Analysts Lower Apple Ratings Amid iPhone Concerns

In a rare decision, analysts at Jefferies have downgraded Apple (NASDAQ: AAPL) to an underperform rating. This is unusual for Wall Street, where negative ratings are often a small fraction of overall assessments.

Weak iPhone Shipments May Impact Sales

Jefferies anticipates weak iPhone shipments in the upcoming fourth quarter. The firm notes that Apple’s artificial intelligence (AI) features haven’t captured consumer interest, referencing a survey indicating most U.S. consumers find these features lacking in usefulness. As a result, Jefferies believes there won’t be an AI-driven upgrade cycle for the iPhone.

Expectations are low for Apple’s upcoming quarterly report, with Jefferies predicting only 5% revenue growth in Q4, falling short of current analyst estimates. The firm’s target price for the stock is set at $200.75.

Strength in Services Revenue

Despite the downgrade tied to iPhone sales, Apple’s strong business model remains intact. The company reported minimal revenue growth of 2% year-over-year for fiscal 2024, with a 6% increase in Q4. However, device revenue declined by 1% over the fiscal year and rose only 4% in the last quarter.

Where Apple is thriving is in its high-margin services revenue, which includes income from the App Store, Apple TV, Apple Pay, and other subscriptions and services. Last fiscal year, services revenue grew by 13% and 12% in Q4, significantly boosting overall performance.

With a services gross margin nearing 74% compared to a product gross margin of about 37%, services are key to Apple’s profitability. Despite stagnant overall revenue, adjusted earnings per share rose by 11% last year to $6.75.

Image source: Getty Images.

Challenges in China and AI Implementation

The anticipated iPhone upgrade cycle surrounding Apple Intelligence appears to be fading. The company has faced challenges, including its AI providing inaccurate news alerts. Surveys reveal that users on both iPhone and Android have expressed indifference toward these AI features. Currently, Apple seems to bear the costs associated with AI without matching revenue benefits.

Additionally, Apple is struggling to implement Apple Intelligence in China, where it faces stiff competition from local brands. According to Counterpoint Research, iPhone sales in China fell by 18% in Q4, while sales for rival Huawei increased by 15.5% in the same period. Although there was initial enthusiasm for the new iPhone in China, the absence of AI technology has put Apple at a disadvantage.

Antitrust Risks with Alphabet

In addition to smartphone challenges, Apple also faces risks from Alphabet’s antitrust case. Alphabet has been providing Apple with an estimated $20 billion annually to keep Google as the default search engine on Safari. This revenue is nearly pure profit for Apple. However, if the antitrust case leads to changes in this agreement, the implications for Apple’s income could be significant, though any shift is likely far off as the appeals process unfolds.

Stock Valuation Changes

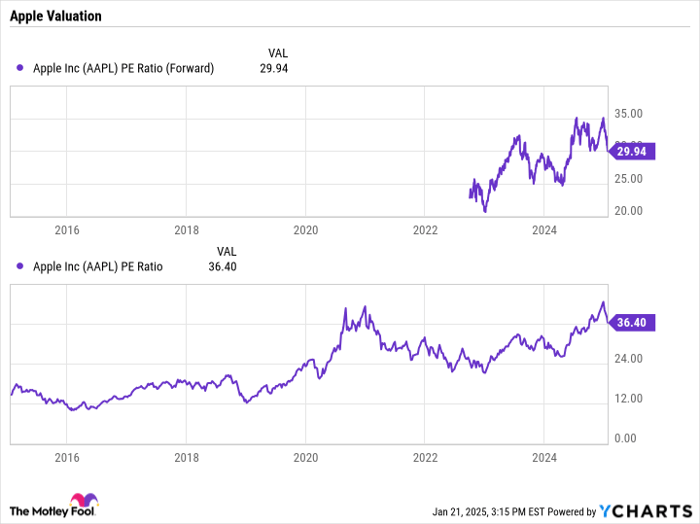

Over the past several years, Apple stock has nearly tripled in price-to-earnings (P/E) ratio, moving from 12 to 36 times, with a forward P/E of about 30 based on current fiscal estimates.

AAPL PE Ratio (Forward) data by YCharts

This expansion is partly due to the increase in high-margin services revenue, which often sees higher valuation multiples compared to hardware. Still, with the potential for reduced iPhone upgrades and notable stock valuation growth in the last six years, selling some shares might be a prudent move.

Should You Invest $1,000 in Apple Now?

Before investing in Apple, consider this:

The Motley Fool Stock Advisor analysts recently spotlighted what they consider the 10 best stocks for current investors, with Apple notably absent from this list. The recommended stocks have shown potential for significant returns.

Take Nvidia’s example: if you had invested $1,000 when it was featured on April 15, 2005, your investment would have grown to an extraordinary $874,051!*

Stock Advisor offers a straightforward guide for investors, complete with portfolio-building advice, regular updates, and two new stock picks each month. The service has significantly outperformed the S&P 500 since 2002*.

Learn more »

*Stock Advisor returns as of January 21, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Apple. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.