Verizon Communications Inc. (VZ) is experiencing strong momentum in its 5G portfolio, driven by increasing customer demand for faster data speeds. The company reported a 2.3% projected growth in sales and a 2.2% growth in earnings per share (EPS) for 2025, although it faces competition from other telecom giants like AT&T, Inc. (T) and T-Mobile US, Inc. (TMUS). Verizon has invested heavily in infrastructure and now offers various pricing plans, contributing to solid customer additions in both its wireless and home broadband segments.

American Tower Corporation (AMT) operates over 149,000 communication sites globally and has upgraded approximately 75% of its towers with 5G technology. However, it anticipates a potential revenue decline of 2.1% in 2025, with modest EPS growth of 1.2%. Despite these challenges, American Tower’s business model relies largely on long-term tenant leases, generating stable and recurring revenue. Nonetheless, it faces risks from high customer concentration and potential lease cancellations, particularly in the U.S. and Canada.

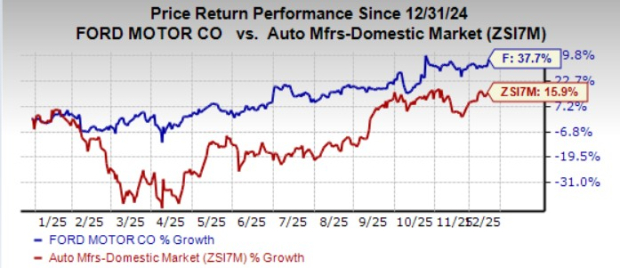

In terms of market performance, Verizon has seen a 4.9% decline in stock value over the past year, outperforming the industry average decline of 8.9%. Meanwhile, American Tower’s shares have decreased by 7.8%. Valuation metrics indicate that Verizon is trading at a price-to-earnings ratio of 8.31, significantly lower than American Tower’s 16.29, suggesting Verizon may present a more attractive investment opportunity based on these metrics.