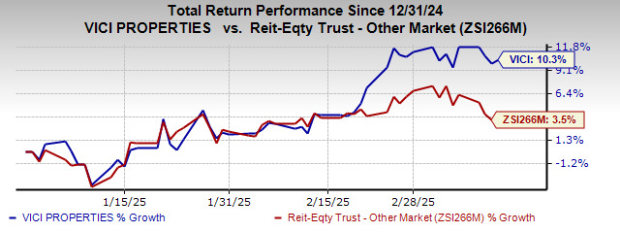

VICI Properties Outperforms with 10.3% Stock Growth in 2023

Shares of VICI Properties (VICI) have increased by 10.3% year-to-date, outpacing the industry growth of 3.5%.

This real estate investment trust (REIT) focuses on experiential properties, boasting a well-diversified portfolio across urban, destination, and drive-to markets in 26 states and one Canadian province.

Analyst Sentiment and Future Outlook

Analysts maintain a favorable view of this Zacks Rank #3 (Hold) company. Over the past month, the Zacks Consensus Estimate for VICI’s 2025 funds from operations (FFO) per share has been revised upward by 2 cents to $2.33.

Image Source: Zacks Investment Research

Factors Behind the Stock Surge

Several elements contribute to the significant uptick in VICI Properties’ stock price. As a triple net lease REIT, the company owns one of the largest, high-quality portfolios centered around gaming, hospitality, wellness, entertainment, and leisure destinations. With a 100% occupancy rate, its properties are vital to tenants, who incur high costs and face complex regulations if they attempt to relocate. This scenario enables VICI to secure a stable and consistent income stream.

The long-term triple-net leases VICI has with its tenants guarantee ongoing revenue along with growth potential. As of December 31, 2024, the company reported that all properties were fully leased, showcasing a weighted average lease term of approximately 40.7 years. Moreover, VICI anticipates that its lease agreements will feature a rent roll of 42%, indexed to the Consumer Price Index (CPI) for 2025, which may rise to 90% by 2035. This strategy offers protection against inflation, ensuring growth in cash flow even amid economic turbulence.

Diversification and Risk Management

VICI has proactively diversified its portfolio to mitigate risks associated with gaming volatility. Investments in experiential assets like Chelsea Piers and Bowlero exemplify this strategy, reinforcing VICI’s position as a leader in the broader experiential real estate market. The effective execution of growth strategies highlights the company’s strong management team, setting the stage for sustained success.

Financial flexibility is also a priority for VICI Properties. As of December 31, 2024, the company reported liquidity of $3.25 billion. The annualized net leverage ratio was 5.3, with a long-term target set between 5.0 and 5.5. Additionally, VICI maintained favorable investment-grade credit ratings of ‘Baa3,’ ‘BBB-,‘ and ‘BBB-‘ from Moody’s, S&P Global Ratings, and Fitch Ratings, respectively, facilitating access to the debt market.

Commitment to Dividends

VICI Properties remains dedicated to solid dividend payouts, an attractive feature for REIT investors. Its annual dividend growth rate has averaged 7% since 2018, surpassing many peers in the triple-net REIT sector. VICI has raised its dividend five times in the past five years, achieving a five-year annualized growth rate of 8.05%. With a robust operating foundation and sound financial standing, VICI’s dividend distribution is likely to remain sustainable.

Considering these factors, analysts expect the upward trend in VICI’s stock to persist in the near term.

Key Risks for VICI Properties

Despite its strengths, VICI Properties faces challenges related to tenant concentration risk and a significant debt load. Macroeconomic uncertainties and inflation may impact the business operations of its tenants.

Stocks Worth Watching

In the broader REIT sector, higher-ranked stocks include Welltower (WELL) and SL Green Realty (SLG), both currently holding a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for Welltower’s 2025 FFO per share stands at $4.89, indicating a year-over-year growth of 13.2%. For SL Green, the estimate for full-year FFO per share is $5.48, an increase of 9% from the prior year.

Note: All earnings figures discussed refer to funds from operations (FFO), a commonly used metric to evaluate REIT performance.

7 Top Stocks for the Next Month

The team of analysts has identified 7 elite stocks from the current pool of 220 Zacks Rank #1 (Strong Buy) stocks, which they believe are primed for early price increases.

Since 1988, past selections have outperformed the market by more than double, with an average annual gain of +24.3%. Take notice of these handpicked stocks for potential investment opportunities.

SL Green Realty Corporation (SLG): Free Stock Analysis Report

Welltower Inc. (WELL): Free Stock Analysis Report

VICI Properties Inc. (VICI): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.