Viking Holdings Faces Overselling But Analysts Predict Recovery

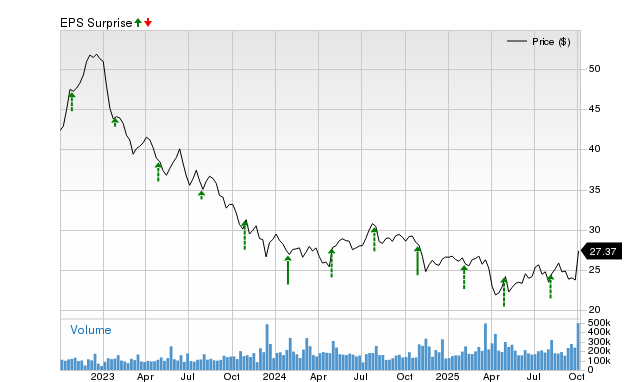

Viking Holdings (VIK) has recently faced significant selling pressure, resulting in a stock decline of 25.1% over the last four weeks. However, the stock is now in oversold territory, and analysts on Wall Street anticipate better earnings than previously expected.

Identifying Oversold Stocks: A Quick Guide

To determine if a stock is oversold, we frequently rely on the Relative Strength Index (RSI), a well-known technical indicator. This momentum oscillator tracks the speed and change of price movements.

RSI values range from zero to 100, and a stock is typically viewed as oversold when its RSI falls below 30. It’s important to note that all stocks fluctuate between overbought and oversold conditions, regardless of their fundamental quality. This is where the RSI proves useful, helping investors quickly assess whether a stock’s price is nearing a potential reversal point.

If a stock’s price dips significantly below its fair value due to excessive selling, investors might consider it an opportune moment to buy, betting on a subsequent rebound. Nonetheless, like any investing tool, RSI has its limitations and should not be relied upon solely for investment decisions.

VIK’s Potential for a Trend Reversal

There are signs that the heavy selling pressure on VIK shares may soon subside, as indicated by its RSI reading of 26.22. This suggests that the stock could be on the verge of a trend reversal, returning to a previous equilibrium between supply and demand.

Additionally, strong consensus among analysts has emerged concerning VIK’s earnings projections. Over the past 30 days, the consensus EPS estimate for VIK has risen by 2.5%. Generally, increasing earnings estimates signal potential price appreciation in the near term.

VIK currently holds a Zacks Rank #1 (Strong Buy), placing it in the top 5% of more than 4,000 ranked stocks based on earnings estimate trends and EPS surprises. This further supports the notion that VIK is likely to experience a turnaround soon. For those interested, you can view the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Expert Insights on Stocks With Growth Potential

Our team of financial experts has identified the top five stocks with the highest probability of more than 100% gains in the coming months. Among these, Director of Research Sheraz Mian highlights one stock that stands out for its potential significant rise.

This leading pick belongs to an innovative financial firm with a fast-growing customer base exceeding 50 million. With a diverse array of advanced solutions, this stock is well-positioned for notable gains. While not every stock on our elite list is guaranteed success, this particular stock could significantly outperform earlier Zacks’ recommendations, such as Nano-X Imaging, which surged by 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Viking Holdings Ltd. (VIK): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.