Before deciding on stock investments, many investors turn to the recommendations of Wall Street analysts for guidance. The question often arises – do these recommendations truly matter when it comes to the stock’s performance? Let’s explore the current sentiment surrounding Amazon (AMZN) by these renowned analysts and dive into whether these recommendations are reliable indicators for investors.

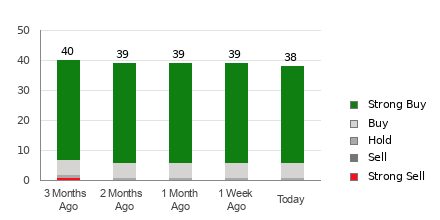

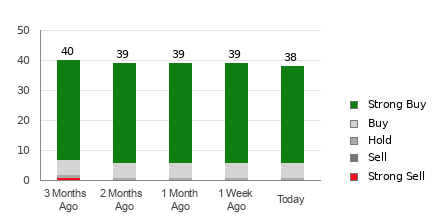

As of now, Amazon holds an Average Brokerage Recommendation (ABR) of 1.11, falling between Strong Buy and Buy on a scale ranging from 1 to 5. Derived from the input of 46 brokerage firms, the ABR is a promising signal for this tech giant. Out of these 46 recommendations, a whopping 91.3% are Strong Buy, with 6.5% being Buy, collectively painting an optimistic picture of Amazon’s future.

The Dance of Brokerage Recommendations for AMZN

While the ABR may favor a Buy decision on Amazon, relying solely on this metric might not always yield success. Research indicates that brokerage recommendations often exhibit a notable bias, leaning towards a positive outlook due to the vested interest these firms hold in the stock they cover. For every pessimistic “Strong Sell” advice, analysts tend to issue a substantial five “Strong Buy” recommendations, showcasing the potential imbalance in their assessments.

So, should investors solely rely on brokerage recommendations to chart their investment journey? Our esteemed Zacks Rank tool, a meticulously audited system classifying stocks from Strong Buy to Strong Sell, serves as a reliable predictor of a stock’s immediate price performance. Harmonizing ABR insights with the Zacks Rank may significantly aid in making well-informed investment choices.

Dispelling ABR vs. Zacks Rank Misconceptions

It’s crucial not to conflate ABR with the Zacks Rank despite their shared 1-5 scale display. While ABR solely hinges on brokerage suggestions and is showcased in decimal figures, ranging like 1.28, the Zacks Rank is a quantitative model emphasizing earnings estimate revisions and represented in whole numbers from 1 to 5. This distinction underscores the varied methodologies and intrinsic purposes of these metrics in assessing stock performance.

Unlike the buoyant nature of brokerage recommendations, the Zacks Rank delves deep into the realm of earnings estimate revisions, establishing a robust connection between these revisions and impending stock price movements. This affirms its reliability in navigating the tumultuous waters of the stock market.

Furthermore, while ABR might lack real-time updates, the Zacks Rank remains promptly responsive to analysts’ evolving earnings estimates, ensuring timely and accurate insights into future stock valuations, proving advantageous for investors seeking sound guidance.

Should Amazon (AMZN) Spark Your Investment Interest?

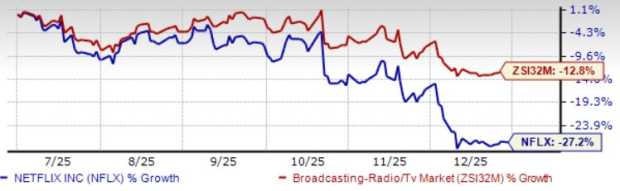

Recent data highlight a 10.6% surge in the Zacks Consensus Estimate for Amazon’s current-year earnings to $4.06, indicating a growing unanimous sentiment among analysts regarding the company’s bright fiscal prospects. This notable consensus, coupled with other positive factors, has positioned Amazon at a Zacks Rank #1 (Strong Buy), heralding a potentially lucrative investment opportunity in the near future.

Given Amazon’s bullish trajectory, the Buy-equivalent ABR may indeed offer valuable guidance to investors navigating the complex web of stock markets and striving to maximize their investment potentials.