Analysts Anticipate Significant Upside for Vanguard Russell 1000 Value ETF

ETF Channel recently analyzed the underlying holdings of various ETFs, comparing current trading prices against the average analyst 12-month forward target prices. For the Vanguard Russell 1000 Value ETF (Symbol: VONV), the findings show an implied analyst target price of $95.53 per unit based on its portfolio of underlying assets.

Currently, VONV is trading at approximately $82.04 per unit, indicating a potential upside of 16.44% should it align with analyst expectations for its holdings. Notably, three companies within VONV’s portfolio stand out for their projected growth relative to their current prices: Amer Sports Inc (Symbol: AS), QuidelOrtho Corp (Symbol: QDEL), and Certara Inc (Symbol: CERT). Amer Sports, trading at $25.60, has an average analyst target of $34.12, presenting a 33.29% upside. Similarly, QuidelOrtho, recent price at $38.68, shows a potential increase of 31.11% towards a target price of $50.71. Certara is estimated to rise by 29.15% from its current price of $11.27 to a target of $14.55.

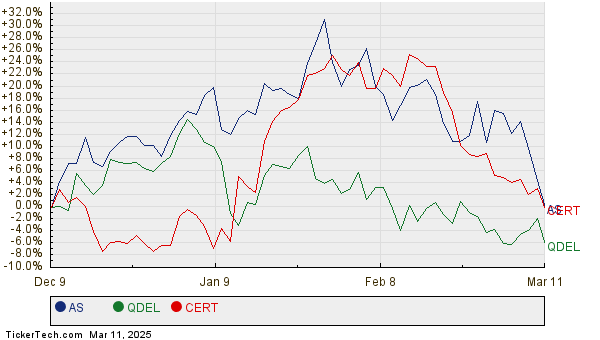

Below is a twelve-month price history chart of the stocks AS, QDEL, and CERT:

Here is a summary table of the discussed analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Russell 1000 Value ETF | VONV | $82.04 | $95.53 | 16.44% |

| Amer Sports Inc | AS | $25.60 | $34.12 | 33.29% |

| QuidelOrtho Corp | QDEL | $38.68 | $50.71 | 31.11% |

| Certara Inc | CERT | $11.27 | $14.55 | 29.15% |

These anticipated price targets beg questions about their accuracy. Are analysts too optimistic about the potential trading prices a year from now? Evaluating the justification behind these targets, alongside current market conditions and recent developments, is essential for discerning investors. While high target prices can indicate a positive outlook, they may also signal potential downgrades if they no longer reflect the current market landscape. Further research is recommended for investors navigating these insights.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

STAR market cap history

RARX market cap history

FLEX shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.