When pondering whether to dive into or steer clear of a stock, investors often turn to analyst opinions. These recommendations typically come from brokerage-firm-housed analysts and enjoy media attention. But, how significant are they really?

Before deconstructing the reliability of brokerage recommendations and their practical application, let’s delve into what these Wall Street heavyweights are saying about DraftKings (DKNG).

Wall Street’s Take on DraftKings

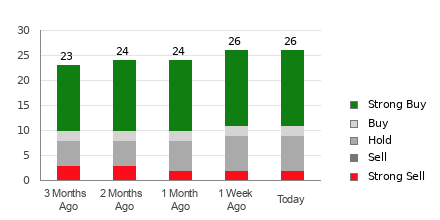

DraftKings currently boasts an average brokerage recommendation (ABR) of 1.29, falling between Strong Buy and Buy on a scale of 1 to 5. Derived from the concrete recommendations of 26 brokerage firms, the ABR implies a positive outlook.

Among the 26 recommendations shaping the current ABR, 21 are Strong Buy and two are Buy. Together, these categories constitute 88.5% of the assessments.

Brokerage Recommendation Trends for DKNG

Check price target & stock forecast for DraftKings here>>>

While the ABR signals buying encouragement for DraftKings, it’d be imprudent to base investment decisions solely on this intel. Several studies have demonstrated the limited effectiveness of brokerage recommendations in identifying stocks with the highest potential for price increases.

So, why the skepticism? Well, these brokerage analysts often harbor a strong bias toward the stocks they cover due to their employers’ vested interests, rendering their ratings disproportionately optimistic. Case in point: for every “Strong Sell” recommendation, brokerage firms hand out a whopping five “Strong Buy” endorsements.

Consequently, it’s prudent to view this data as validation for one’s own analysis or as a companion to a proven, reliable tool for predicting stock price movements.

The Zacks Rank vs. ABR

Enter the Zacks Rank — our proprietary stock rating tool with an externally verified track record — which categorizes stocks based on a range of factors, prognosticating price performance in the near future. Consequently, cross-referencing the ABR with the Zacks Rank can be a prudent strategy for making sound investments.

However, the Zacks Rank and ABR are fundamentally divergent. The ABR hinges solely on brokerage recommendations and is denoted with decimals, such as 1.28. On the contrary, the Zacks Rank is a quantitative model leveraging earnings estimate revisions and is indicated by whole numbers ranging from 1 to 5.

Historically, analysts employed by brokerage firms have maintained an unduly sunny outlook with their recommendations, often swayed by their employers’ vested interests. In stark contrast, the Zacks Rank derives its vitality from earnings estimate revisions, with robust evidence pinpointing a solid correlation between these alterations and near-term stock price movements.

Furthermore, the Zacks Rank evenly doles out its grades across all stocks for which brokerage analysts furnish current-year earnings estimates, thereby preserving equilibrium among its five ranks at all times.

Another crucial difference between the ABR and Zacks Rank pertains to freshness. While the ABR may lag behind, the Zacks Rank remains contemporaneous owing to brokerage analysts’ prompt adjustments to reflect evolving business dynamics, ensuring timeliness in predicting future stock prices.

Is DraftKings a Sound Bet?

In terms of earnings estimate revisions for DraftKings, the Zacks Consensus Estimate for the current year has surged by 4.8% over the past month to reach -$1.48.

Analysts’ mounting enthusiasm regarding the company’s earnings prospects, mirrored in a strong consensus in pushing EPS estimates higher, could well be a legitimate catalyst for the stock to surge in the near term.

Given the magnitude of the recent consensus estimate shift and three other associated factors, DraftKings currently flaunts a Zacks Rank #2 (Buy). For a detailed list of today’s Zacks Rank #1 (Strong Buy) stocks, click here >>>>

Hence, the Buy-equivalent ABR for DraftKings may well serve as a prudent guide for investors.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we startled our members by offering 30-day access to all our picks for a grand sum of $1. No strings attached to spend another cent.

Thousands jumped at the opportunity. Thousands didn’t — they suspected a catch. Yes, we have our ulterior motives. We want you to familiarize yourself with our suite of portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more. In the year 2023 alone, they’ve sealed 162 positions with double- and triple-digit gains.

DraftKings Inc. (DKNG) : Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.