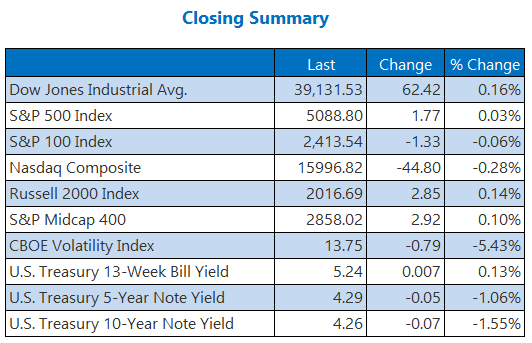

Wall Street capped off a victorious, yet abridged trading week with a triumphant crescendo, as all three key indices marked their territories at historic peaks. The Dow and the S&P 500 sustained their record-breaking spree, while the S&P 500 relinquished some gains after breaching the 5,100 milestone for the first time during the day. Concurrently, the Nasdaq backtracked to conclude the session in the red following the subsiding euphoria surrounding Nvidia’s (NVDA) quarterly earnings unveiling.

Delve deeper into today’s market panorama for a comprehensive analysis:

Key Insights for Today

- The emergence of newfound optimism in the market might foreshadow a marked downtrend in long-term U.S. government bond values. (MarketWatch)

- Following an inquiry into human rights violations, Amazon.com (AMZN) is set to disburse $1.9 million to over 700 migrant laborers. (CNBC)

- A pioneering milestone as an online car retailer posts its inaugural annual profit.

- Barclays is placing their chips on DraftKings stock—find out why.

- Master the art of utilizing analyst recommendations to elevate your trading strategy.

Oil Prices Experience Weekly Downturn

Oil futures encountered a drop today, culminating in a 1.9% decline over the week after anticipations of an imminent Federal Reserve interest rate cut waned. April-delivery West Texas Intermediate (WTI) crude plummeted by $1.60, marking a 2% descent to settle at $77.01 per barrel.

Meanwhile, the glittering realm of gold witnessed a surge, with April-contracted gold soaring by $18.70, depicting a 0.9% ascent to wrap up at $2,049.40 per ounce. The near-month agreement also notched a 0.5% upswing this week, courtesy of the softening of the U.S. dollar post the Federal Reserve’s interest rate policy revision.

The expressions and viewpoints articulated herein are the personal opinions of the author and may not align with those of Nasdaq, Inc.