Best Buy Faces Challenges Amidst Declining Stock Performance

Best Buy Co., Inc. (BBY) has a market capitalization of $15.6 billion and operates as a specialty retailer. The company sells a variety of products, including consumer electronics, home office supplies, entertainment software, and kitchen appliances. Headquartered in Richfield, Minnesota, Best Buy runs numerous locations in the U.S. and Canada.

Market Underperformance

Over the past year, Best Buy has significantly lagged behind the broader market. Specifically, BBY’s stock has decreased by 1.3% in the last 52 weeks and 14.5% year-to-date (YTD). In contrast, the S&P 500 Index ($SPX) has gained 12.3% over the same period.

When comparing its performance to the SPDR S&P Retail ETF (XRT), Best Buy has performed slightly better. XRT has seen a decline of 5.3% over the past year, while BBY’s YTD performance is a 6.6% drop compared to XRT.

Impact of Recent Earnings Report

Best Buy’s stock price fell 13.3% following its disappointing Q4 results released on March 4. During Q4 2025, which contained only 13 weeks—compared to 14 weeks in Q4 2024—sales reached $675 million. After adjusting for the extra week, revenues for the quarter fell by 16 basis points (bps) year-over-year to $13.9 billion. The company also reported $475 million in impairment charges related to its Best Buy Health division, leading to a downward revision in expected growth for this unit, significantly impacting overall net income and shaking investor confidence.

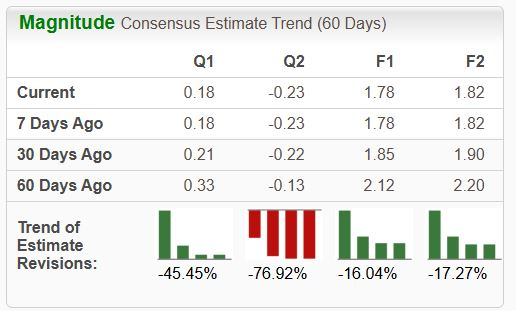

Furthermore, Best Buy experienced a slight decline in adjusted non-GAAP margins, resulting in a 5.2% year-over-year decrease in adjusted earnings per share (EPS) to $2.58.

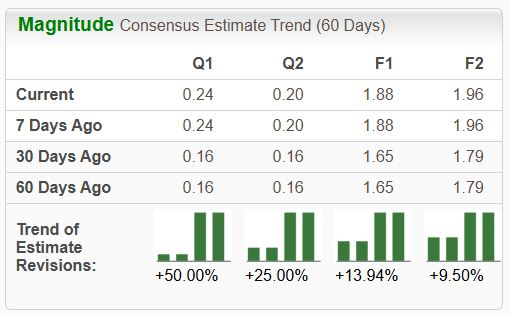

Future Projections

For the current fiscal year ending in January 2026, analysts project a 2.2% year-over-year decline in adjusted EPS, estimating it will reach $6.23. Best Buy has had a mixed history regarding earnings surprises. It has exceeded bottom-line expectations in three out of the last four quarters but fell short in one instance.

Analyst Ratings and Price Targets

The consensus rating for Best Buy’s stock is currently a “Moderate Buy.” Among the 23 analysts covering BBY, 10 have issued “Strong Buy” ratings, 12 recommended “Holds,” and one suggested a “Moderate Sell.” This rating suggests less bullish sentiment compared to two months ago when 11 analysts indicated “Strong Buy” recommendations.

On May 13, DA Davidson analyst Michael Baker reaffirmed a “Buy” rating but revised the price target down to $95. Presently, BBY’s average price target stands at $88.15, reflecting a 20.1% premium over current levels, while the street-high target of $110 indicates a potential upside of 49.9%.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.