When making financial decisions, investors often rely on the guidance of Wall Street analysts. Their recommendations can significantly sway stock prices. But do these suggestions truly hold weight?

Before delving into the reliability of brokerage recommendations and how they can be leveraged, it’s vital to assess what Wall Street’s heavyweights opine about Amazon (AMZN).

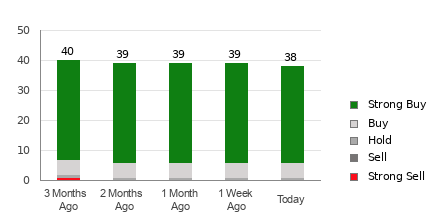

Currently, Amazon boasts an average brokerage recommendation (ABR) of 1.11, positioning it between Strong Buy and Buy on a scale of 1 to 5. Out of the 46 recommendations contributing to the ABR, a whopping 91.3% advocate a Strong Buy, with an additional 6.5% endorsing a Buy.

Brokerage Recommendation Trends for AMZN

Check price target & stock forecast for Amazon here>>>

While the ABR advises buying Amazon, it’s essential to supplement this information with additional analysis. Numerous studies have indicated the limited efficacy of brokerage recommendations in identifying stocks with substantial price upside.

Why is this the case? One key reason is the inherent bias of brokerage analysts towards positively recommending the stocks they cover. Research demonstrates that for every “Strong Sell” recommendation, brokerage firms furnish five “Strong Buys,” thus skewing their perspective. Consequently, their interest may not always align with that of retail investors, casting doubt on the insight they provide into a stock’s future price movements.

Our proprietary stock rating tool, Zacks Rank, stands as a more reliable gauge with a validated track record. It stratifies stocks into five categories, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), serving as a robust indicator of a stock’s forthcoming price performance. Hence, validating the ABR against the Zacks Rank could prove to be a savvy investment strategy.

Zacks Rank Should Not Be Confused With ABR

Although both Zacks Rank and ABR inhabit a 1-5 spectrum, they diverge significantly. While the ABR hinges solely on brokerage recommendations and is often expressed in decimals (e.g., 1.28), the Zacks Rank operates as a quantitative model predicated on earnings estimate revisions, yielding whole-number scores from 1 to 5.

Analysts employed by brokerage firms are prone to issuing overly optimistic ratings due to their employers’ vested interests, frequently misleading investors. In contrast, the Zacks Rank, propelled by earnings estimate revisions, exhibits a strong correlation between short-term stock price movements and trends in earnings estimate revisions, as backed by empirical research.

Moreover, the Zacks Rank systematically apportions its different grades across all stocks for which brokerage analysts furnish earnings estimates for the current year, maintaining equilibrium. This equanimity stands in stark contrast to the ABR, which may not be promptly updated. Conversely, the Zacks Rank swiftly assimilates earnings estimate revisions, ensuring the timeliness of its future price movement forecasts.

Should You Invest in AMZN?

Regarding earnings estimate revisions for Amazon, the Zacks Consensus Estimate for the current year has surged by 11.8% over the past month to $4.03. This palpable uptick, coupled with analysts’ collective optimism reflected in substantial upward EPS estimate revisions, has culminated in a Zacks Rank #1 (Strong Buy) for Amazon.

Ergo, the ABR’s endorsement of purchasing Amazon signifies a compelling guiding principle for investors.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.