Analyst Recommendations: Assessing Veeva Systems’ Stock Outlook

Investors frequently turn to Wall Street analysts for guidance when deciding whether to buy, sell, or hold stocks. Changes in ratings from brokerage-firm analysts can significantly impact stock prices. But how much do these recommendations really matter?

To evaluate the reliability of brokerage recommendations, let us examine what analysts think of Veeva Systems (VEEV).

Current Brokerage Recommendations for Veeva

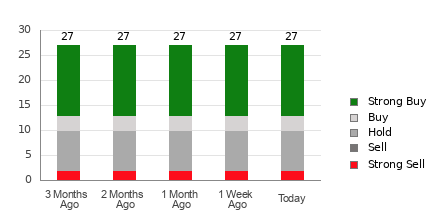

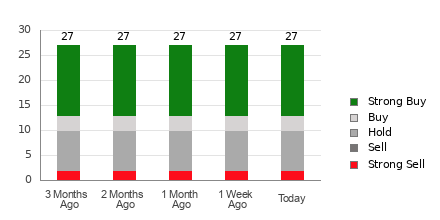

Veeva has an average brokerage recommendation (ABR) of 1.97, which is between Strong Buy and Buy on a scale of 1 to 5, according to the recommendations from 27 brokerage firms. Specifically, there are 14 Strong Buy and three Buy recommendations, making up 51.9% and 11.1% of the total, respectively.

Check price target & stock forecast for Veeva here>>>

Understanding the Limitations of Brokerage Ratings

While the current ABR suggests buying Veeva, relying solely on this information may not be prudent. Research indicates brokerage recommendations often show limited success in identifying stocks with the highest price appreciation potential.

Why is this? Brokerage firms tend to display a positive bias in their ratings, tied to their vested interests in the stocks they cover. Data indicates a pattern where for every “Strong Sell” recommendation, there are about five “Strong Buy” ratings, raising concerns about alignment with retail investor interests.

This suggests that brokerage recommendations may not accurately reflect a stock’s true trajectory. Instead, such ratings could serve as a way to corroborate your own research and analysis methodology.

The Zacks Rank vs. Average Brokerage Recommendation

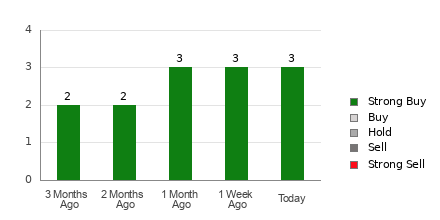

The Zacks Rank, an externally validated metric, categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) based on earnings estimate revisions. This model has a stronger historical correlation with near-term price performance compared to the ABR.

While both the Zacks Rank and ABR utilize a 1-5 scale, they serve different purposes. The ABR relies solely on analyst recommendations and often displays decimal points (e.g., 1.28). In contrast, the Zacks Rank is a quantitative model driven by earnings estimates, displayed in whole numbers.

It’s evident that brokerage analysts tend to skew their recommendations positively due to their firm’s interests, leading to potential misguidance for investors. Conversely, the Zacks Rank reacts promptly to changes in earnings estimates, providing timely insights for future price movements.

Evaluating Veeva’s Investment Potential

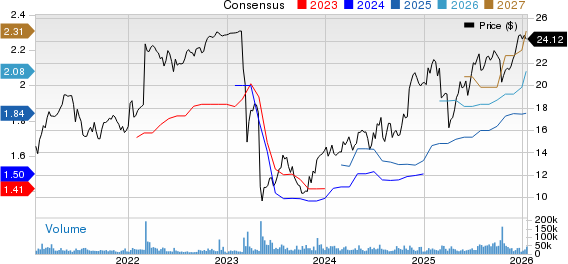

The latest earnings estimate revisions show a 5.5% increase in the Zacks Consensus Estimate for Veeva this month, bringing it to $7.30. This growing optimism among analysts may indicate strong potential for the stock’s appreciation in the near term.

The significant adjustment in the consensus estimate, combined with several supportive factors, gives Veeva a Zacks Rank #1 (Strong Buy). For those interested, view today’s Zacks Rank #1 (Strong Buy) stocks here>>>>

Consequently, while the Buy-equivalent ABR offers valuable direction, it should be considered alongside other analyses to inform investment choices.

Emerging Trends in the Semiconductor Sector

Zacks has identified a leading semiconductor stock as a top investment opportunity. This company is only 1/9,000th the size of NVIDIA, which surged over 800% post-recommendation. With strong earnings growth and an expanding clientele, it is well-positioned to meet the escalating demand for Artificial Intelligence, Machine Learning, and the Internet of Things.

Furthermore, global semiconductor manufacturing is projected to increase from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Veeva Systems Inc. (VEEV): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.