The average one-year price target for the iPath Series B S&P 500 VIX Short-Term Futures ETN (BATS: VXX) has been revised to $28.28 per share, marking a 14.77% decrease from the previous estimate of $33.18 on December 5, 2025. This target range is derived from analysts, with forecasts between $21.00 and $32.75 per share. The current price of VXX is $27.86, reflecting a 1.51% increase from this average price target.

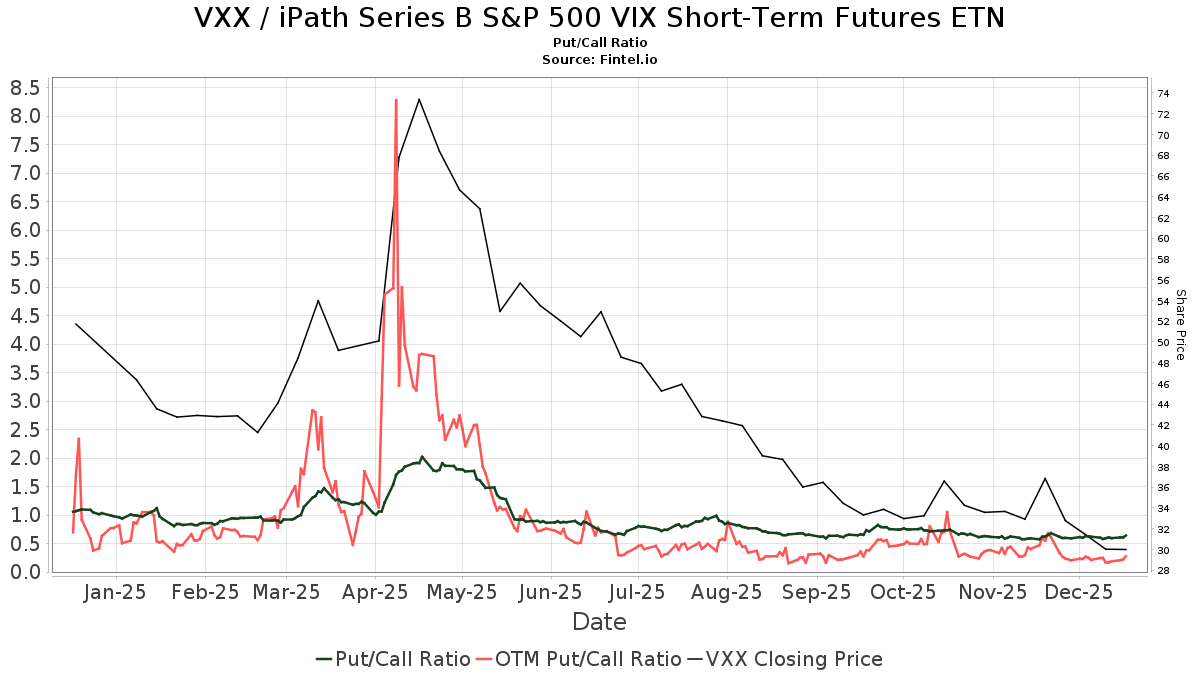

A total of 93 funds now report positions in VXX, a 47.62% increase of 30 institutions from the previous quarter. Average portfolio weight dedicated to VXX has risen by 190.11% to 0.21%. In contrast, total institutional shares owned have decreased by 7.77% to 8,005K. The put/call ratio stands at 0.61, indicating a bullish market sentiment.

Goldman Sachs holds 1,357K shares of VXX, an increase of 26.01% from 1,004K shares in prior filings, although its portfolio allocation decreased by 80.30%. BCJ Capital Management raised its ownership to 734K shares from none, while Ausdal Financial Partners increased its holding to 646K shares from 119K, marking an 81.65% rise. Conversely, Barclays significantly reduced its VXX shares from 5,251K to 615K, a reduction of 754.20% over the last quarter.