The Rise of Vanguard’s VOO in the S&P 500 ETF Market

Exchange-traded funds (ETFs) have seen tremendous growth, particularly among retail traders. Today, we delve into the surge of ETFs that track the S&P 500 index.

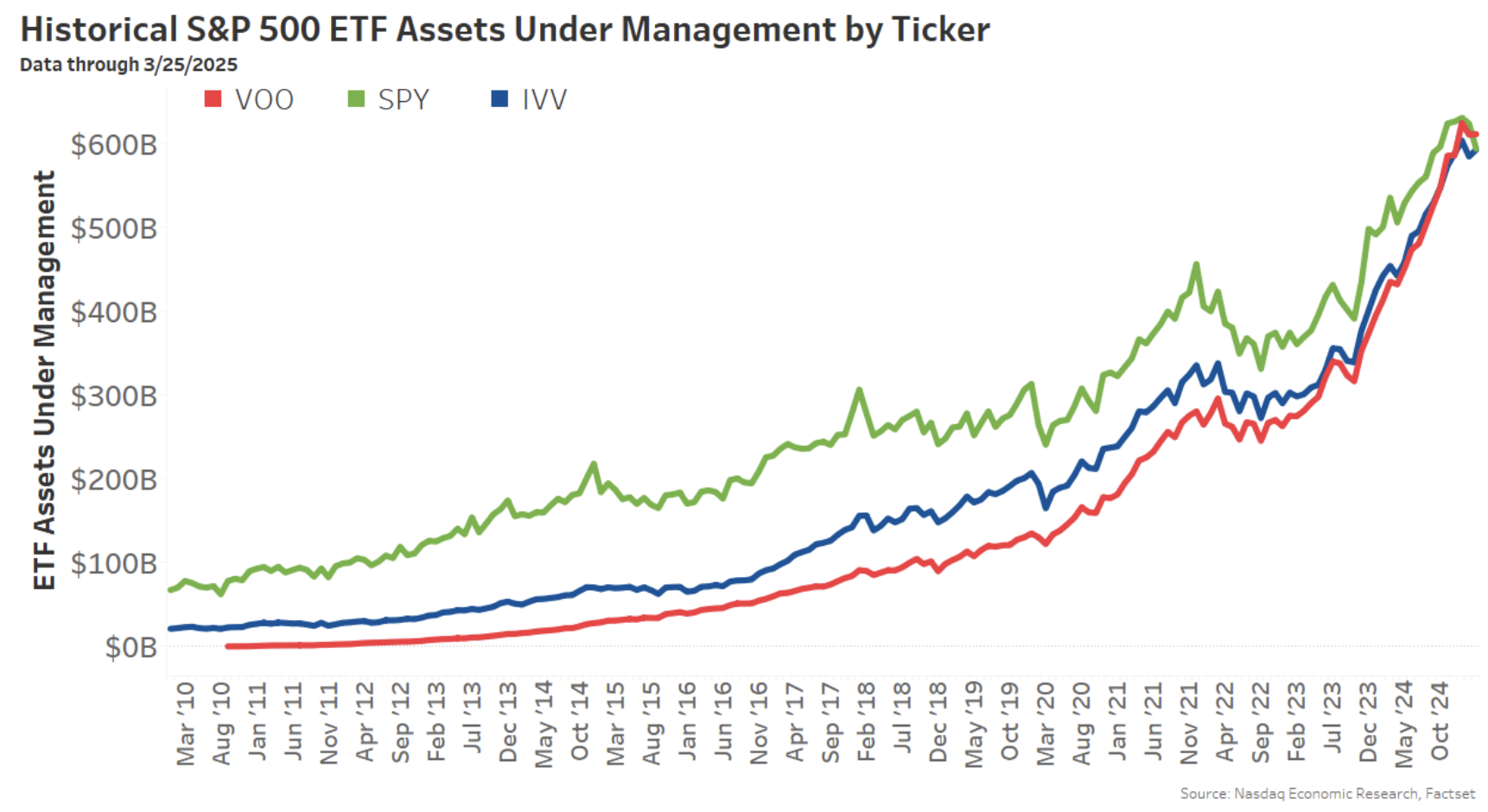

Vanguard’s VOO recently surpassed State Street’s SPY to become the largest S&P 500 ETF. However, data indicates that while VOO takes the lead in assets under management (AUM), SPY still performs well in other metrics. Meanwhile, BlackRock’s IVV closely follows behind and is gaining traction.

Vanguard’s VOO Takes a Lead in AUM

Since 2010, AUM for S&P 500 ETFs has surged from $88 billion to over $1.8 trillion. Initially, State Street’s SPY held a dominant 76% of S&P 500 ETF assets as the oldest U.S. ETF.

As depicted in the chart below, competitors like Vanguard’s VOO and BlackRock’s IVV are rapidly closing the gap. Recently, VOO managed to surpass SPY in total assets.

Chart 1: VOO and IVV Applying Pressure on SPY’s AUM Lead

The rising popularity of VOO and IVV could be attributed to their lower holding costs, which are less than one-third of SPY’s expenses.

IVV and VOO Are Seeing Significant Inflows

Since 2017, VOO and IVV have captured a significant majority of ETF net inflows. In total, these three ETFs saw about $643 billion in net creations, with VOO accounting for 54% of that figure.

Notably, data from our retail trading updates reveals that SPY attracted the most retail inflows. Since early 2017, SPY has gained $52 billion in AUM from retail investors, exceeding the combined net new retail assets of VOO, IVV, and SPLG.

This trend indicates that institutional investors are primarily driving the growth of IVV and VOO, while retail participation in SPY has led to overall positive flows. Retail net flows represent 127.6% of total fund flows for SPY, highlighting that non-retail investors are increasingly allocating their assets to IVV and VOO.

Chart 2: 128% of Net New AUM in SPY Derived From Retail Investors Since 2017

SPY Maintains Strong Liquidity in the Market

One category where SPY remains unmatched is liquidity. SPY trades over $28 billion daily, significantly outpacing both IVV and VOO by more than ten times.

Interestingly, while retail investors show enthusiasm for ETFs, their trading volume is modest compared to overall market liquidity (illustrated in Chart 3). Retail trading continues to be heavily focused on SPY, representing nearly 80% of all retail value traded in S&P 500 ETFs.

Chart 3: SPY Represents 89% of Dollars Traded by S&P 500 ETFs Since 2017

State Street Still Holds Some Competitive Edge

It’s important to note that SPY is not the only S&P 500 ETF available. State Street launched another S&P 500 ETF, SPLG, in 2017, which has attracted $58 billion in assets due to its lower management fees, similar to IVV and VOO.

When combining the assets of SPY and SPLG, State Street can still claim the title of having the largest S&P 500 ETF assets—at least for the time being.