“Consensus Analyst Recommendations – A Fool’s Gold?”

Analyst recommendations serve as the guiding stars in a tempestuous sea of stock picking. These recommendations are thought to have the power to influence stock prices, but should they be trusted?

Embarking on this journey, let’s first peek behind the curtains and see what the Wall Street mavens have to say about the investment potential of Berkshire Hathaway B (BRK.B).

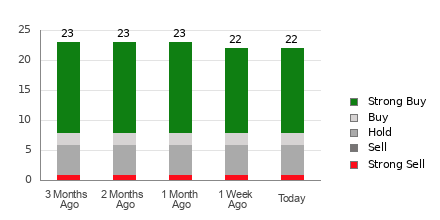

Peering into the Brokerage Recommendation Trends for BRK.B, it is revealed that the stock holds an average brokerage recommendation (ABR) of 1.67 on a scale of 1 to 5. This scale spans from Strong Buy to Strong Sell, with 1.67 likened to a status between Strong Buy and Buy. Of the three recommendations contributing to the current ABR, a staggering 66.7% are fervent Strong Buy endorsements, painting a optimistic picture of the stock.

“Navigating the Quagmire of Brokerage Recommendations”

The ABR data, while seemingly urging investors to plunge into Berkshire Hathaway B, should not be the sole compass used to make investment decisions. Research has shown that brokerage recommendations often fall short in predicting the best price-increasing stocks, as these recommendations are commonly tainted by the brokers’ vested interests in the stocks they cover. In fact, for every “Strong Sell” recommendation, five “Strong Buy” recommendations are bestowed. As such, blindly following these recommendations could lead investors astray.

Enter Zacks Rank, a proven tool with an externally audited record, providing a more reliable gauge of a stock’s potential performance. The Zacks Rank not only differentiates itself from ABR but also rests on the bedrock of earnings estimate revisions. It is this emphasis on earnings estimates that imbues the Zacks Rank with a higher degree of accuracy in predicting near-term stock price movements.

“Unraveling the Layers of Zacks Rank”

While ABR and Zacks Rank may share a numerical range, the similarities end there. The ABR relies solely on brokerage recommendations and is exhibited with decimal points, such as 1.28. In contrast, the Zacks Rank employs a quantitative model based on earnings estimate revisions, yielding whole numbers from 1 to 5.

Empirical research signifies a pervasive trend of analysts proffering overly optimistic recommendations due to their firms’ vested interests in the stocks. On the flip side, the Zacks Rank centers on earnings estimate revisions, with studies illustrating a robust correlation between these revisions and imminent stock price movements. Notably, the Zacks Rank maintains balance by proportionally applying its different grades across all stocks with current-year earnings estimates from brokerage analysts.

“Peering into the Crystal Ball of Earnings Estimations”

Delving into the earnings estimate revisions for Berkshire Hathaway B, the Zacks Consensus Estimate holds steadfast at $16.36 for the current year, a testament to analysts’ unwavering views on the company’s earnings prospects. This steadfast consensus estimate has culminated in a Zacks Rank #3 (Hold) for Berkshire Hathaway B, signifying a cautionary stance on the stock’s trajectory in the near term.

In the end, relying solely on the Buy-equivalent ABR for Berkshire Hathaway B may prove myopic and lack the depth needed to make a sound investment decision.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.