Amidst the chaos of Wall Street, where analyst recommendations reign supreme and shape market sentiment, the question remains – should investors bet the farm on these ratings? Let us wade into the murky waters of broker recommendations to decipher the current sentiment surrounding Intuitive Surgical, Inc. (ISRG).

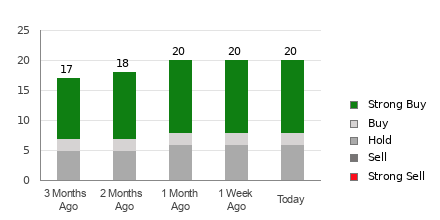

Intuitive Surgical, Inc. stands tall with an average brokerage recommendation (ABR) of 1.61, nestled between a Strong Buy and a Buy on the rating scale of 1 to 5. This valuation is an amalgamation of inputs from 23 brokerage firms, of which 15 chant the Strong Buy mantra, while two rally behind a Buy signal. These bullish echoes dominate the chorus, with Strong Buy trumpeting at 65.2% and Buy trailing at 8.7% of total recommendations.

Decoding the Brokerage Recommendation Rollercoaster for ISRG

Curious about Intuitive Surgical, Inc.’s price target and stock forecast? Dive in here>>>

Yet, a word to the wise – placing blind faith in these ratings might not be the golden ticket to prosperity. Studies reveal the fleeting nature of brokerage recommendations in identifying stocks poised for a dazzling performance surge.

But why, you ask? Well, peek behind the analyst’s curtain, and a conflict of interest emerges. For every bearish whisper of “Strong Sell,” brokerage houses shower five “Strong Buy” accolades upon the same stock. This tango of interests leaves retail investors fumbling in the dark, devoid of illumination on the stock’s trajectory. It might be advisable to cross-verify this data with your own analysis toolkit or a reliable market crystal ball.

The Zacks Rank, our trusty stock oracle with a robust track record under its belt, partitions equities into five tiers, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This ranking holds the key to a stock’s forthcoming performance tango. Thus, juxtaposing the ABR against the Zacks Rank could unveil a profitable investment path.

The Zacks Rank: Your North Star Amidst ABR Constellations

In the swirling vortex of investment advice, don’t conflate the Zacks Rank with the ABR. These siblings may sport a similar 1-to-5 numerical garb, but their essence diverges.

The ABR finds its rhythm through broker recommendations, garbed in decimal robes (1.28, anyone?). Conversely, the Zacks Rank dances to the beat of earnings estimate revisions, prancing about in whole numbers – from 1 to 5.

Bear in mind, broker analysts, swayed by corporate patronage, often wear rose-tinted glasses, skewing their recommendations. In sharp contrast, the Zacks Rank’s heart pulsates to the rhythm of earnings estimate revisions. This dance between revisions and stock prices is no frivolous affair, with empirical data showcasing a poignant connection.

Unlike the ABR, the Zacks Rank quenches the thirst for fresh insights. While the former might resemble stale bread, the latter’s timely updates paint a vivid picture of changing market tides, empowering investors with foresight into stock trajectories.

Is ISRG a Diamond in the Rough?

A cursory glance at Intuitive Surgical, Inc.’s earnings estimate murmurs a tale of caution – the Zacks Consensus Estimate for the current year waltzes down by 1.3% to $6.18 in the past lunar cycle.

While the discord among analysts over the company’s profit prospects crescendos, with a unanimous chant bellowing lower EPS estimates, storm clouds may loom over the stock’s horizon. This symphony of change paints a Zacks Rank #4 (Sell) cloak over Intuitive Surgical, Inc. Unveil today’s roster of Zacks Rank #1 (Strong Buy) luminaries here >>>>

Thus, it behooves us to peer through a skeptic’s lens at ISRG’s Buy-laden ABR.

Dive into the Elite: Zacks Top 10 Stocks for 2024

With the clock ticking, seize a chance to ride the coattails of our Top 10 stock darlings for 2024. Handpicked by Zacks’ Director of Research, Sheraz Mian, this treasure trove boasts a stellar track record. From its genesis in 2012 through the dawn of November 2023, the Zacks Top 10 Stocks dazzled, clocking a stupendous +974.1% gain, nearly tripling the S&P 500’s +340.1% rise. Sheraz scouted through 4,400 companies under Zacks’ cloak, crafting a bouquet of the finest 10 stocks for adventure in 2024. Don’t be left behind in this gala of boundless potential.

Explore the New Top 10 Stocks >>

Intuitive Surgical, Inc. (ISRG) : Marvel at the Free Stock Analysis Report

To devour this saga on Zacks.com, step inside the literary realm here.

Venturing into the psyche of the author, these thoughts and sentiments reflect a singular voice and do not mirror the resonances of Nasdaq, Inc.