Broker Recommendations: A Tossed Salad of Confusion

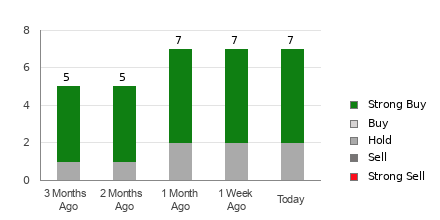

When considering the fate of a stock like Kura Sushi (KRUS), analysts’ opinions often resemble a scattered smorgasbord. The current average brokerage recommendation (ABR) for KRUS stands at 1.75, indicating a taste somewhere between Strong Buy and Buy, as per eight brokerage firms.

In this flavorful mix of recommendations, an appetizing five out of eight dishes serve up a hearty Strong Buy, tempting the palates of 62.5% of analysts.

Bridging the Gap between Analytics and Appetite

Yet, savoring these recommendations should be met with caution. History shows that relying solely on brokerage suggestions is akin to trusting a hungry fox in a henhouse. Analysts often season their ratings with a pinch of bias, leaning more towards Strong Buy than Strong Sell by a 5:1 ratio.

So, is there a more reliable recipe for investment success?

Zacks Rank: A Dish Served Hot

Introducing the Zacks Rank – a mouth-watering tool with a proven track record in the stock market kitchen. This tool, based on earnings estimate revisions, offers a menu from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), guiding investors towards savory returns.

Unlike the ABR salad, the Zacks Rank steak and potatoes model focuses on the meaty core of earnings estimate revisions, backing it with robust historical taste.

Comparing Apples to Oranges: ABR vs. Zacks Rank

The distinction between the ABR and Zacks Rank boils down to freshness and flavor. While ABR may lack spice, Zacks Rank constantly stirs the pot, updating swiftly with analysts’ revised estimates.

Bite into Zacks Rank #3 (Hold) for KRUS, signaling stable expectations. Paired with unchanged consensus estimates for the year, this appetizing blend suggests KRUS may simmer in sync with the market for the foreseeable future.

Seasoning Your Portfolio with Care

In this culinary journey of stock selection, heed caution with the Buy-equivalent ABR for Kura Sushi. Like a master chef adjusting seasoning to taste, investors must blend recommendations with thorough analysis to concoct the perfect investment recipe.

Above all, the table stakes are high. As a discerning investor, choose your appetizers wisely, balancing the flavors of broker recommendations with the robust seasoning of the Zacks Rank for a delectable investing experience.