the company’s ability to raise dividends coming into question. The recent meager increase in the dividend only serves to compound these concerns.

As investors grapple with this troubling outlook, the need for caution and vigilance is paramount. The path ahead for 3M seems fraught with legal and financial obstacles, demanding unwavering diligence from shareholders.

Is 3M About to Kill Its Dividend Streak? A Warning for Investors

Investors in 3M are bracing themselves for the upcoming dividend announcement, and the stakes couldn’t be higher. With the possibility of the company breaking its long-held tradition of increasing the dividend, shareholders are on edge.

Management Losing Commitment?

For some time now, observable changes in how 3M’s management references the dividend during earnings calls have raised concerns. The once steadfast commitment appears to be wavering, hinting at a potential shift in priorities. Should the dividend remain unchanged, it could signal a significant warning for investors.

Recent history offers a cautionary tale. Several companies have recently broken their extensive dividend increase records. Considering the prevailing pessimism surrounding the stock, 3M might be contemplating a similar move, adding to the unease among investors.

Shifting Rhetoric on Dividends

In 2021, management’s language exuded confidence as they highlighted the 63rd consecutive year of dividend increases, emphasizing its significance to shareholders as the second priority. Fast forward to 2023, and the tone has notably shifted. References to dividends and share repurchases as “important pillars” have given way to a less emphatic acknowledgment of the amount returned to shareholders, alongside a shift in emphasis towards stock buybacks.

Historical Context and Investor Concerns

This gradual evolution in rhetoric has not gone unnoticed. The changing tone and priorities have raised red flags for many long-term investors, signaling a potential disconnect from the company’s historical values and investor expectations. The market’s response has been swift, with pressure mounting on 3M’s stock price. In fact, the stock currently offers one of the highest yields in the past 35 years, further adding to the growing investor anxiety.

Market Impact: Soros’ Theory of Reflexivity

George Soros’ theory of reflexivity offers insight into the potential repercussions of a persistently depressed stock price. As per the theory, negative perceptions stemming from a declining stock value can trigger a self-reinforcing cycle, impacting both investor sentiment and management decision-making. With an uncertain outlook, such conditions could spur management to prioritize financial prudence, potentially leading to a dividend cut to safeguard the company’s financial health and restore investor confidence.

Amidst this looming uncertainty, the implications extend beyond mere financial metrics. The market’s response stands as an alarming signal, prompting investors to reconsider their positions and exercise caution.

Conclusion and Caution for Investors

The evolving situation at 3M serves as a pivotal reminder for investors to remain vigilant. While the company’s historical standing in the Dow Jones and its long dividend track record might instill confidence, recent developments call for a cautious approach. The prevailing pessimism surrounding the stock demands a critical evaluation, emphasizing the need for discernment and a thorough re-assessment of the investment landscape.

As the uncertainty looms and the market reacts, prudence dictates a cautious approach. The wide-ranging implications of a potential dividend cut at 3M serve as a sobering illustration of the shifting dynamics, prompting investors to exercise due diligence and consider their positions judiciously.

As the looming announcement threatens to unsettle the investment landscape, it is imperative for shareholders to closely monitor the developments and recalibrate their investment strategies accordingly.

For those holding 3M shares, the prevailing sentiment advocates a prudent course of action. Amidst the prevailing unease, divesting current holdings might offer a strategic move, mitigating potential losses and paving the way for a more promising investment avenue.