Valuing Cannabis Companies: Understanding Financial Distress and Market Options

Analysts have various methods for assessing the value of cannabis companies. Viridian often employs Discounted Cash Flow Analysis, Public Company Comparables, and M&A Precedent Transactions to evaluate both smaller private entities and larger public firms.

High Distress Levels Among Cannabis Firms

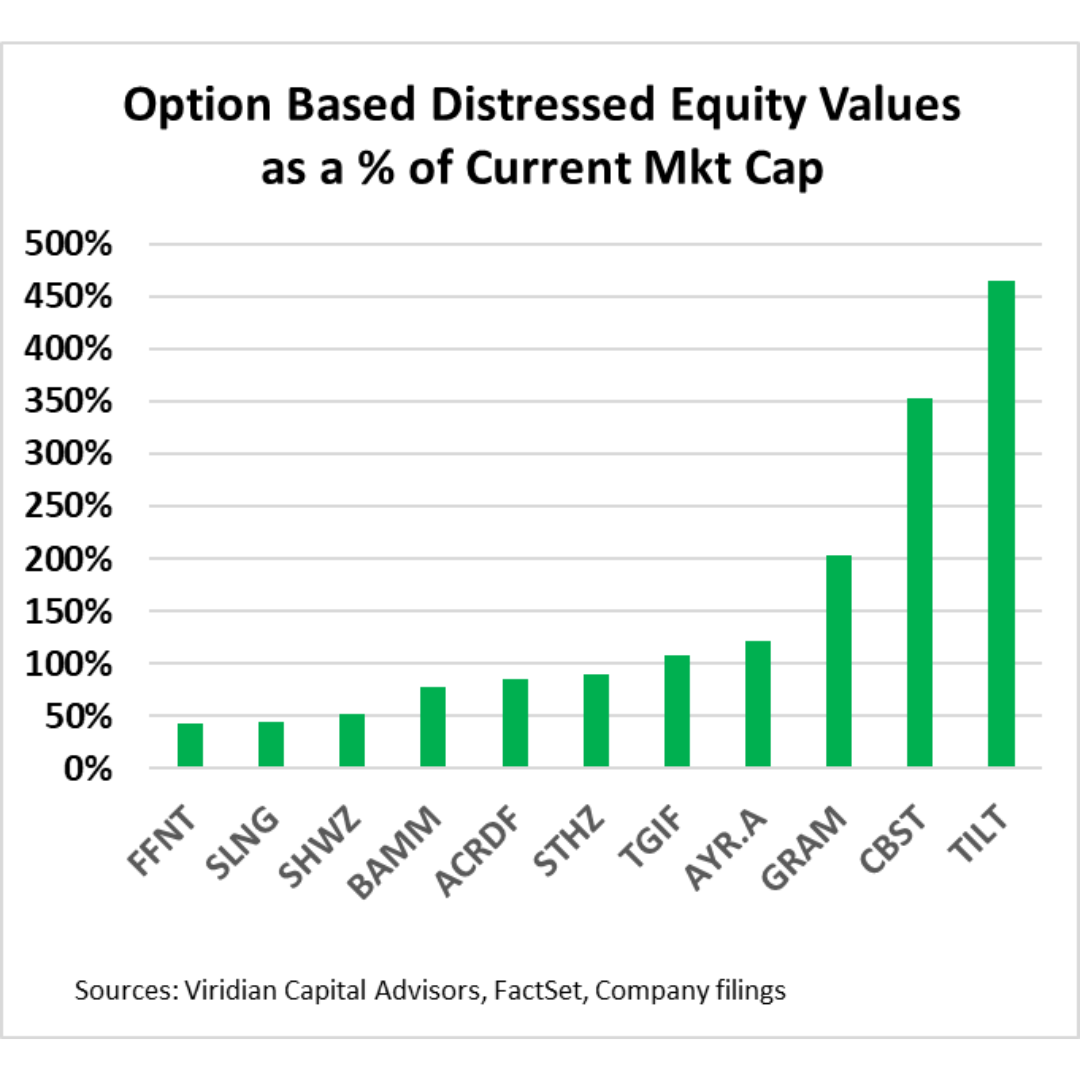

Consider the challenge of valuing a company where the current asset value is near or below its debt amount. The companies shown in the accompanying chart all have total liabilities exceeding nine times their market capitalization, suggesting significant financial distress. Notably, our initial asset value estimation for every company listed, aside from Cannabist CBSTF, is lower than their total debt.

The Equity Perspective

Does this imply that equity holds no value? Not necessarily. Financial theory posits that equity can be viewed as a call option on the asset’s value, with the debt acting as the strike price. When asset values exceed debt, equity holders can liquidate assets for a profit. Conversely, if asset values fall below debt, equity holders can relinquish their holdings to the debt holders without additional liabilities. Under this framework, corporate equity cannot be worthless unless the time for exercising the option expires. The chart compares our option valuation with each company’s current market capitalization.

Methods for Valuing Assets and Options

Determining the current asset value is crucial yet complex. We have chosen a maximum value of one times sales and a liquidation value of one times tangible assets. Though these estimates may seem low, they reflect the notable credit risk linked to these equities. Another key aspect is the option lifespan; we use the weighted average maturity of the debt. For companies with current liabilities, we assign a lifespan of one year.

Assessing Volatility and Valuation

Volatility plays a critical role in any option pricing model. We have set it at 30%, which is consistent with our modeling for equity call options tied to convertible debt or warrants. Although lower than observed volatilities for equities, this figure acknowledges that valuation of cannabis stocks can be hindered by short-selling challenges. Thus, it is a reasonable, albeit conservative, estimate of asset value volatility.

The Black-Scholes model serves as our primary valuation tool, given that these companies are unlikely to distribute dividends soon.

Current Liquidation Strategies of Key Players

Several companies, including Slang SLGWF, Statehouse STHZF, and Tilt TLLTF, are currently liquidating assets. In contrast, firms like AYR AYRWF, Cannabist CBSTF, Gold Flora GRAM, and Schwazze have not initiated restructuring processes, despite indicators of financial distress.

Market Insights from Viridian’s Analysis

Of the eleven companies analyzed, six show option valuations below their market caps, while five exceed them significantly.

Investors often perceive volatility as unfavorable, yet it can also be interpreted positively. Distressed cannabis companies possess two critical assets: time and hope. With numerous potential positive changes on the horizon, option valuation techniques become essential for assessing these higher-risk equities.

The Viridian Capital Chart of the Week showcases significant trends in investment, valuation, and M&A activity derived from the Viridian Cannabis Deal Tracker.

The Viridian Cannabis Deal Tracker offers market intelligence that cannabis companies, investors, and acquirers rely on for informed decisions about capital allocation and M&A strategies. Established in 2015, the Tracker has tracked over 2,500 capital raises and 1,000 M&A transactions, culminating in more than $50 billion in total value. Each week, it compiles and analyzes closed deals while segmenting them by important metrics, including:

-

Industry Sector (Tracking capital flow and M&A deals across 12 sectors, from cultivation to branding to software)

-

Deal Structure (Distinguishing between equity/debt in capital raises and cash/stock/earnout in M&A) Status of the company involved (public vs. private)

-

Key Players in Transactions (Issuer/Investor/Lender/Acquirer) and key deal terms (Pricing and Valuation)

-

Key Deal Terms (Including deal size, pricing, and capital costs)

-

Deals by the location of Issuer/Buyer/Seller (Tracking capital flow by state and country)

-

Credit Ratings (Including leverage and liquidity ratios)

The preceding article is from one of our external contributors. It does not reflect Benzinga’s opinions and has not been edited.

Market News and Data brought to you by Benzinga APIs