While European stocks often play second fiddle to their U.S. counterparts, the Vanguard FTSE Europe ETF (NYSEARCA:VGK) has emerged as a star, boasting a robust 17.7% gain over the last six months. With exposure to 1,295 European stocks that offer a blend of affordability and higher dividend yields compared to U.S. stocks, VGK stands out as a hidden gem in the investment landscape.

For those who have long ignored the European market, the time is ripe to diversify and tap into the potential of European stocks that can complement U.S. holdings in a well-balanced portfolio.

Decoding VGK’s Investment Strategy

Vanguard’s $19.5 billion ETF aims to mirror the FTSE Developed Europe All Cap Index, capturing the performance of stocks across major European markets. It delivers a diverse basket of stocks spanning countries like France, Germany, Sweden, and the United Kingdom.

A Spectrum of Exciting Holdings

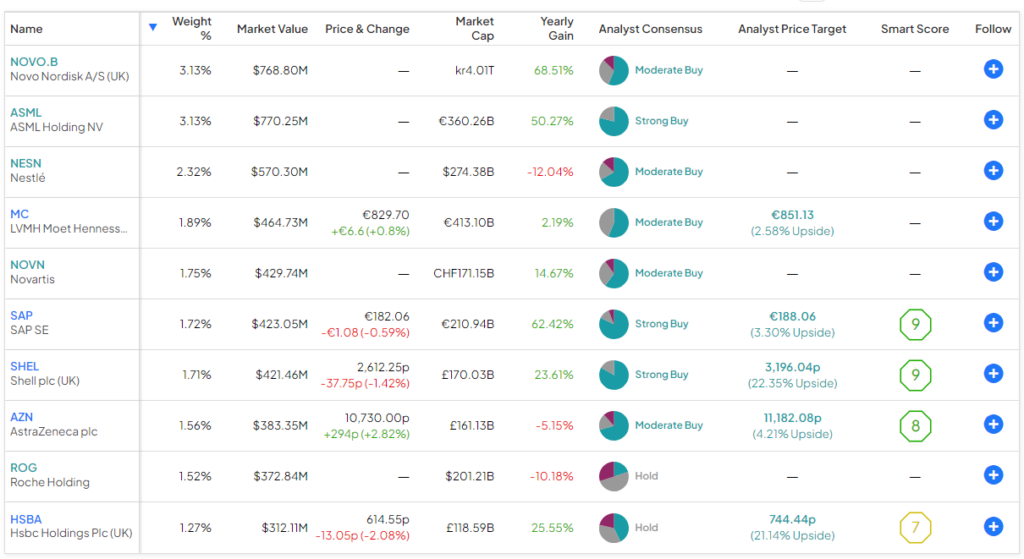

VGK offers a treasure trove of diversification with its 1,295 holdings, preventing over-concentration with its top 10 holdings that only account for 20.0% of assets. This contrasts sharply with the S&P 500, where mega-cap stocks dominate the index.

Top holdings like Novo Nordisk, ASML Holding, and SAP AG showcase the hidden innovation and potential of European companies. These giants in pharmaceuticals, technology, and energy sectors are quietly outperforming, with Novo Nordisk boasting a ‘Perfect 10’ Smart Score.

Historically Favorable Valuations

Compared to the lofty valuations of the S&P 500, VGK shines with a modest average price-to-earnings multiple of 13.9 times. As per Morgan Stanley, the valuation gap between U.S. and European stocks recently hit a record high, signaling potential opportunities for savvy investors eyeing value.

An Attractive Dividend Yield

VGK not only offers a bargain with its valuation but sweetens the deal with a generous dividend yield of 3.2%, far surpassing the S&P 500’s 1.4% yield. What’s more, VGK consistently rewards investors with a quarterly dividend payout for the last 16 years.

Investor-Friendly Expense Ratio

Adding to its appeal, VGK boasts an investor-friendly expense ratio of just 0.09%, allowing investors to keep more of their returns. This cost-effectiveness, pioneered by Vanguard, ensures that investors can navigate the market with minimal fees and maximum value.

Looking ahead, Wall Street paints a rosy picture for VGK, with a consensus rating of Moderate Buy and an anticipated 24.8% upside potential, underscoring the latent value waiting to be unlocked in European equities.

The Takeaway: Embrace the European Flair

Despite its surging performance, European stocks remain a bargain compared to their U.S. counterparts, offering a unique mix of value and yield. While VGK may not overshadow U.S. stocks, its attributes – from reasonable valuation to high dividend yield to Wall Street’s optimism – make a compelling case for investors to tap into Europe’s potential riches.

As an investor, consider adding a dash of Europe to your investment palette, leveraging VGK’s strengths to balance your portfolio and unlock the diverse opportunities that the European market presents.

Disclaimer: The author’s views and opinions expressed herein are personal and may not align with those of Nasdaq, Inc.