Analysts Predict 9.99% Upside for Vanguard Utilities ETF VPU

At ETF Channel, we analyzed the underlying holdings of Exchange Traded Funds (ETFs) in our coverage universe. We compared the trading price of each holding with the average analyst 12-month forward target price. For the Vanguard Utilities ETF (Symbol: VPU), we determined the implied analyst target price for the ETF is $187.60 per unit.

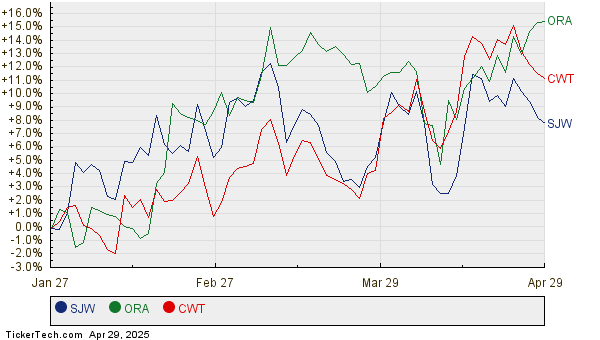

Currently, VPU is trading at about $170.57 per unit. This indicates that analysts see a potential upside of 9.99% based on their target prices for the ETF’s underlying holdings. Notably, three holdings within VPU stand out with significant upside potential: SJW Group (Symbol: SJW), Ormat Technologies Inc (Symbol: ORA), and California Water Service Group (Symbol: CWT). SJW currently trades at $53.51 per share, while its average analyst target is $60.40, representing an upside of 12.88%. Similarly, ORA has a recent share price of $73.22, with an analyst target price of $82.50, suggesting a potential upside of 12.67%. Analysts expect CWT’s price to reach $55.80 per share, which is 12.61% higher than its recent price of $49.55. Below, you can see a twelve-month price history chart comparing the performance of SJW, ORA, and CWT:

Here’s a summary table of the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Utilities ETF | VPU | $170.57 | $187.60 | 9.99% |

| SJW Group | SJW | $53.51 | $60.40 | 12.88% |

| Ormat Technologies Inc | ORA | $73.22 | $82.50 | 12.67% |

| California Water Service Group | CWT | $49.55 | $55.80 | 12.61% |

Are analysts justified in these targets, or might they be overly optimistic about stock prices in the next 12 months? It’s essential to investigate whether analysts have valid justifications for their predictions or if they are trailing behind recent company and industry developments. A high price target compared to a stock’s trading price can indicate optimism, but it may also signal potential downgrades if the targets are based on outdated information. Further research by investors could clarify these points.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Insights:

· Top Ten Hedge Funds Holding PLLL

· GENK Historical Stock Prices

· LGO YTD Return

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.