The Dawn of Innovation

Visa Inc. recently announced a trio of cutting-edge AI-powered risk and fraud prevention solutions, set to debut in the first half of 2024. These innovations, part of Visa Protect, enhance the company’s suite of value-added services—a fortification that includes issuing, acceptance, risk, and identity solutions, underscoring Visa’s ongoing commitment to pioneering advancements.

AI at the Helm

At the core of these advancements is Visa’s profound expertise in artificial intelligence. Leading the pack is the Visa Deep Authorization, a transaction risk scoring solution that refines the management of card-not-present (CNP) payments, effectively combating digital fraud without disrupting the user experience.

Furthermore, Visa has expanded its AI-powered fraud risk management tools to support transactions beyond the Visa network, consolidating fraud detection efforts for issuers while reducing operational costs — a move that bolsters fraud defenses across the board.

Anticipating Future Threats

The third solution, tailored for instant payment processes like peer-to-peer wallets and account transfers, stands as a testament to Visa’s forward-thinking approach in curbing fraudulent activities swiftly and efficiently. By harnessing deep learning AI, this solution evaluates real-time risks to preemptively thwart potential fraud, embodying Visa’s proactive stance against financial threats.

This proactive approach not only safeguards immediate transactions but also extends its umbrella of security beyond Visa’s network, fortifying the global payment ecosystem. Moreover, these efforts signify Visa’s steadfast dedication to fortify its risk and fraud solutions suite, hand in hand with enhancing its value-added services portfolio.

Strategic Investments Yield Fruits

Visa’s substantial investments, totaling $10 billion over the past five years in technology and innovation, are a testament to the company’s unwavering commitment to fortify its payment network’s security. Partnering with top-tier security provider Expel in 2023 further cements Visa’s resolve to combat a diverse range of cyber threats, ensuring global clients a safe and secure financial landscape.

The forward-looking approach has borne fruit, with Visa’s data processing revenues witnessing a robust 14% increase in the first quarter of fiscal 2024, signaling the effectiveness of its strategic initiatives and technological investments.

A Promising Horizon

With the digital realm expanding rapidly, the demand for advanced security solutions is poised for sustained growth. The enhanced Visa Protect suite not only addresses the evolving challenges of the digital era but also positions Visa as a stalwart guardian of financial integrity amidst the complexities of digital transactions.

As businesses of all sizes grapple with the specter of digital fraud, Visa’s innovative solutions serve as a beacon of hope, promising a secure and seamless payment ecosystem for all stakeholders.

Charting a Path Forward

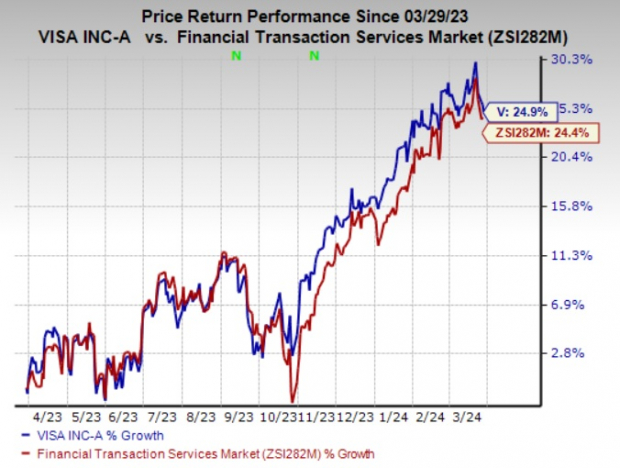

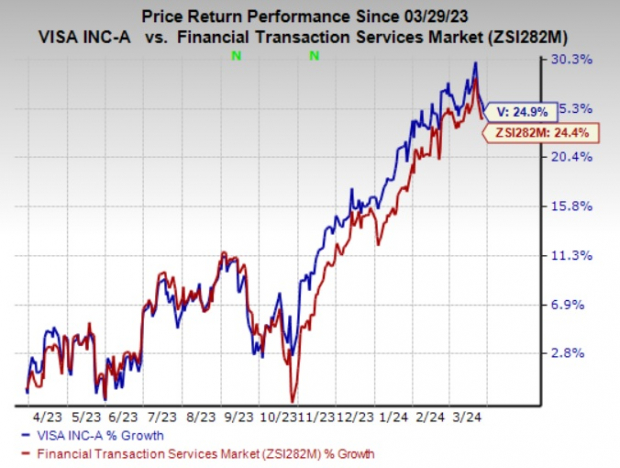

Shares of Visa have surged by 24.9% in the past year, outpacing industry growth. With a Zacks Rank #3 (Hold), Visa’s trajectory reflects a blend of innovation, resilience, and strategic foresight that positions the company as a leader in the ever-evolving landscape of digital finance.

Image Source: Zacks Investment Research