When it comes to stock investments, the opinions of Wall Street analysts often carry weight. However, before jumping on the Buy, Sell, or Hold bandwagon based on their recommendations, it’s essential to dig deeper. Let’s delve into the current sentiment surrounding Amazon (AMZN) and evaluate the implications of brokerage recommendations.

Interpreting Analyst Trends for Amazon

Explore price targets and stock forecasts for Amazon here >>>

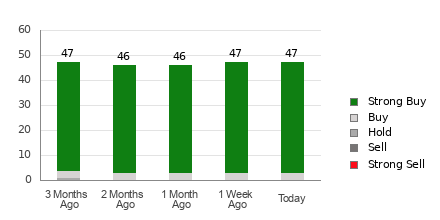

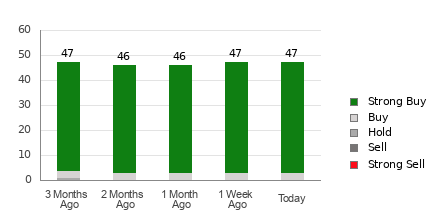

With an average brokerage recommendation of 1.06 for Amazon, falling between Strong Buy and Buy, the consensus appears bullish. However, relying solely on this figure may not be prudent, as history reveals a disconnect between analyst recommendations and actual stock performance.

Brokerage analysts exhibit a conspicuous positive bias towards stocks they cover, with a glaring discrepancy in “Strong Buy” versus “Strong Sell” ratings. Thus, discerning investors may benefit more from cross-referencing this data with independent research or reliable indicators like the Zacks Rank.

Navigating the Zacks Rank vs. ABR Conundrum

While both the Zacks Rank and ABR utilize a 1-5 scale, they entail distinct methodologies. Where ABR hinges on brokerage recommendations, often tainted by vested interests, the Zacks Rank leverages earnings estimate revisions for a more objective assessment.

Empirical evidence underpins the efficacy of the Zacks Rank, emphasizing the significance of earnings estimate trends in predicting stock performance. Unlike the ABR, the Zacks Rank preserves a constant balance across its five-tier structure, offering timelier insights into potential price movements.

Assessing Amazon’s Investment Viability

Amazon’s unaltered Zacks Consensus Estimate of $4.74 for the current year suggests a stable earnings outlook, reflected in a Zacks Rank #3 (Hold). While a stagnant estimate bodes well for short-term performance alignment with the market, caution is warranted given the prevailing ABR bias.

Considering the landscape of brokerage recommendations and the proven dynamics of the Zacks Rank, prudent investors may opt for a discerning approach towards Amazon’s investment potential.

Anticipating an Infrastructure Stock Surge Across America

A forthcoming surge in U.S. infrastructure revamp presents a lucrative opportunity. As trillions funnel into this bipartisan initiative, strategic investors stand to reap substantial benefits.

Are you positioned to capitalize on this monumental wave early? Zacks’ Special Report offers insights into five companies poised to thrive amidst the infrastructure overhaul.

Unlock the potential gains from infrastructure spending now >>

Delve into the Free Stock Analysis Report for Amazon.com, Inc. (AMZN)

Read the full article on Zacks.com here.

Gain insights from Zacks Investment Research

Author’s views and opinions are expressed herein, independent of Nasdaq, Inc.’s perspective.