Examining Microsoft: Are Analyst Recommendations Reliable?

Investors frequently look to Wall Street analysts for guidance on their stock decisions. However, the real impact of these recommendations, especially when they change, is crucial to understand. How important are they, really?

Let’s take a closer look at what analysts are currently saying about Microsoft (MSFT).

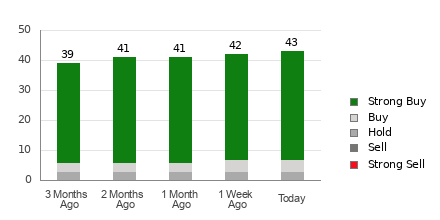

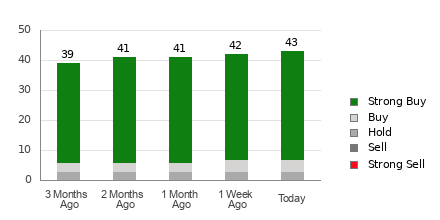

Microsoft holds an average brokerage recommendation (ABR) of 1.23, which is on a scale from 1 to 5 — where 1 represents Strong Buy and 5 denotes Strong Sell. This recommendation is based on data from 43 brokerage firms, indicating a preference between Strong Buy and Buy.

Out of the 43 recommendations contributing to this ABR, 36 are classified as Strong Buy and four as Buy. In percentage terms, Strong Buy recommendations account for 83.7%, while Buy represents 9.3% of the total.

Trends in Brokerage Recommendations for MSFT

While an ABR favoring a buy might seem promising, relying on this alone for your investment decisions could be misguided. Studies indicate that brokerage ratings often fail to direct investors to stocks with genuine price appreciation potential.

Why is this the case? Analysts from brokerage firms frequently hold a biased view when rating stocks due to potential conflicts of interest. Our research suggests these firms generate five “Strong Buy” ratings for each “Strong Sell,” which misrepresents the actual risks associated with their recommendations.

It is prudent to view these ratings as supplementary information rather than a standalone guide. They can serve as validation for your own research or tools known for indicating stock performance accurately.

One such tool is the Zacks Rank — a proprietary stock rating system that operates on earnings estimate revisions. It categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and has shown effectiveness in predicting short-term stock performance. Thus, matching the ABR with the Zacks Rank could lead to smarter investment decisions.

Understanding the Distinction Between ABR and Zacks Rank

Even though both the ABR and Zacks Rank operate on a 1 to 5 scale, they serve different purposes.

The ABR is purely based on broker recommendations, generally shown in decimals like 1.28. In contrast, the Zacks Rank is a quantitative model focused on the shifts in earnings estimates, displayed as whole numbers.

Traditionally, brokerage analysts are overly positive in their ratings. Their favorability skews the recommendation spectrum, often leading investors astray rather than providing authentic guidance.

Conversely, the Zacks Rank is built upon earnings estimate revisions, showcasing a strong relationship between these revisions and stock price movements in the short term.

The grades within Zacks Rank are evenly distributed among all stocks that analysts cover for earnings estimates, ensuring there is a balanced representation across the ranks.

Another crucial point is the timeliness of the two systems. The ABR may not always reflect the latest information available. In contrast, the Zacks Rank updates quickly as analysts adjust their forecasts based on new company developments, making it a more current indicator of stock price trends.

Is Microsoft a Worthy Investment?

For Microsoft, the Zacks Consensus Estimate for this year has dipped by 0.1% over the past month to $12.92.

This decline indicates a growing skepticism among analysts regarding the company’s earnings, pointing to a possible downturn for the stock shortly.

The reduction in consensus estimates, alongside three other related metrics, has led to a Zacks Rank #4 (Sell) for Microsoft. For those interested in stocks rated #1 by Zacks, the full list is available here.

Consequently, it’s wise to approach Microsoft’s Buy-equivalent ABR with caution.

Uncovering the Best Stocks for the Coming Month

Recent analysis highlights 7 noteworthy stocks from a pool of 220 Zacks Rank #1 Strong Buys, considered most likely to see price increases soon.

Since 1988, stocks on this list have outperformed the market by more than double, averaging a yearly gain of +24.1%. These seven stocks deserve your immediate attention.

If you’re interested in up-to-date recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

To explore this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.