Deciphering the Average Brokerage Recommendation for CDNS

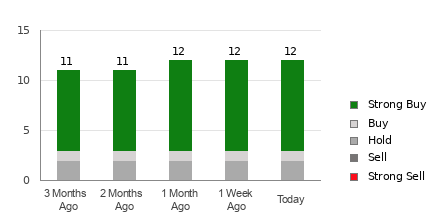

When it comes to making investment decisions, the counsel of Wall Street analysts holds a peculiar weight in the minds of investors. In the case of Cadence Design Systems (CDNS), the average brokerage recommendation (ABR) currently stands at 1.42, teetering between a Strong Buy and Buy rating. This evaluation derives from a consensus reached by 12 brokerage firms, with a majority advocating for a Strong Buy position.

Unveiling the Crux of Brokerage Recommendations

Despite the seemingly resounding support for investing in Cadence based on ABR, a prudent investor must tread cautiously. Studies have shown a limited correlation between brokerage recommendations and a stock’s potential for significant price appreciation. The inherent bias of these analysts, influenced by their firms’ interests, often skews their ratings towards an overly optimistic outlook.

The Role of Zacks Rank in Investment Decisions

Enter the Zacks Rank – a battle-tested stock rating tool that has stood the test of time. Unlike ABR, the Zacks Rank hinges its assessment on earnings estimate revisions and is categorized from #1 (Strong Buy) to #5 (Strong Sell). This data-driven approach provides a more reliable gauge of a stock’s short-term performance, backed by empirical evidence linking earnings estimate trends with price movements.

Decoding the Nuances Between ABR and Zacks Rank

While ABR relies solely on brokerage recommendations, Zacks Rank harnesses the power of earnings estimate revisions for its analysis. This dichotomy reflects the underlying essence of each metric – with ABR showcasing a more generalized perspective and Zacks Rank delving into the nitty-gritty of a stock’s growth potential.

Insight Into CDNS: A Promising Investment Opportunity?

Delving into Cadence’s performance, the Zacks Consensus Estimate for the current year has seen a 5% uptick, settling at $5.87. This positive revision, coupled with analysts’ unanimity in projecting higher EPS figures, has propelled Cadence to a Zacks Rank #1 (Strong Buy) designation, signifying a favorable outlook for the stock in the near future.

Given these compelling indicators, investors eyeing CDNS as a prospective investment avenue may find solace in the promising trajectory projected by both ABR and Zacks Rank.

Final Thoughts

In the intricate tapestry of investment decisions, the amalgamation of analytical tools and expert opinions serves as a guiding compass. While ABR provides a bird’s eye view, Zacks Rank hones in on the granular details that can potentially unlock hidden value in stocks like Cadence. It’s this synergy of perspectives that empowers investors to make informed and strategic investment choices.