Wall Street’s Take on Archrock Inc.: What Investors Need to Know

Investors often look to Wall Street analysts when deciding what stocks to buy, hold, or sell. Changes in analyst ratings can influence a stock’s price, but how much weight should investors give these recommendations?

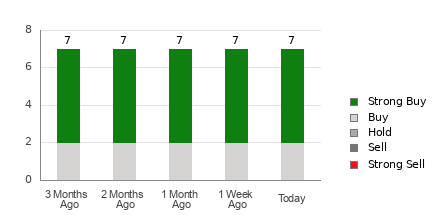

Currently, Archrock Inc. (AROC) holds an average brokerage recommendation (ABR) of 1.29. This rating is derived from the assessments made by seven brokerage firms, where ratings range from 1 to 5, with 1 being Strong Buy and 5 being Strong Sell. An ABR of 1.29 leans between Strong Buy and Buy.

Out of the seven recommendations, five are Strong Buy and two are Buy, which together represent 71.4% and 28.6% of all ratings, respectively.

Current Trends in Analyst Ratings for AROC

Explore Archrock Inc.’s price target and stock forecast here >>>

While the ABR suggests that investors should buy Archrock Inc., relying solely on this rating may not be wise. Research indicates that these recommendations often fail to successfully guide investors toward stocks that will noticeably rise in value.

Why is that? Analysts at brokerage firms usually have a conflict of interest, leading to overly positive ratings. Our studies show that for every Strong Sell rating, firms provide five Strong Buy ratings.

This disconnect means that brokerage recommendations do not always align with retail investors’ interests, limiting their usefulness in predicting a stock’s price movement. Therefore, utilizing this information to reinforce your own research or combining it with tools known for effective stock price predictions is advisable.

Zacks Rank, our proprietary stock rating system, categorizes stocks into five levels, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This method effectively indicates a stock’s potential performance in the near term. Pairing the ABR with the Zacks Rank could enhance investment decisions.

Understanding the Difference: ABR vs. Zacks Rank

Though both the ABR and Zacks Rank use a 1-5 scale, they measure different things.

The ABR is based entirely on analyst ratings and can include decimal points (e.g., 1.28), while the Zacks Rank is a quantitative model utilizing earnings estimate revisions and is represented in whole numbers—1 to 5.

Brokerage analysts tend to be more hopeful in their ratings due to the influence of their firms, often giving ratings that do not reflect available research, which may mislead investors.

On the flip side, the Zacks Rank is shaped by actual earnings estimate revisions, which are closely linked to stock price movements based on empirical data.

Additionally, because the Zacks Rank applies its grades evenly across all stocks with current earnings estimates, it maintains a consistent balance among the different ranks.

Another significant difference is in the frequency of updates. The ABR might not always reflect the latest changes, while the Zacks Rank incorporates analysts’ revisions swiftly, ensuring timely insights into potential price shifts.

Evaluating AROC as an Investment

Examining Archrock Inc.’s earnings estimate revisions reveals that the Zacks Consensus Estimate remains stable at $1.03 for the current year.

Consistent views from analysts concerning Archrock’s earnings prospects, as indicated by an unchanged consensus estimate, may suggest the stock will perform similarly to the overall market in the near future.

Given these circumstances, Archrock Inc. has garnered a Zacks Rank of #3 (Hold), influenced by the recent consensus estimate and three additional factors related to earnings estimates. You can find a complete list of Zacks Rank #1 (Strong Buy) stocks here >>>>

Given the circumstances, it may be wise to approach the current Buy-equivalent ABR for Archrock Inc. with caution.

New Zacks Top 10 Stocks for 2025 Just Released

Don’t miss this opportunity; you can still get in on Zacks’ top tickers for 2025. Curated by Zacks Director of Research, Sheraz Mian, this portfolio has consistently delivered impressive results. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio gained +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz has sifted through 4,400 companies to select the top 10 to buy and hold for 2025. Be among the first to discover these recently announced stocks with great potential.

Archrock, Inc. (AROC) : Free Stock Analysis Report

Read the full article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.