When it comes to making investment decisions, the input of Wall Street analysts is often deemed vital. Their recommendations have the power to sway stock prices, eliciting curiosity about the wisdom of heeding their advice. In this report, we delve into Wall Street’s views on Adobe Systems (ADBE) and scrutinize the reliability of brokerage recommendations. So, should you take cues from the bullish sentiment on Adobe?

Understanding Analyst Recommendations for ADBE

Adobe currently boasts an average brokerage recommendation (ABR) of 1.63. This rating, derived from the consensus of 27 brokerage firms, hovers between Strong Buy and Buy on a scale of 1 to 5. Notably, 70.4% of the recommendations stand at Strong Buy, with Buy commanding a 3.7% share.

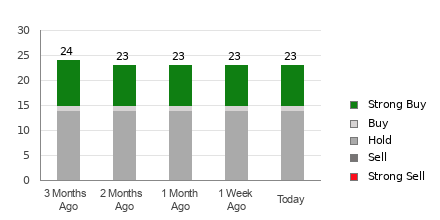

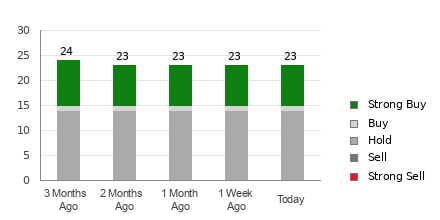

Brokerage Recommendation Trends for ADBE

Curious about the price target and stock forecast for Adobe? Check it out here.>>>

While the ABR paints a rosy picture for Adobe, the efficacy of relying solely on this metric remains murky. Research indicates that brokerage recommendations, often skewed by institutional interests, may not serve as reliable indicators for astute investment decisions. So, how can investors discern the wheat from the chaff?

For investors seeking a more dependable gauge, the Zacks Rank, rooted in extensive audited data, offers a compelling alternative. This proprietary stock rating tool has a proven track record of forecasting stock performance and complements the ABR in facilitating sound investment choices.

Distinguishing ABR from Zacks Rank

Despite sharing a 1 to 5 scale, ABR and Zacks Rank serve different purposes. The former relies solely on brokerage recommendations, often influenced by institutional biases, while Zacks Rank leverages earnings estimate revisions to predict stock movements.

Unlike the potentially outdated ABR, Zacks Rank quickly responds to analyst updates, offering timelier insights into future stock prices. This crucial difference highlights the Zacks Rank’s merit as a more objective and dynamic indicator for investors.

Insight into Adobe’s Investment Prospects

Against the backdrop of subdued consensus estimates for the year, Adobe holds a Zacks Rank #3 (Hold). Analysts’ unswerving forecasts and the lack of significant estimate changes indicate a stable trajectory for the company, aligning it with broader market performance in the near term.

For investors mulling over the Buy-equivalent ABR, exercising cautious optimism would be prudent, given the firm’s current standing. The convergence of the Zacks Rank insight with the ABR underscores the importance of a balanced approach to investment decisions.

As you ponder the implications of Wall Street’s acclaim for Adobe, remember that exploring multiple perspectives and data points can empower informed investment choices. While the ABR may capture Wall Street’s trumpet of praise, complementing it with robust tools like the Zacks Rank can refine your investment radar.

7 Best Stocks for the Next 30 Days

Looking for elite stock picks? Our experts have hand-picked 7 distinguished stocks from the Zacks Rank #1 Strong Buys list. These stocks are touted as “Most Likely for Early Price Pops,” having historically outperformed the market with an average yearly growth of +24.0% since 1988. Don’t miss this exclusive opportunity!

Access the Free Stock Analysis Report for Adobe Inc. (ADBE)

Read this article on Zacks.com for more insights.

Explore Zacks Investment Research for further updates.

The opinions expressed in this piece are personal to the author and do not necessarily reflect the views of Nasdaq, Inc.