Analysts See Significant Upside for Vanguard Russell 1000 ETF

In our analysis of the ETFs covered by ETF Channel, we examined the trading prices of individual holdings against their average 12-month forward target prices. For the Vanguard Russell 1000 ETF (Symbol: VONE), the implied analyst target price based on its underlying assets stands at $298.56 per unit.

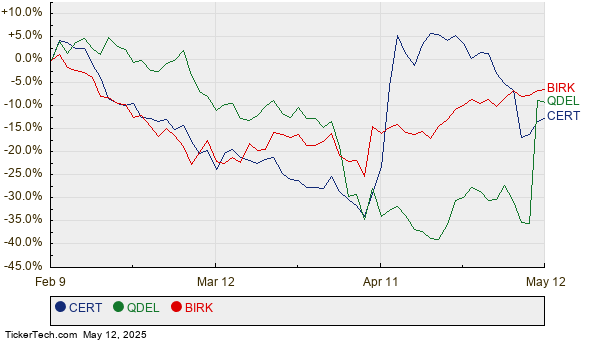

Currently, VONE is trading at approximately $256.76 per unit, indicating that analysts project a 16.28% upside if the average target prices of its underlying holdings are realized. Notably, three of VONE’s components offer significant upside potential: Certara Inc (Symbol: CERT), QuidelOrtho Corp (Symbol: QDEL), and Birkenstock Holding PLC (Symbol: BIRK). Certara, trading at $11.98/share, has an average target of $15.61/share, suggesting a potential increase of 30.31%. Similarly, QDEL, priced at $36.34/share, has an average target of $46.43/share, reflecting a 27.76% upside. Meanwhile, analysts expect BIRK to reach a target price of $66.79/share, indicating a 27.01% increase from its current price of $52.59.

Below is a chart illustrating the twelve-month price history of CERT, QDEL, and BIRK:

Here’s a summary table of the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Russell 1000 ETF | VONE | $256.76 | $298.56 | 16.28% |

| Certara Inc | CERT | $11.98 | $15.61 | 30.31% |

| QuidelOrtho Corp | QDEL | $36.34 | $46.43 | 27.76% |

| Birkenstock Holding PLC | BIRK | $52.59 | $66.79 | 27.01% |

Investors may wonder if analysts are justified in their targets or overly optimistic about future trading prices. Understanding whether these targets are grounded in recent developments or are becoming outdated is essential for making informed decisions. Analysts’ high price targets relative to current trading prices can indicate optimism, yet they may also lead to downgrades if based on previous market conditions. Further research is recommended to evaluate these projections.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Resources:

• Blue Chip Dividend Stocks Hedge Funds Are Selling

• Funds Holding TBND

• Top Ten Hedge Funds Holding BBD

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.