Investors seeking a strong yield and reliable passive income should take a look at VICI Properties Inc. (NYSE:VICI), a concentrated real estate investment trust with a sprawling portfolio of entertainment properties.

Despite the cyclical nature of VICI Properties’ earnings, the dividend is well-protected and poised for growth, even in the event of a U.S. economic recession in 2024.

The trust’s low pay-out ratio, on-par with the AFFO-based pay-out ratio of dividend champ Realty Income Corp. (O), coupled with the inclusion of trophy assets, make for compelling reasons to consider investing in VICI Properties in the current year.

Historical Ratings

Approximately a year ago, my article on VICI Properties emphasized its 4.5% dividend yield as an effective hedge against inflation, owing to the trust’s inclusion of rent escalators in its lease contracts. As the trust’s organic FFO continues to grow, the investment thesis remains strong. The recent 6% dividend increase in the third quarter underscores the compelling nature of VICI Properties, even in a low-rate, receding inflation environment.

Real Estate Concentration: Balancing Opportunities And Risks

VICI Properties is a net lease real estate investment trust heavily focused on the entertainment industry, with a significant portfolio of casino properties, particularly in Las Vegas. The trust’s real estate holdings boast a substantial number of casino properties, convention space, and over 60,000 hotel rooms, alongside golf courses.

The gaming segment of VICI Properties’ portfolio features casino properties with universal name recognition, including The Mirage, Caesars Palace, Park MGM, and The Venetian Resort. These assets, deeply rooted in the Las Vegas landscape, cater to the city’s 41 million annual visitors, who are a vital revenue source for the trust.

While the trust’s focus on Las Vegas presents an opportunity for robust revenue and dividend growth, it also exposes the portfolio to a recession-driven decline in tourist traffic. However, the high barrier to entry for new casinos, along with an exceptionally long weighted-average lease term, protects VICI Properties in this concentrated market.

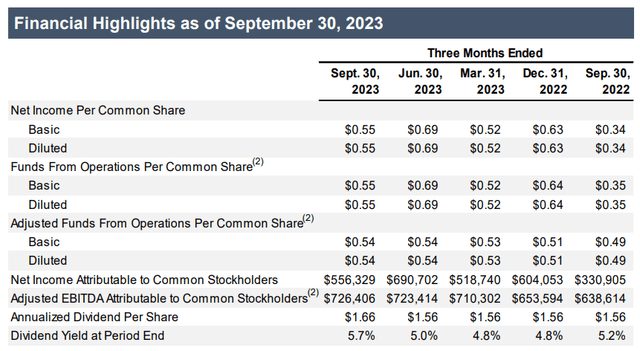

Growth In Adjusted Funds From Operations

VICI Properties is experiencing robust growth in its underlying cash flow, with adjusted cumulative FFO rising 34% year-over-year to $1.62 billion since January. Additionally, the EBITDA (adjusted) has soared 38% to $2.16 billion, indicating healthy underlying business trends. Maintaining a 100% occupancy rate in the third quarter, the trust is well-positioned for continued growth through both organic expansion and strategic acquisitions, potentially during a recessionary period.

VICI Properties: A Solid Choice for Passive Income Investors

VICI Properties recently raised its dividend pay-out from $1.56 per share per quarter to $1.66 per share per quarter, reflecting a dividend raise of 6.4%. This increase, coupled with a moderate dividend pay-out ratio, makes VICI Properties a compelling passive income investment.

Comparing Dividend Safety

VICI Properties, with a 75% adjusted funds from operations (AFFO) pay-out ratio in the last twelve months, offers top-of-the-class dividend safety when compared to Realty Income Corp. (O) with a 12-months dividend pay-out ratio of approximately 76%, based on adjusted funds from operations.

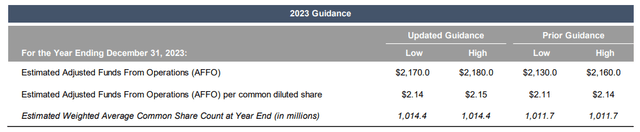

Evaluating AFFO Multiple

At an AFFO multiple of 14.9x, VICI Properties presents a strong investment opportunity, especially with the potential for 4-5% AFFO growth in 2024. Comparatively, EPR Properties Inc. (EPR) and Realty Income are selling for AFFO multiples of 9.4x and 14.4x, respectively, making VICI Properties a favorable choice.

Considerations for Passive Income Investors

VICI Properties, being more cyclical in nature, may experience greater profit fluctuations than other real estate investment trusts. However, this also positions it for stronger profit and dividend growth during good economic times.

Final Thoughts

VICI Properties’ moderate pay-out ratio, 6% dividend hike, and focus on long-term lease contracts make it a solid choice for passive income investors in 2024, regardless of economic conditions. The trust is expected to continue growing its dividend, making it a compelling investment even in a low-rate environment.