Vishay Intertechnology has debuted its Siliconix SiSD5300DN, a 30 V n-channel TrenchFET Gen V power MOSFET, designed to offer improved thermal performance and increased power density across various power conversion applications.

Revolutionary Advancements in Power MOSFET

The new device showcases a 35% enhancement over its predecessors, providing 18% lower on-resistance and reduced thermal resistance for minimized conduction and switching losses. Moreover, the MOSFET’s PowerPAK 1212-F source flip technology expands the ground pad’s area, ensuring efficient thermal dissipation for cooler operation.

This revolutionary technology also minimizes switching area, thereby reducing trace noise impact and simplifying the parallelization of multiple devices on a single-layer PCB with its center gate design package. Its versatility makes it suitable for a myriad of applications, including secondary rectification, BMS, buck converters, motor drives, load switches, welding equipment, servers and radio base stations.

Vishay Intertechnology, Inc. Expands Its MOSFET Portfolio

In addition to Siliconix SiSD5300DN, the company has introduced synchronous buck regulator modules — SiC931, SiC951, and SiC967. These modules are equipped with adjustable switching frequencies, current limit, soft start, and PMBus 1.3 compliant operation, ensuring ultrafast transient response, tight ripple regulation, and loop stability. They offer a compact design, which is 69% smaller than other solutions, while retaining enhanced power density, reduced design complexity, and time to market.

Vishay has also unveiled the SiHP054N65E, a fourth-generation 650 V E Series power MOSFET, delivering high efficiency and power density for telecom, industrial, and computing applications. With a 48.2% reduction in on-resistance, this MOSFET boasts an ultra-low gate charge of 72 nC, enhancing energy efficiency for server and telecom power supplies.

The Global Power MOSFET Market

These new offerings from Vishay are strategically positioned to leverage the growth opportunities within the global power MOSFET market, projected to reach $60.1 billion by 2033, with a compounded annual growth rate (CAGR) of 9.3% from 2023 to 2033 based on a report by Future Market Insights.

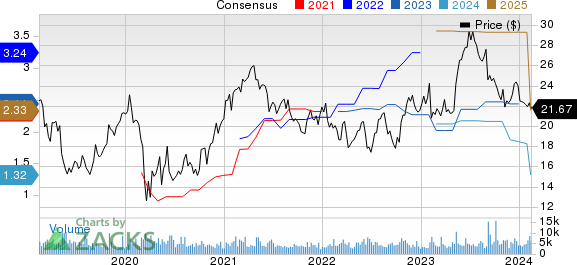

Despite the promising potential, Vishay faces macroeconomic uncertainties and subdued demand across industrial end markets. The company’s shares have declined by 9.6% year-to-date, notably underperforming the Zacks Computer & Technology sector’s growth rate of 9.2%.

Vishay Intertechnology’s Position in the Market

The Zacks Consensus Estimate for first-quarter 2024 revenues anticipates a 15.8% year-over-year decline, adding to the challenges faced by the company.

Actionable Insights and Investment Opportunities

Vishay currently carries a Zacks Rank #5 (Strong Sell). However, investors might consider looking into other opportunities within the technology sector.

For instance, companies such as CrowdStrike (CRWD), Badger Meter (BMI), and AMETEK (AME), which carry favorable Zacks Ranks, present alternate investment prospects. CrowdStrike bears a Zacks Rank #1 (Strong Buy), whereas Badger Meter and AMETEK both currently hold a Zacks Rank #2 (Buy).

While considering investment options, factors such as stock performance in the year-to-date period, accompanied by long-term earnings growth rates, should be carefully evaluated. For instance, CrowdStrike has indicated a notable 31% gain, with a long-term earnings growth rate of 36.07%. Badger Meter, despite recording a 0.6% decline in the year-to-date period, has a long-term earnings growth rate of 12.27%. On the other hand, AMETEK, with a 5.2% increase in the year-to-date period, has a long-term earnings growth rate of 9.19%.

Given the multitude of investment options, it’s essential for investors to conduct comprehensive research before making any decisions.