Analysts Predict Growth for Vanguard Russell 1000 ETF and Key Holdings

At ETF Channel, we’ve analyzed the current market conditions for various ETFs. By comparing the trading prices of the holdings in the Vanguard Russell 1000 ETF (Symbol: VONE) against estimated analyst target prices for the next 12 months, we’ve calculated a weighted average target for VONE at $287.28 per unit.

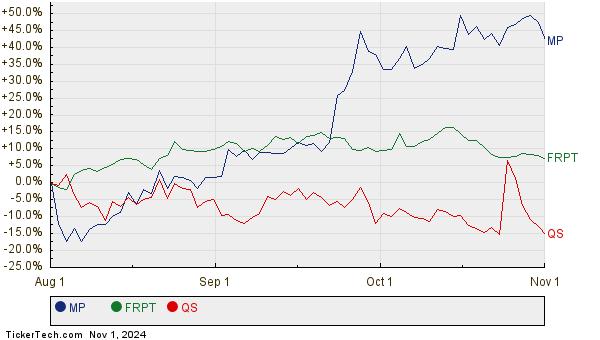

Currently, VONE trades at approximately $258.20 per unit, indicating an expected upside of 11.26% based on analysts’ predictions for its underlying holdings. Noteworthy stocks within VONE include MP Materials Corp (Symbol: MP), Freshpet Inc (Symbol: FRPT), and QuantumScape Corp (Symbol: QS). For instance, MP traded recently at $17.99 per share, yet analysts target it 15.21% higher at $20.73. Likewise, FRPT, priced at $132.54, has a target of $151.69, which translates to a 14.45% potential growth. In addition, analysts anticipate QS to rise to $5.89 from its current $5.15, reflecting a 14.33% upside. Below is a chart highlighting the recent stock performance of MP, FRPT, and QS:

Here’s a summary of the current analyst targets for VONE and its major holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Russell 1000 ETF | VONE | $258.20 | $287.28 | 11.26% |

| MP Materials Corp | MP | $17.99 | $20.73 | 15.21% |

| Freshpet Inc | FRPT | $132.54 | $151.69 | 14.45% |

| QuantumScape Corp | QS | $5.15 | $5.89 | 14.33% |

The question remains: Are these analysts justified in their optimistic targets, or are they being overly optimistic? It’s essential for investors to investigate whether these evaluations are based on sound reasoning or outdated perspectives on recent market developments. High price targets might signal optimism, yet they can also result in downgrades if market conditions shift.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Other Insights:

• Bruce Berkowitz Stock Picks

• SDD Historical Stock Prices

• FSB Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.