Wall Street Analysts Optimistic on Disney: What Investors Should Know

Investors often rely on insights from Wall Street analysts when deciding whether to Buy, Sell, or Hold a stock. While media coverage of changes in brokerage ratings can influence stock prices, how useful are these ratings in practice?

Let’s take a closer look at the current sentiment around Walt Disney (DIS) as expressed by these analysts.

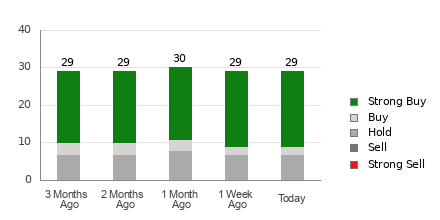

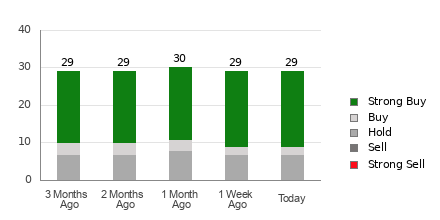

Disney holds an average brokerage recommendation (ABR) of 1.53 on a scale from 1 to 5, where 1 is Strong Buy and 5 is Strong Sell. This rating is based on the recommendations from 29 brokerage firms, indicating a consensus leaning toward a Strong Buy, as the breakdown shows 20 Strong Buy ratings and 2 Buy ratings, making up approximately 69% and 6.9% of all recommendations, respectively.

Understanding Disney’s Brokerage Recommendations

Check price target & stock forecast for Disney here>>>

While the ABR suggests a favorable outlook for Disney, making investment choices based solely on these ratings could be risky. Numerous studies have revealed that brokerage recommendations often fail to accurately predict which stocks will rise in value.

The reason? Brokerage analysts often exhibit a strong positive bias due to the interests of the brokerage firms that employ them. Research indicates that analysts issue five “Strong Buy” recommendations for every one “Strong Sell” on average.

This discrepancy means that retail investors might not have the insights they need for successful decision-making. To enhance your strategy, it may be beneficial to validate these recommendations with your own analysis or with a reliable tool that effectively forecasts stock price movements.

We at Zacks offer a proprietary stock rating tool called the Zacks Rank, which categorizes stocks into five groups from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This tool has a strong record of predicting short-term uptrends in stock prices. Utilizing the Zacks Rank in conjunction with the ABR could significantly aid in making sound investment decisions.

Distinguishing Between Zacks Rank and ABR

Although both the Zacks Rank and ABR use a scale from 1 to 5, they measure different factors.

The ABR is solely based on the recommendations from brokerage analysts and usually includes decimals (e.g., 1.28). Conversely, the Zacks Rank is grounded in quantitative metrics focused on earnings estimate revisions and is represented in whole numbers.

Historically, brokerage analysts have been excessively optimistic. Their ratings often do not accurately reflect the underlying research, primarily due to potential biases from their employer’s interests. This leads to more misleading information than helpful guidance for investors.

In contrast, the Zacks Rank emphasizes earnings estimate revisions, which are closely correlated with near-term price movements based on empirical data.

Moreover, the Zacks Rank maintains a constant distribution among its five classifications, ensuring a balanced outlook across all stocks that analysts evaluate for earnings estimates.

Another crucial difference relates to timeliness. The ABR may not always reflect current data, whereas the Zacks Rank is regularly updated to incorporate the latest earnings estimates made by analysts.

Assessing Disney’s Investment Potential

Currently, the Zacks Consensus Estimate for Disney has remained steady at $5.41 over the past month.

This stability in analysts’ earnings expectations suggests that Disney’s stock could perform in line with market trends in the near future.

Due to the lack of recent changes in earnings estimates, Disney holds a Zacks Rank of #3 (Hold). You can view the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

This calls for some caution in light of the Buy-equivalent ABR for Disney.

Top Stock Pick Could Substantially Rise

Amid thousands of stocks, five Zacks experts have each highlighted their top pick that could potentially soar +100% or more in the coming months. From these selections, the Director of Research Sheraz Mian has identified one stock he believes has the most explosive growth potential.

This company is appealing to millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter. The recent market pullback presents a prime opportunity for investors. While not all of our top picks succeed, this one has the potential to exceed the performance of previous high-flyers like Nano-X Imaging, which surged +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

The Walt Disney Company (DIS): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.