Investors frequently lean on the counsel of Wall Street pundits before deciding to buy, sell, or hold a stock. But, do these so-called experts wield significant clout, or are their recommendations akin to a gust of wind in the financial markets? Let’s delve into the latest outlook on StoneCo Ltd. (STNE) from these investment gurus, and then mull over the reliability of brokerage recommendations and how to harness them toward your potential gain.

StoneCo Ltd.’s Average Brokerage Recommendation (ABR)

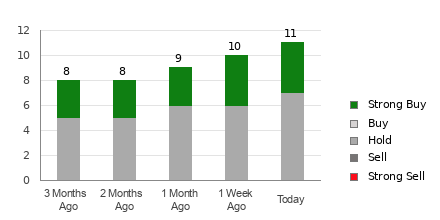

StoneCo Ltd. presently boasts an average brokerage recommendation (ABR) of 1.67 (on a scale of 1 to 5, where 1 denotes “Strong Buy” and 5 translates to “Strong Sell”). This rating stems from the sum total of recommendations (Buy, Hold, Sell, etc.) offered by 12 brokerage firms. Practically, the ABR of 1.67 falls approximately between a Strong Buy and Buy.

Out of the 12 contributing recommendations for the current ABR, a striking eight are Strong Buy indications, accounting for a remarkable 66.7% of all recommendations.

Interpreting Brokerage Recommendation Trends for STNE

Check price target & stock forecast for StoneCo Ltd. here>>>

While the ABR conveys a bullish sentiment for StoneCo Ltd., it’s prudent not to hinge investment decisions solely on this factor. Studies indicate that brokerage recommendations offer scant useful insights for selecting stocks with the greatest potential for price appreciation.

Why? The ratings issued by analysts at brokerage firms are often steeped in an overtly positive bias due to their employers’ vested interests in the stocks they cover. Notably, brokerage firms proffer five “Strong Buy” recommendations for every “Strong Sell” recommendation, signifying a distinct misalignment with the interests of individual investors, and rarely hinting at the actual trajectory of a stock’s price. Therefore, the recommended use for this information may lie in corroborating your personal research or an established indicator adept at projecting stock price movements.

The Zacks Rank: A Potent Referral Tool

Our proprietary stock rating system, Zacks Rank, has been externally audited and stands as a valuable yardstick for categorizing stocks into five classifications, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This method serves as an adept predictor of a stock’s price performance in the near term. Therefore, validating the ABR with the Zacks Rank could materialize as a judicious approach to make a lucrative investment call.

It’s Not Apples to Apples: ABR vs. Zacks Rank

While both the ABR and Zacks Rank flaunt a 1-5 range, they represent fundamentally distinct metrics altogether. Broker ratings exclusively factor into computing the ABR, often portrayed in decimals (e.g. 1.28). On the contrary, the Zacks Rank hinges on a quantitative model designed to leverage the potential of earnings estimate revisions, and is depicted in whole numbers from 1 to 5.

Analysts working at brokerage firms persist in issuing overly optimistic recommendations. Their assessments are skewed favorably due to their employers’ vested interests, thereby veering more toward misleading investors than serving as a reliable guide.

Conversely, the Zacks Rank pivots on earnings estimate revisions, a factor profoundly linked to near-term stock price movements, as evidenced by empirical research.

In addition, the varied gradations of the Zacks Rank are distributed proportionally across all stocks for which brokerage analysts furnish earnings estimates for the subsequent fiscal year. In essence, this tool perpetually maintains an equilibrium among the five ranks it assigns.

Another differentiating factor between the ABR and Zacks Rank involves their timeliness. While ABR may lack the latest updates, the Zacks Rank keeps abreast of the situation as brokerage analysts continually recalibrate their earnings estimates to mirror evolving business trends, ensuring prompt prophecy of future stock prices.

Is STNE a Viable Investment?

Reviewing the trajectory of earnings estimate revisions for StoneCo Ltd., the Zacks Consensus Estimate for the ongoing year has expanded by 0.4% in the past month, now standing at $0.88.

The mounting optimism among analysts concerning the company’s earnings outlook, evidenced by a robust consensus in favor of revising EPS estimates upward, could present a compelling rationale for the stock to soar in the immediate future.

Markedly, the magnitude of the recent alteration in the consensus estimate, coupled with three additional factors related to earnings estimates, warrants a Zacks Rank #1 (Strong Buy) designation for StoneCo Ltd. You can peruse the complete register of present Zacks Rank #1 (Strong Buy) stocks here >>>>

Thus, the ABR, tantamount to a Buy, for StoneCo Ltd. might proffer pivotal guidance for investors.

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook, has identified five hand-picked stocks with unparalleled growth prospects in the vibrant domain of Artificial Intelligence. The AI industry is anticipated to unleash an economic impact reminiscent of the internet and iPhone by 2030, estimated at a staggering $15.7 trillion.

Today, you have the opportunity to invest in the upcoming wave of automation – one that addresses inquiries, acknowledges fallibilities, contests erroneous suppositions, and dismisses unsuitable entreaties. As one of the chosen companies articulates, “Automation liberates individuals from the mundane, empowering them to accomplish the extraordinary.”

Download Free ChatGPT Stock Report Right Now >>

StoneCo Ltd. (STNE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.