Rivian Automotive: Evaluating Growth Potential Amid Price Discounts

Rivian Automotive (NASDAQ: RIVN) shares are currently trading at a notable discount compared to competitors like Lucid Group and Tesla. However, the electric vehicle (EV) manufacturer holds significant growth potential, with a significant sales inflection point expected within the next 12 months.

Key Factors Influencing Rivian’s Stock Performance

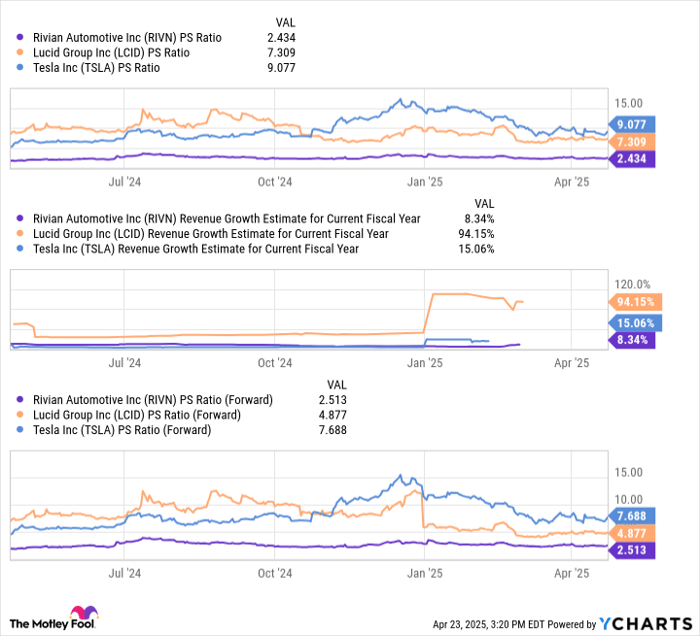

Rivian’s shares are priced at just 2.2 times sales, a substantial discount relative to its rivals. The company plans to introduce three new mass-market vehicles next year, slated for production beginning in early 2026. These models are projected to be priced under $50,000, a critical price point that could open up the market to millions of new customers. Presently, Rivian’s existing models are priced at $70,000 and above.

When Tesla launched its mass-market vehicles—the Model 3 and Model Y—its sales saw a significant increase, doubling or tripling in subsequent years. Rivian could experience a similar outcome. However, the current pricing of Rivian’s shares suggests a lack of confidence in this potential growth.

RIVN PS Ratio data by YCharts. PS = price-to-sales.

Looking Ahead: Sales Projections and Market Sentiment

Over the next year, Rivian’s sales base is anticipated to remain mostly stable, with the stock trading at approximately 2.5 times forward sales. This valuation appears reasonable given the expected growth rates. Yet, these estimates only account for the next 12 months. Rivian’s new models are set to launch just as this period concludes, and several quarters may be needed to fully gauge their market impact.

The market currently does not reflect much growth for Rivian shares, as this anticipated growth is expected to materialize beyond most analysts’ projections. Therefore, investors should closely monitor Rivian’s price-to-sales ratio alongside its full-year growth estimates. Once these estimates begin to integrate sales from Rivian’s new mass-market vehicles, the stock’s valuation may rise in relation to Lucid’s and Tesla’s.

Is Investing in Rivian Automotive Right for You?

Before deciding to invest in Rivian Automotive, consider the following:

Significantly, Rivian Automotive did not make the list of the 10 best stocks identified by industry analysts. Historical examples show that successful recommendations can yield substantial returns; for instance, a $1,000 investment in Netflix back on December 17, 2004, would be worth approximately $594,046 today, and a similar investment in Nvidia from April 15, 2005, would be around $680,390 now.

The Stock Advisor program reports an average return of 872%, far surpassing the S&P 500’s return of 160%. It’s essential to consider these statistics when evaluating potential investments.

Ryan Vanzo has no position in any of the mentioned stocks. The Motley Fool has positions in and recommends Tesla.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.