Before you decide to bet the farm on Allegro MicroSystems, Inc. (ALGM), a word to the wise about those Wall Street analysts: They may be more interested in peddling stock than helping you get rich. Think of them as the used-car salesmen of the financial world.

Brokerage Recommendations: A Shaky Foundation

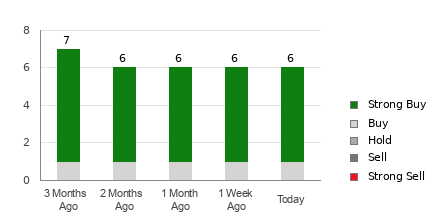

Eight brokerage firms are doling out advice on ALGM. Yet, the stock’s average brokerage recommendation (ABR) clocks in at 1.63, a rating between Strong Buy and Buy. What does this really tell us? The majority of these watchdogs bark “Strong Buy,” but do they have your best interests at heart?

Questioning the Reliability of Brokerage Ratings

It turns out that relying solely on brokerage recommendations is akin to navigating with a broken compass. The reality is that brokerage firms have a vested interest in the stocks they cover. Their analysts are about as likely to brand a stock “Strong Sell” as they are to turn down a corner office. This throws the reliability of their recommendations into question.

ABR vs. Zacks Rank: A Smarter Path

So, where does this leave us? Enter the Zacks Rank, a gold mine for investors. This tool uses earnings estimate revisions to categorize stocks, offering a more objective view of a stock’s potential. Unlike the ABR, the Zacks Rank keeps the rose-colored glasses at bay.

New Insights Could Steer Clear of Outdated Opinions

Additionally, the Zacks Rank is more than just smoke and mirrors. It’s always up-to-date with the latest earnings estimate revisions. This means the Zacks Rank offers fresh, untainted guidance, unencumbered by brokerage firms’ self-serving interests.

The Verdict on ALGM

So, back to Allegro MicroSystems, Inc. The consensus estimate remains unmoved at $1.36—an indication of steady analyst views. Based on this, ALGM has been assigned a Zacks Rank #3 (Hold). This, my friends, is where prudence should prevail, cautiously navigating the elusive waters of brokerage recommendations.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Allegro MicroSystems, Inc. (ALGM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.