Exploring General Motors Company’s Brokerage Recommendations

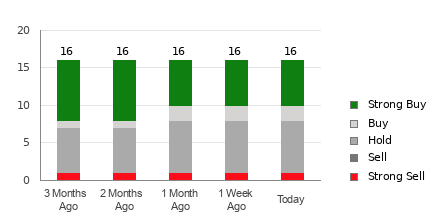

Before contemplating an investment in General Motors Company (GM), it is prudent to delve into the insights provided by Wall Street’s esteemed analysts. Offering recommendations that range from Strong Buy to Strong Sell, these financial gurus have bestowed an average brokerage recommendation (ABR) of 1.83 upon GM. This amalgamation of ratings places GM between a Strong Buy and Buy.

Within the cohort of 21 brokerage firms contributing to the ABR, 12 recommendations advocate for a Strong Buy, while two suggest a simple Buy. These positive outlooks account for a significant 66.6% of all suggestions offered.

Dissecting the Nuances of Brokerage Recommendations

One might be tempted to jump on the “buy” bandwagon solely based on the bullish ABR for GM. However, historical evidence suggests that brokerage recommendations don’t always lead to optimal investment decisions. Research reveals a glaring positive bias among analysts, where “Strong Buy” recommendations vastly outnumber “Strong Sell” ratings.

Given these dynamics, it is crucial for investors to use brokerage recommendations as a means of validation rather than complete reliance. Seeking alternative tools with a proven track record in predicting stock price movements could be beneficial.

The Power of Zacks Rank in Investment Decisions

One such tool with a reliable performance history is the Zacks Rank. This proprietary stock rating system classifies stocks across a spectrum from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). The correlation between earnings estimate revisions and short-term stock price movements further solidifies the credibility of the Zacks Rank.

Unveiling the Dichotomy Between ABR and Zacks Rank

While both ABR and Zacks Rank adopt a numeric scale, their methodologies diverge significantly. ABR hinges on brokerage recommendations, often marred by positive biases, whereas Zacks Rank leverages earnings estimate revisions for a more balanced assessment.

This distinction is critical, as research indicates that trends in earnings estimate revisions are highly impactful on stock prices, making Zacks Rank a compelling tool for investors.

Assessing GM’s Investment Viability

Closely examining earnings estimate revisions for General Motors Company, the recent uptick in the Zacks Consensus Estimate to $9 presents a promising outlook. Analysts’ unanimous positive sentiment in revising EPS estimates upward culminates in a Zacks Rank #1 (Strong Buy) for GM.

Therefore, integrating the Buy-equivalent ABR for GM into one’s investment strategy could prove beneficial, provided investors exercise caution and supplement their decisions with thorough research.

Ready to embark on your investment journey? Investigate the Zacks Top 10 Stocks for 2024, carefully curated for maximum success potential by Zacks Director of Research, Sheraz Mian. Don’t miss out on this exclusive opportunity to explore high-potential stocks for the coming year!

Discover Zacks Top 10 Stocks for 2024 >>

For the original article, visit Zacks Investment Research.

The opinions expressed are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.