Vertex Pharmaceuticals (NasdaqGS:VRTX) finds itself in the shining limelight as analysts revise the average one-year price target to $474.94 per share, representing an impressive 11.27% increase from the prior estimate of $426.85 dated January 16, 2024.

This upward revision showcases a bullish sentiment towards the stock’s potential growth trajectory in the coming year. The latest price targets range widely from a low of $328.25 to a high of $606.90 per share, with the average target signifying a substantial 10.45% uptick from the latest reported closing price of $430.00 per share.

Understanding the Investment Landscape

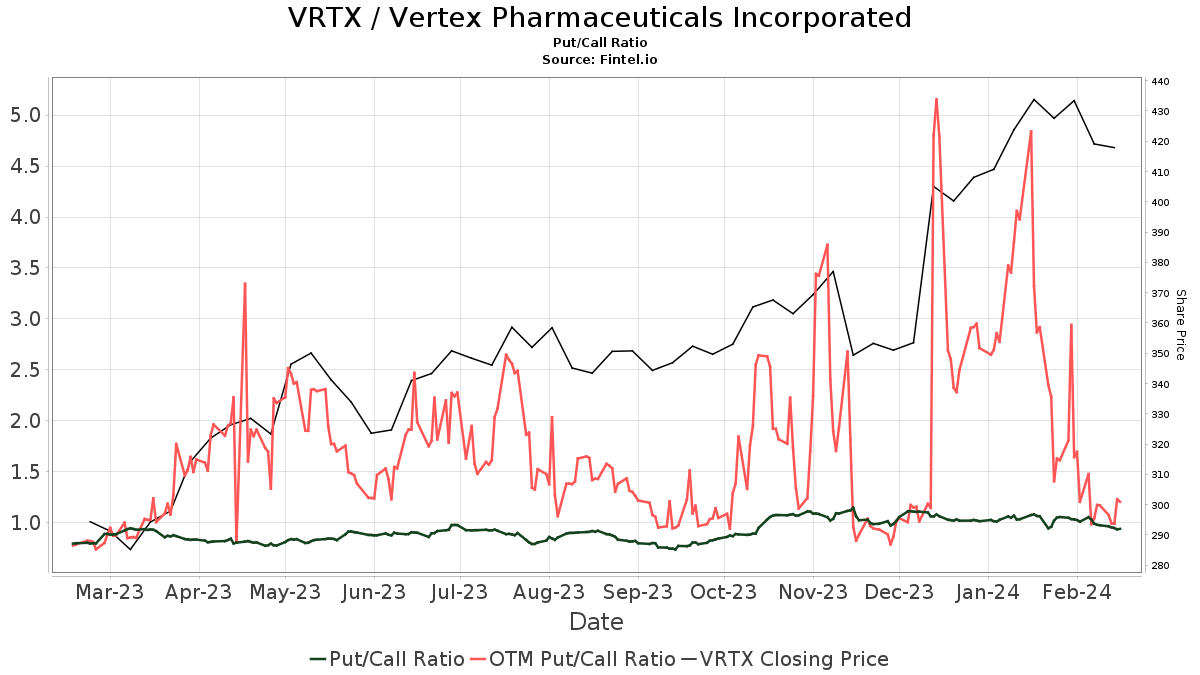

The market pulse is resonating positively for Vertex Pharmaceuticals as 2720 funds or institutions are currently holding positions in the company’s stock. This reflects a notable increase of 153 owners or 5.96% in the last quarter alone. The average portfolio weight allocated to VRTX by these funds stands at 0.53%, displaying a slight dip of 2.17%. Institutions have shown confidence in the company with total shares held rising by 0.10% to 282,365K shares in the last three months.  The put/call ratio of VRTX is 0.96, signaling a strong bullish outlook among investors.

The put/call ratio of VRTX is 0.96, signaling a strong bullish outlook among investors.

Insider Trading Trends

Capital World Investors have significantly bolstered their confidence in Vertex Pharmaceuticals by increasing their ownership to 21,806K shares, representing 8.44% of the company. Their portfolio allocation witnessed a substantial surge of 27.39% in the last quarter, underscoring their optimistic outlook.

Vanguard Total Stock Market Index Fund Investor Shares maintained their holding at 8,034K shares, accounting for 3.11% ownership. Despite a minor reduction from their prior ownership, the firm exhibited a 2.53% increase in their portfolio allocation, signaling continued faith in Vertex Pharmaceuticals’ growth trajectory.

Alliancebernstein, on the other hand, reduced their stake slightly to 7,040K shares, representing 2.73% ownership. The firm decreased their portfolio allocation by 0.99% in the last quarter, showcasing a cautious approach towards their investment in VRTX.

GROWTH FUND OF AMERICA upped the ante by increasing their ownership to 6,913K shares, translating to a 2.68% ownership stake. Their surge of 14.60% in portfolio allocation underlines a strong belief in Vertex Pharmaceuticals’ future prospects.

Vanguard 500 Index Fund Investor Shares strengthened their position by acquiring 6,202K shares, representing 2.40% ownership. With a 2.32% increase in portfolio allocation over the last quarter, the firm demonstrates a growing conviction in VRTX as a promising investment.

Delving into Vertex Pharmaceuticals’ Roots

(This insight is provided by the company itself.)

Vertex Pharmaceuticals stands as a global biotechnology powerhouse committed to fostering scientific innovation for the creation of transformative medications for individuals grappling with severe ailments. Notably, the company boasts a suite of approved medicines designed to address the root cause of cystic fibrosis – a rare, life-threatening genetic disorder. Additionally, Vertex is actively engaged in various clinical and research undertakings in the field of CF. Beyond cystic fibrosis, Vertex has a diverse pipeline of investigational small molecule drugs targeting other critical diseases, leveraging a deep understanding of human biology. These diseases range from pain management to alpha-1 antitrypsin deficiency and APOL1-mediated kidney diseases. Furthermore, the company boasts a rapidly growing portfolio of cell and genetic therapies aimed at combating illnesses like sickle cell disease, beta thalassemia, Duchenne muscular dystrophy, and type 1 diabetes mellitus.

Fintel serves as an invaluable investing research portal catering to individual investors, traders, financial advisors, and emerging hedge funds.

Featuring an extensive global dataset covering fundaments, analyst insights, ownership trends, and sentiment analysis, Fintel stands out as a go-to resource for uncovering profitable opportunities in the market. Additionally, Fintel’s selection of premium stock picks, driven by cutting-edge quantitative models, equips users with the necessary tools for maximizing returns on their investments.

Continue Your Discovery

For more detailed information, the original version of this article is available on Fintel.

The thoughts and perspectives articulated herein represent the author’s viewpoints and do not necessarily mirror the sentiments of Nasdaq, Inc.